Unveiling Potential Amidst Turbulence

Amidst the tempestuous seas of the stock market, one company stands out like a sturdy oak in a raging storm, weathering the volatility with resilience and grace. This particular entity has been hand-picked by seasoned experts from Zacks, speculating a remarkable surge of over 100% in the near future. The significance of this choice is not to be underestimated, as it symbolizes hope and potential amidst uncertain times.

A Beacon for Investors

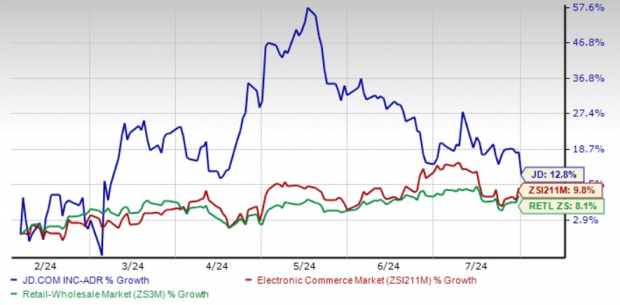

In a market teeming with thousands of options, the foresight of Zacks experts shines bright like a lighthouse illuminating the path for investors. This company, captivating millennial and Gen Z audiences alike, reeled in a staggering $1 billion in revenue in the last quarter alone – a testament to its robust business model and solid foundation. The recent pullback in its stock price presents a golden opportunity for investors to embark on a journey towards potential abundance.

Learning from History

History often serves as a poignant teacher, shedding light on the potential growth trajectories of companies in times of turbulence. Comparisons to past winners like Nano-X Imaging, which soared by an astonishing +129.6% in little over nine months, provide a glimpse into the immense possibilities that lie ahead for this selected entity. While not all elite picks are guaranteed triumphs, this particular choice holds the promise of surpassing even the loftiest expectations.