A shift in the financial landscape caught the eye of big players, casting a bearish shadow over Bank of America. A close examination of options data for Bank of America (BAC) exposed 37 peculiar trades.

Zooming in, our investigation revealed a split sentiment among traders, with 45% taking a bullish stance and 48% displaying bearish behavior. Among these trades, 25 were puts valued at $1,600,134, while 12 were calls worth $408,606.

Deciphering Price Predictions

Scrutinizing the Volume and Open Interest figures, it appears that significant players have set their sights on a price range spanning $20.0 to $48.0 for Bank of America in the previous quarter.

Trends in Volume & Open Interest

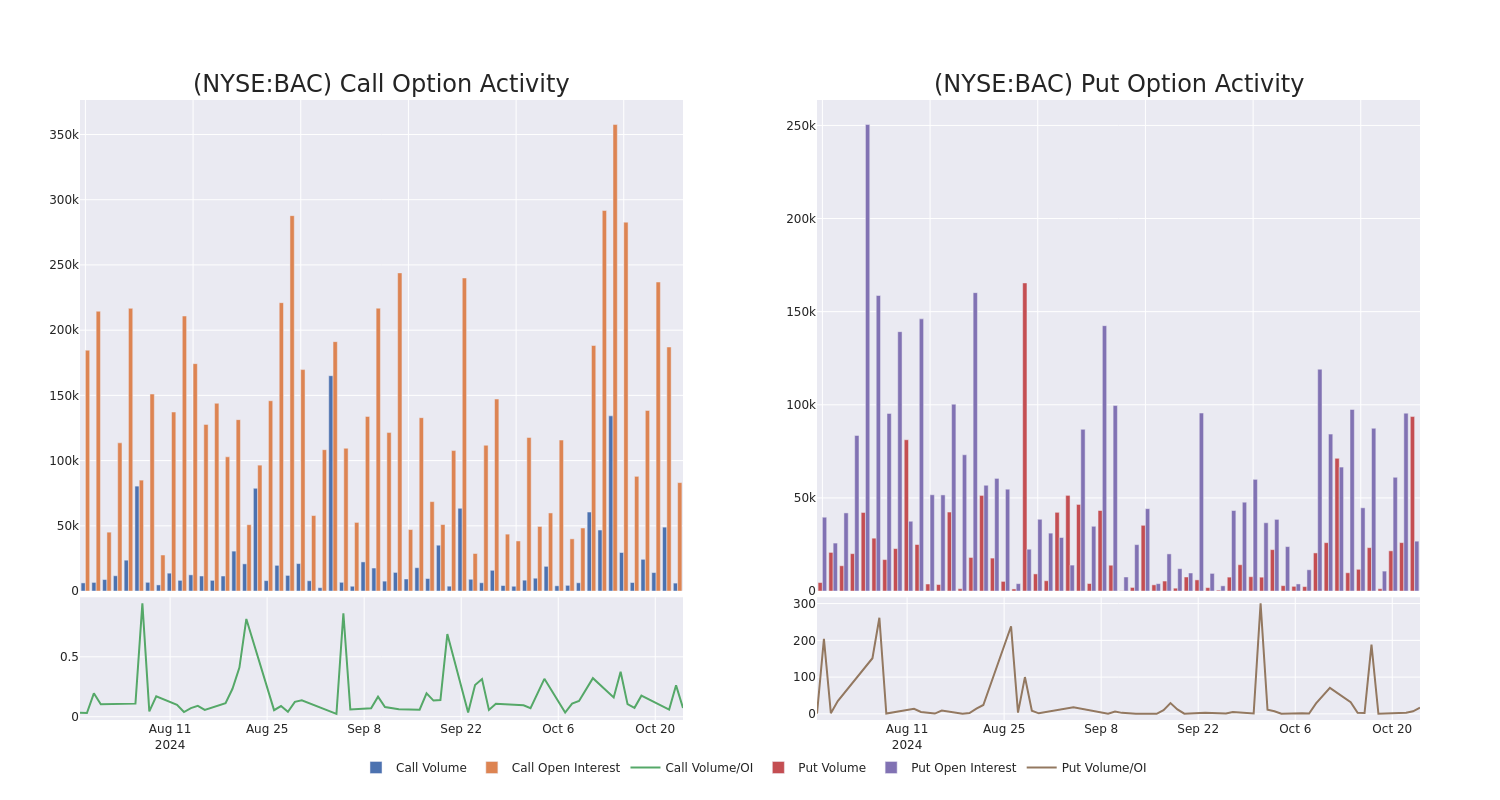

Regarding liquidity and engagement, the average open interest for Bank of America options trades today stands at 9159.25, with a cumulative volume of 99,774.00.

Referencing the chart below will provide a visual narrative of the volume and open interest progression concerning call and put options within the $20.0 to $48.0 strike price range for Bank of America over the last 30 days.

Bank of America Options Activity: A 30-Day Overview

Noteworthy Options Transactions Unearthed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BAC | PUT | SWEEP | BULLISH | 01/17/25 | $2.42 | $2.4 | $2.4 | $43.00 | $79.9K | 5.4K | 4.0K |

| BAC | CALL | SWEEP | BEARISH | 12/20/24 | $22.5 | $22.4 | $22.43 | $20.00 | $76.2K | 15 | 0 |

| BAC | PUT | SWEEP | BULLISH | 01/17/25 | $2.37 | $2.34 | $2.34 | $43.00 | $76.0K | 5.4K | 6.2K |

| BAC | PUT | SWEEP | BULLISH | 01/17/25 | $2.35 | $2.33 | $2.33 | $43.00 | $73.3K | 5.4K | 6.2K |

| BAC | PUT | SWEEP | BULLISH | 01/17/25 | $2.43 | $2.41 | $2.41 | $43.00 | $72.3K | 5.4K | 3.7K |

Insight Into Bank of America

Bank of America, a colossal financial institution in the United States, boasts assets surpassing $3.0 trillion. Organized into four key segments, it covers consumer banking, global wealth and investment management, global banking, and global markets.

Consumer services, including branches, lending products, and cards, alongside wealth and brokerage services from Merrill Lynch and the private bank, constitute its retail facade. Wholesale activities encompass investment banking, real estate lending, and capital markets, with a primary focus on the US market.

Given the recent options saga surrounding Bank of America, it’s high time we delve into the company’s current standing.

Status Report on Bank of America

- Trading in the vicinity of 15,957,725 shares, BAC’s price experiences a nominal dip of -0.09%, settling at $42.3.

- Indicators suggest the stock might be teetering towards overbought territory.

- An earnings announcement is looming in 84 days.

Expert Perspectives on Bank of America

Five market experts have issued recent ratings for Bank of America, aligning on a consensus target price of $48.2.

A Glimpse into Unusual Options Activity: The Puzzles of Smart Money

Delving into the intriguing world of unusual options, Benziga Edge’s report uncovers potential market shifts before they materialize, offering insight into significant positions being taken on favorite stocks.

* Morgan Stanley maintains an Overweight rating on Bank of America with a price target of $48.

* RBC Capital downgrades its rating to Outperform, revising the price target to $46.

* Morgan Stanley stays firm with an Overweight rating and a target price of $47 on Bank of America.

* Keefe, Bruyette & Woods continues to champion an Outperform rating with a $50 price target for Bank of America.

* Oppenheimer reiterates an Outperform rating with a $50 target price for Bank of America.

Options trading introduces heightened risks and potential rewards. Astute traders navigate these waters by staying informed, adapting strategies, monitoring indicators, and keenly observing market gyrations.