The Market Frenzy:

Alibaba (BABA) has been making waves across online investment platforms, attracting significant attention. As investors pore over the data streams, it seems prudent to consider the underlying dynamics that could steer the course of this stock going forward.

The recent trajectory reveals a 4.6% surge in Alibaba’s shares over the last month, outpacing the S&P 500 composite by 0.8%. Meanwhile, the Zacks Internet – Commerce industry, which houses Alibaba, has seen a gain of 5.3% over this period. But what lies ahead for the stock?

Delving Into Earnings:

At the heart of any investment lie the company’s earnings prospects. Zacks underscores the paramount importance of tracking a firm’s earnings estimates. The rationale is simple – a stock’s value hinges on the anticipated future cash flows. Hence, the spotlight is on how analysts revise earnings estimates, as these changes often influence short-term price movements.

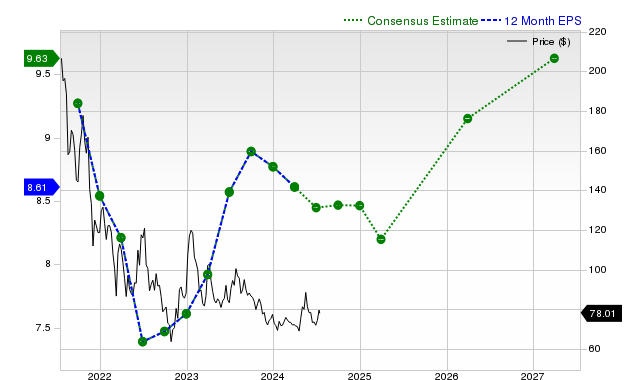

The consensus points to Alibaba’s earnings projected at $2.24 per share for the current quarter, showcasing a -6.7% YoY change. Looking ahead, estimates settle at $8.20 for the fiscal year, with a -4.9% YoY shift. Into the next fiscal year, a more optimistic estimate of $9.15 per share reflects an +11.6% change.

Drilling into Forecasts:

While earnings growth is essential, revenue traction is equally pivotal. In Alibaba’s case, a forecast of $34.95 billion revenue for the current quarter implies an +8.2% YoY leap. Projections for the coming fiscal years look promising at $138.63 billion and $148.86 billion, indicating growth prospects of +6.2% and +7.4%, respectively.

Performance Measured:

Reflecting on past performance, Alibaba recorded revenues of $30.73 billion in the last reported quarter, marking a +1.4% YoY change. Notably, the company exceeded revenue estimates by +0.46%, with EPS performing better than expected by +12.9%.

Valuation Insights:

No investment evaluation is complete without a valuation check. Assessing key metrics such as P/E, P/S, and P/CF against historical trends and industry peers reveals Alibaba’s current value proposition. The Zacks Value Style Score gives Alibaba an A grade, indicating an attractive valuation relative to its industry counterparts.

Conclusion:

As you mull over Alibaba’s prospects, a deeper look into its fundamentals and market sentiment may provide clarity. While the current analysis points to solid potential, the Zacks Rank #4 (Sell) signals a note of caution for the near term.