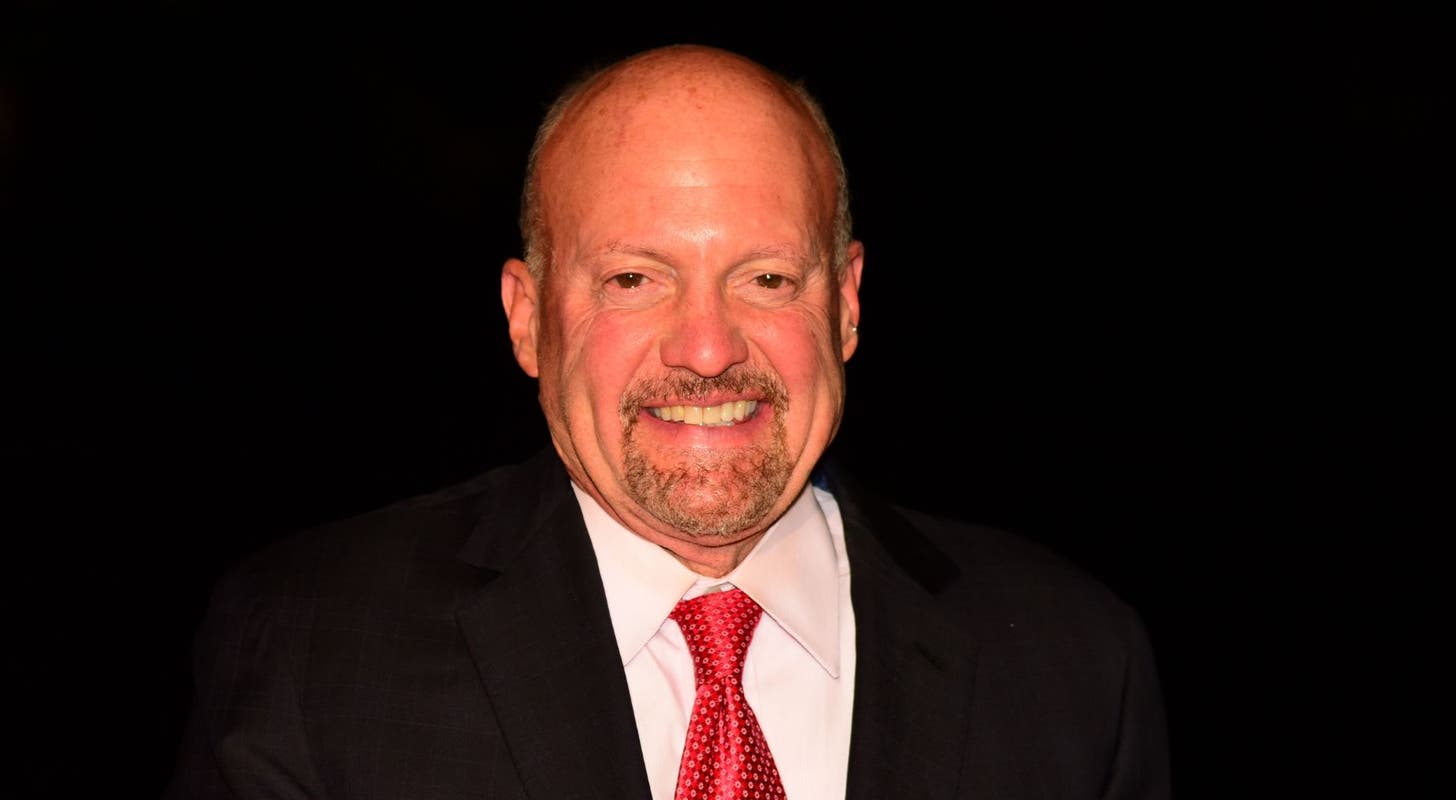

The Wise Words of Jim Cramer

On CNBC’s “Mad Money Lightning Round,” well-known financial guru Jim Cramer has expressed caution in purchasing shares of semiconductor company Taiwan Semiconductor Manufacturing Company Limited (TSM) . Amidst a generally optimistic climate, Cramer advised restraint, stating, “We cannot be so eager to buy the first dip.”

Cramer’s words come at a time when the semiconductor industry is experiencing significant growth. Taiwan Semi recorded a substantial 7.9% year-on-year revenue increase in January 2024, reaching NT$215.79 billion ($6.9 billion). This impressive upswing can be attributed to robust demand for AI chips, which helped offset declining consumer electronics sales.

In the same discussion, Cramer expressed a favorable view towards MPLX LP, a company that recently surpassed expectations by reporting earnings of $1.10 per share for the fourth quarter, exceeding the anticipated 94 cents per share. With sales totaling $2.97 billion, surpassing the market’s estimates of $2.85 billion, MPLX seems to be in a very strong position.

Conversely, Cramer recommended that investors “ring the register” on Celestica Inc. (CLS), advising them to sell a third of their shares. This shift in recommendation comes after Celestica announced better-than-expected fourth-quarter financial results and issued guidance for the first quarter that exceeded estimates. Additionally, the company appointed Kulvinder (Kelly) Ahuja to its Board of Directors.

The Stock Market Response

- Shares of MPLX gained 0.7% to close at $39.32 on Tuesday.

- Taiwan Semiconductor shares fell 1.1% to settle at $125.33.

- Celestica shares fell 5.2% to settle at $37.46 on Tuesday.