It has been a tumultuous year for Li Auto stock, stumbling initially due to a lackluster launch of its first all-electric vehicle and a slump in Q1 deliveries. However, a transformation has occurred since March, with the potential for further momentum fueled by government initiatives boosting the local market. The outlook is bright, underpinned by a robust delivery forecast and impressive profit margins.

The Impact of China Stimulus on Li Auto

For the uninitiated, Li Auto is a leading New Energy Vehicle (NEV) company based in Beijing, specializing in Extended Range Electric Vehicles. These innovative hybrids combine battery technology with traditional engines, offering remarkable vehicle ranges. The L6 model, for instance, boasts a claimed range of 1,390 kilometers – a testament to Li’s promise.

Despite initial setbacks including disappointing Q1 deliveries for its Li Mega BEV, Li Auto has rebounded impressively. Deliveries have soared in Q2 and Q3, with the company achieving a 40% increase in vehicle deliveries compared to the previous year. The stock, along with other Chinese counterparts and foreign-listed Chinese firms, experienced a significant surge following Beijing’s recent stimulus measures announcement. These actions, including interest rate cuts and banking regulations adjustments, are expected to positively impact Li Auto through increased consumer spending potential and enhanced market sentiment.

Impressive Delivery Growth for Li Auto

Although LI stock has rebounded following the stimulus announcement, it remains down 34.4% year-to-date. Despite the stumble with the Li Mega debut, the company’s delivery recovery has been substantial. Notably, in July, Li achieved a record monthly delivery of 51,000 vehicles, driven by the strong demand for its cost-effective L6 model. The company foresees continued growth, with a projected delivery range of 145,000 to 155,000 vehicles in Q3. The recent milestone of 100,000 deliveries for the L6 model signifies a crucial turning point for Li Auto.

Margin Success for Li Auto

In the realm of vehicle margins among Chinese EV startups, Li Auto is setting the pace. The company reported a remarkable 18.7% margin in Q2, outperforming competitors like NIO and XPeng, as well as established players such as Tesla and BYD. Though a slight decline was noted quarter-over-quarter, Li Auto retains a significant advantage in this critical metric. NIO achieved a 12.2% margin in Q2, while XPeng trailed with a 6.4% margin. Li Auto’s superior margins, along with its profitability and robust delivery projections, position it favorably in the competitive NEV landscape.

Value Proposition of Li Auto Stock

Despite its recent successes, Li Auto stock remains attractively priced. Trading at a discount compared to its industry peers, Li Auto boasts a forward price-to-earnings (P/E) ratio of 21.5x – lower than Tesla’s multiple of 108x. Furthermore, its forward EV-to-sales ratio of 0.65x places it at a significant valuation gap compared to rivals like Nio and Xpeng. An added advantage is Li’s strong cash position, with a net cash holding of $11.25 billion, surpassing competitors like BYD.

Analysts’ View on Li Auto Stock

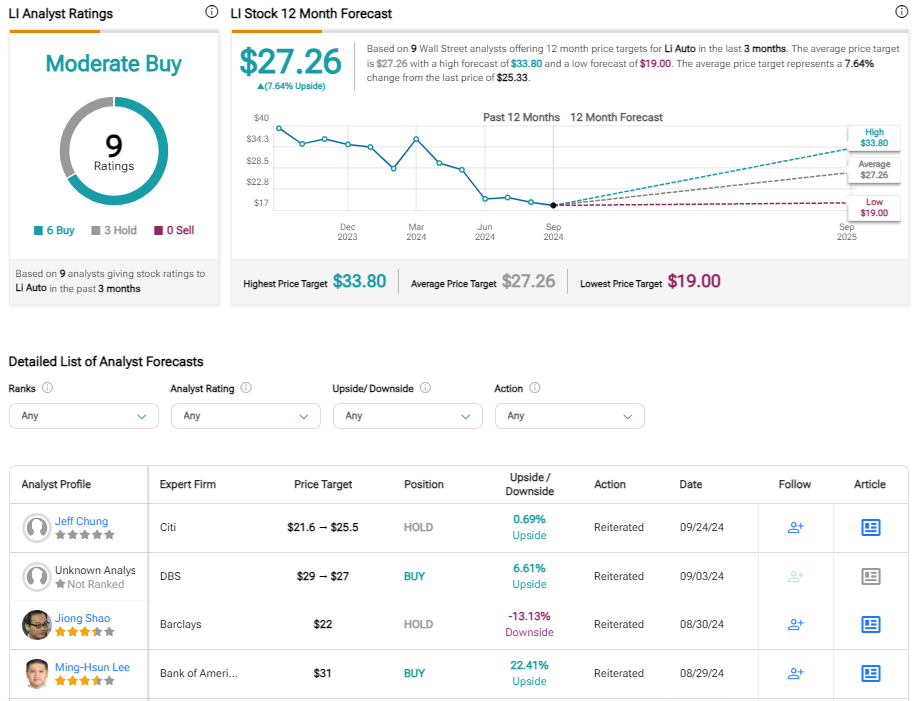

According to analysts on TipRanks, LI stock holds a Moderate Buy rating, with six Buys, three Holds, and zero Sells in the past quarter. The average price target for Li Auto stock stands at $27.26, suggesting an approximate 8% upside potential.

Final Thoughts on Li Auto Stock

The trajectory for Li Auto stock appears promising, with industry-leading margins and a strong delivery outlook. The recent government interventions are expected to further propel Li Auto’s growth by stimulating domestic demand. As Li Auto continues its upward climb, investors may find substantial value and promise in this evolving market landscape.