Super Micro Computer (SMCI) has been quite the wildfire since it went public in 2007, delivering meteoric returns to shareholders. Over the last half-decade alone, SMCI’s share price skyrocketed an eye-watering 2,294%. Specializing in high-performance computing systems, server technology, and storage solutions, Super Micro excels at crafting tailor-made systems for various industries, including AI, machine learning, and data centers.

Is Super Micro Stock Oversold?

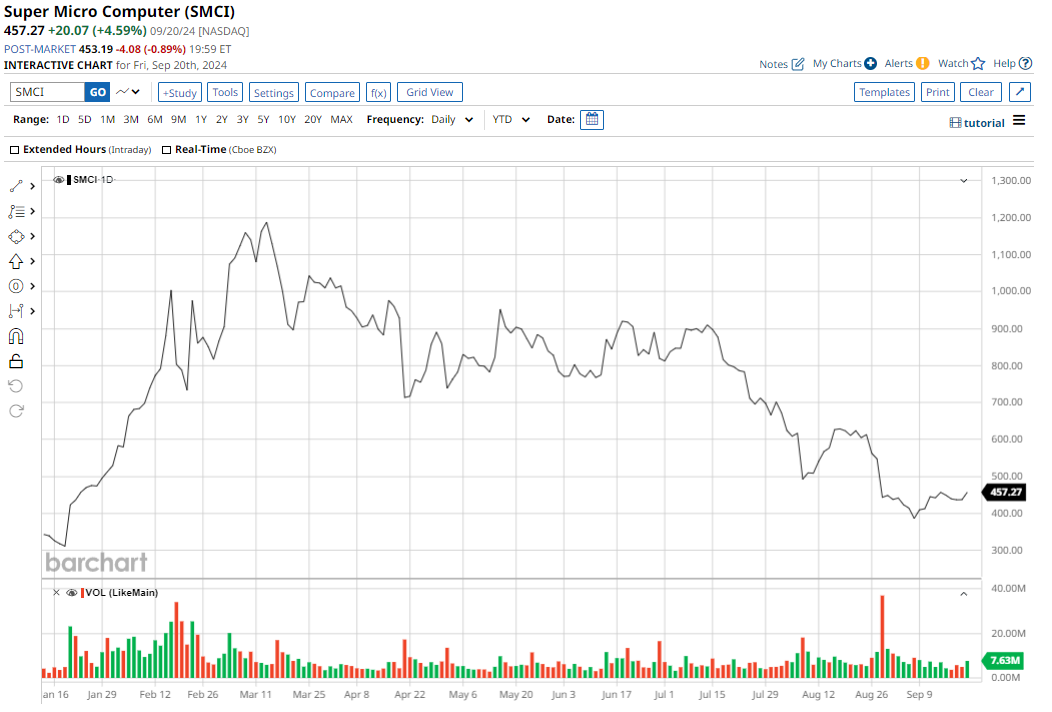

Despite its impressive track record, Super Micro Computer stock recently hit a rough patch. A damning report from short-seller Hindenburg Research triggered a downward spiral, accusing the company of undisclosed related-party transactions and accounting irregularities. Additionally, rumors swirled that key customers like Tesla and Nvidia were pulling away. Investors scrambled to offload the stock as Super Micro delayed filing its 10-K annual report.

Despite the recent slump, SMCI remains up 63.8% YTD, outpacing both the S&P 500 Index and the Nasdaq Composite. Needham analysts suggest that the recent sell-off may have been excessive, deeming certain margin projections as overly pessimistic.

Post its recent nosedive, SMCI stock appears reasonably valued, trading at 13.63x forward adjusted earnings, a markdown from the tech sector median and its historical average. Likewise, with a forward price/sales ratio of 0.95, there’s an opportunity to acquire SMCI’s future earnings and revenue growth on the cheap.

Analysts foresee Super Micro Computer reporting over 41% EPS growth this fiscal year with an expected revenue surge of 87%.

The Big Picture for SMCI

Super Micro Computer is well-positioned to tap into thriving markets. Forecasts indicate that the AI server market could hit $177.4 billion by 2032, and data center storage capacity might double from 10.1 zettabytes in 2023 to 21.0 ZB in 2027. SMCI’s adeptness at customizing server offerings aligns it favorably to serve this expanding space.

Moreover, Super Micro’s pioneering use of liquid cooling in servers, touted as an eco-friendly initiative, offers space-saving benefits that cut costs for data center owners. Still, this shift introduces margin pressure at a time when the AI sector is under intense scrutiny.

Inside SMCI’s Fundamentals

Super Micro’s staggering growth story hinges on remarkable revenue and earnings expansion. Over the past decade, the company notched up impressive CAGRs of 26.12% in revenues and 36.41% in earnings.

In its recent fiscal quarter, SMCI posted a 78.1% growth in EPS to $6.25, slightly missing estimates. Revenues surged to $5.29 billion, up 143% from the prior year on the back of surging demand for new AI infrastructures.

Looking ahead, SMCI envisions per-share earnings between $6.69 to $8.27 for the current quarter, with revenue expected to land between $6 billion and $7 billion. The full-year revenue forecast ranges from $26 billion to $30 billion, surpassing Wall Street estimates.

Super Micro Computer closed the quarter with a $1.7 billion cash balance, exceeding its short-term debts of $1.5 billion. The company’s board greenlit a 10-for-1 stock split effective October 1.

What’s the Analyst Forecast for Super Micro Computer Stock?

Analysts, including Loop Capital, have tempered their optimism for SMCI, trimming price targets amid market uncertainties. The consensus remains at a “Moderate Buy” among analysts covering the stock, with an average price target of $782.31, signaling a potential upside of 67.8%.

As market tides shift, investors eye Super Micro Computer with cautious optimism, awaiting clarity on its future trajectory.