The recent bounce-back in the stock market has provided a brief respite from the whirlwind of volatility that engulfed investors. As the looming Fed rates decision casts a shadow of uncertainty, the potential for heightened volatility is on the horizon.

This momentary calm may unveil a hidden gem for astute investors – stocks exhibiting a low implied volatility percentile.

Decoding Implied Volatility Percentile

Implied volatility metrics are currently painting a picture of tantalizing opportunities. Take Pfizer (PFE), for instance, with its implied volatility at 21%, a mere whisper away from its twelve-month low of 18% amidst a roaring high of 34%.

An essential gauge for option traders, the IV Percentile measures how a stock’s current implied volatility stacks up against its historical range. This comparison offers a benchmark to assess the stock’s volatility dynamics.

Visualizing this metric as a percentage ranging from 0-100%, a score of zero signifies rock-bottom implied volatility, whereas a perfect 100% heralds peak volatility levels for the stock.

To pinpoint stocks with alluringly low implied volatility percentiles, we turn our eyes to the Stock Screener, a powerful tool that acts as a magnifying glass in the vast market landscape.

Unveiling the Low Volatility Gems

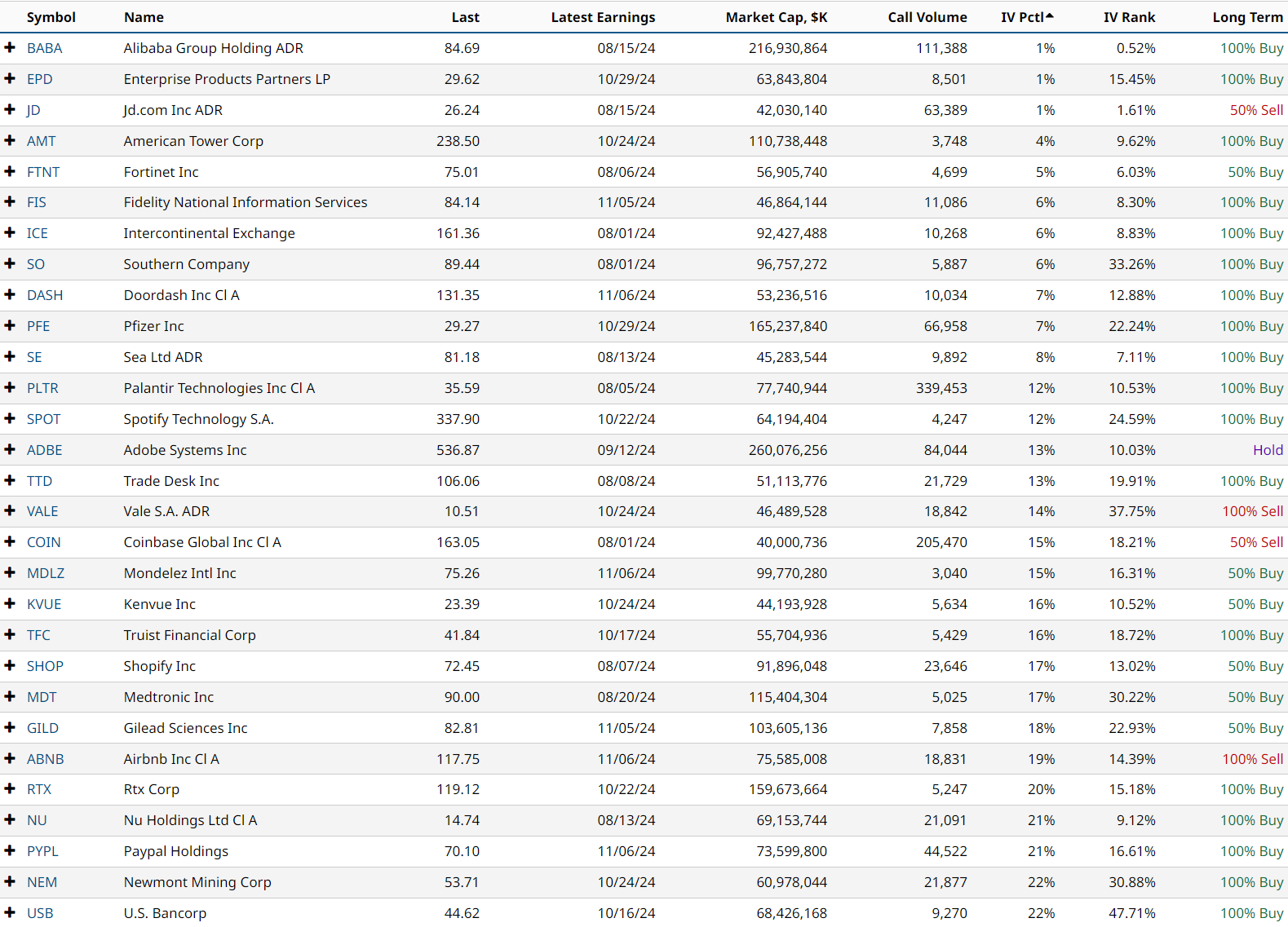

Filtering stocks with stringent criteria such as high Total Options Volume (> 2,000), significant Market Cap (> 40 billion), and an IV Percentile of less than 25%, we unearth a treasure trove of low volatility stocks, including:

- Alibaba (BABA)

- Enterprise Products Partners (EPD)

- JD.com (JD)

- American Tower Corp (AMT)

- Fortinet (FTNT)

- Fidelity National Information Services (FIS)

- Intercontinental Exchange (ICE)

- Southern Company (SO)

- DoorDash (DASH)

- Pfizer (PFE)

For the complete list, refer to the visual representation below:

Mastering the Art of IV Percentile

When the implied volatility percentile hits the floor, it’s time to navigate towards long volatility trades such as debit spreads, long straddles, and long strangles.

An insightful strategy involves comparing a stock’s IV Percentile against the broader market landscape. If pervasive low IV Percentile prevails across all stocks, the competitive edge diminishes. However, amidst a market-wide surge in implied volatility, the time is ripe to seize undervalued volatility among the listed gems.

Furthermore, charting the upcoming earnings dates becomes crucial, as stocks often embark on dramatic trajectories post-earnings announcements.

Remember, while the allure of options beckons, tread cautiously as the seas can turn tumultuous. Consult your financial advisor, conduct thorough due diligence, and remember to harness prudence in your investment decisions.