Despite facing a year-over-year decline in its top-line, Keysight Technologies Inc. managed to impress investors by beating the Zacks Consensus Estimates in its second-quarter fiscal 2024 results. The company showcased strength in various sectors such as electric vehicles and AI data centers, along with growth in defense modernization spending in the United States and Europe.

The acquisition of Riscure expanded Keysight’s security assessment capabilities, providing a boost for semiconductors, embedded systems, and connected devices.

Strong Earnings Performance

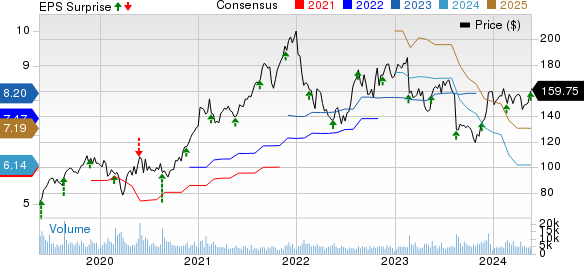

Key insights into the financials reveal that despite a drop in net income – $126 million or 72 cents per share on a GAAP basis, down from $283 million or $1.58 per share in the year-ago quarter – this was primarily due to the decline in the top line.

Non-GAAP net income fared better at $247 million or $1.41 per share, surpassing the prior-year quarter. The company showed resilience by beating the Zacks Consensus Estimate.

Revenue Resilience Amid Market Challenges

While quarterly net sales declined to $1.22 billion from $1.39 billion in the previous year, Keysight witnessed growth in certain segments like the Communication Solutions Group (CSG) with $840 million in revenues, despite an overall 10% year-over-year decline. Aerospace, Defense & Government end markets faced a slowdown, but demand from U.S. government, defense modernization efforts, and AI data center solutions balanced the scale.

The Electronic Industrial Solutions Group (EISG) segment experienced a drop in revenues to $376 million from $453 million in the previous year, largely due to soft demand in consumer electronics and manufacturing. However, strong performance in EV solutions helped mitigate some of the losses.

Operational Details and Financial Health

Operational margins reflected the revenue challenges, with non-GAAP gross profit totaling $790 million and gross margins at 65% compared to 66.7% in the previous year. The non-GAAP operating margin stood at 24.2%, down from 30.4%.

Keysight’s cash flow from operating activities noted a decrease, falling to $438 million from $789 million a year ago. The company ended the quarter with $1.66 billion in cash and cash equivalents, offset by $1.2 billion in long-term debt.

Future Outlook and Investor Recommendations

Looking into the third quarter of fiscal 2024, Keysight anticipates revenues in the range of $1.180-$1.200 billion with non-GAAP earnings expected between $1.30 and $1.36 per share. The company currently holds a Zacks Rank #3 (Hold).

Investors seeking alternatives might consider companies like NVIDIA Corporation (Zacks Rank #2), Arista Networks, Inc. (Zacks Rank #1), and Silicon Motion Technology Corporation (Zacks Rank #1) for potential opportunities and growth.

Exciting Investment Opportunities in Diverse Sectors

Unlocking Potential in Various Industries

Investors are currently buzzing over a range of compelling opportunities in the market. These include a medical manufacturer that has seen a staggering growth of +11,000% over the past 15 years, a rental company dominating its sector, an energy powerhouse poised to increase its already substantial dividend by 25%, an aerospace and defense firm securing a contract potentially worth $80 billion, and a leading chipmaker expanding its operations with massive new plants in the U.S.