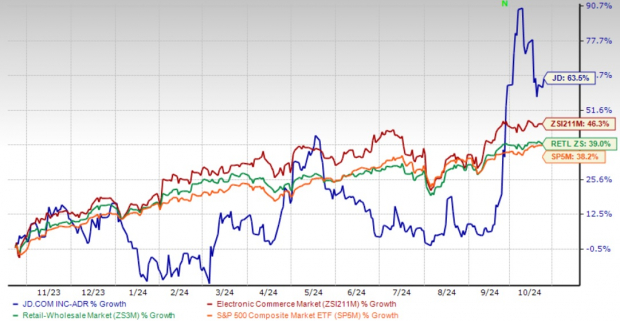

The landscape of retail has shifted favorably, heralding good tidings for investors with JD.com. The company’s robust performance, exemplified by a remarkable 60% surge in stock value over the past year, paints a picture of optimism ahead of the forthcoming holiday season. This meteoric rise stands out amidst improving retail conditions, buoyed by a Commerce Department report indicating a 0.4% increase in September’s retail sales, outstripping analysts’ forecasts.

Peering through the historical lens, this performance is particularly striking following the Federal Reserve’s recent 50-basis point rate cut, the first of its kind since March 2020. A stark departure from the previous cycle’s tightening measures that pushed rates to a 23-year apex, the current scenario of lower interest rates coupled with falling gasoline prices is fostering an environment primed for consumer spending on discretionary products, setting the stage for retailers like JD.com to flourish.

As the holiday season beckons, projections appear rosy for JD.com. According to Adobe Analytics, online sales are expected to hit $240.8 billion, marking an 8.4% increase compared to the previous period. Mobile shopping is slated to reach a record $128.1 billion, surging by 12.8%, seamlessly aligning with JD.com’s cutting-edge digital infrastructure and inventive technological solutions.

JD Redefines Retail with AI & Omnichannel Strategy

JD.com’s prowess in the e-commerce domain stands as a testament to its diverse range of offerings, spanning from electronics to home appliances. Strategic alliances with prestigious international brands such as the French luxury fashion group SMCP underscore JD.com’s capacity to allure and retain top-tier merchants on its platform. The blossoming flagship stores have significantly bolstered the JD Retail segment.

Furthermore, JD.com’s symbiotic e-commerce relationship with Walmart expands horizons for both parties. Hosting Walmart and Sam’s Club Flagship Stores on its platform and furnishing them with fulfillment solutions bolsters JD.com’s e-commerce stronghold.

A standout attribute of JD.com lies in its sophisticated supply chain and logistics network, underpinned by cutting-edge technology in AI, big data analytics, and cloud computing. This techno-marvel has empowered the company to construct a smart supply-chain platform, overseeing processes from upstream manufacturing and procurement down to final-mile delivery. Collaborating with JD Logistics, its majority-owned subsidiary Dada orchestrates efficient on-demand and last-mile delivery services, especially tailored for grocery and fresh products through JD Daojia.

In the grand tapestry of e-commerce, JD.com’s omnichannel strategy erects a bastion that elevates it beyond competitors like Alibaba and PDD Holdings. The introduction of JD MALL, an offline store boasting over 200,000 items from 200+ brands, marks a significant leap in merging online and offline shopping realms. Venturing into the offline fresh food domain with 7FRESH further underscores its dedication to delivering holistic shopping experiences. These initiatives resonate profoundly as Cyber Week sales are slated to escalate by 7% year over year, touching $40.6 billion and capturing 16.9% of total holiday season sales.

Upward Estimate Revision Bodes Well for JD

JD.com’s well-forged relationships with suppliers, brands, and partners position it favorably for sustained growth. The company’s expansive fulfillment infrastructure across the nation ensures swift, efficient, and dependable delivery services, enhancing the overall shopping journey for patrons.

The Zacks Consensus Estimate anticipates 2024 revenues to stand at $159.34 billion, forecasting a 4.7% year-over-year climb. The consensus figure for 2024 earnings is estimated at $3.97 per share, indicating a 27.2% yearly upsurge.

JD Stock: An Undervalued Gem in E-commerce Space

Trading at a discount with a forward 12-month Price/Sales ratio of 0.38X in contrast to the Zacks Internet – Commerce industry’s 1.72X, JD.com comes across as significantly underpriced, offering a compelling proposition for investors scouting value in the e-commerce domain. This substantial discrepancy in valuation hints at the market’s potential oversight of JD.com’s sturdy fundamentals, robust logistics architecture, and growth prospects, particularly on the cusp of the promising holiday season.

Conclusion

For prospective investors contemplating JD.com, the amalgamation of favorable macroeconomic conditions, sanguine e-commerce growth forecasts, and the company’s technological and operational acumen presents a persuasive investment prospect ahead of the festive season. Emboldened by a Zacks Rank #1 (Strong Buy) and an A Growth Score, JD.com exudes sturdy investment promise. The company’s holistic retail approach, blending state-of-the-art technology, resilient logistics, and strategic affiliations, suggests it is well-equipped to seize the anticipated holiday shopping spree while upholding its competitive edge via relentless innovation and service excellence.

The horizon for JD.com shines brightly, offering investors a beacon of promise amid the ever-evolving e-commerce landscape.

Infrastructure Stock Boom to Sweep America

A monumental drive to revamp the dilapidated U.S. infrastructure is poised to commence imminently. Spanning bipartisan support, this endeavor promises to be both pressing and ineluctable. Trillions are earmarked for this ambitious overhaul, paving the way for fortunes to be minted.

The only query that remains is, “Will you seize the right stocks early on when their growth potential is at its zenith?”

Zacks has unveiled a Special Report to aid you in this quest, and today, it comes free of charge. Unearth 5 exceptional companies poised to reap the rewards.

The Impact of Infrastructure Investment on the Economy

Driving Economic Growth

Infrastructure investment fuels economic growth, impacting everything from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Long-Term Benefits

With historical context in mind, hefty infrastructure spending filters into nearly every sector, from transportation to utilities, buttressing economic activity and employment opportunities for years to come.

Investor Opportunities

For investors eyeing potential avenues for growth, the surge in infrastructure spending presents unique opportunities to capitalize on the growth trajectory of various industries involved in the development and maintenance of critical infrastructure.

Profitability in Infrastructure

As infrastructure investment continues to soar, savvy investors stand to benefit from the ripple effects across the economy, including increased demand for materials, equipment, and skilled labor to support the expansion and maintenance of infrastructure projects.