Lucid (NASDAQ: LCID) stock is on the rise in Monday’s trading, defying its recent record low. As of 11:30 a.m. ET, the company’s share price has surged by 3%, outpacing the S&P 500 index, up 0.3%, and the Nasdaq Composite index, up 0.5%, according to S&P Global Market Intelligence. The upward movement, bolstered by bullish market momentum, has been further fueled by a recent recall announced by industry heavyweight Tesla.

Market Reaction to Lucid’s Resilience

Lucid’s stock experienced a notable surge in early trading, momentarily peaking at a 9.2% increase. This rebound is attributed to not only emerging bullish market sentiment but also the ripple effect of Tesla’s announcement of a recall affecting 4,382 vehicles in Australia. The recall, citing a software issue that could impact steering, mirrors Lucid’s own recent recall of over 2,000 Lucid Air vehicles due to concerns about faulty high-voltage coolant heaters.

Is Lucid Group a Viable Investment?

Last week, Lucid stock hit an all-time low of $2.54 per share, reflecting bearish indicators for demand in the EV industry. While the current gain marks a welcome shift from recent downward trends, uncertainties still loom over the company’s long-term prospects. The past quarter saw Lucid reporting an operating loss of roughly $752.9 million, despite revenue of $137.8 million and 1,457 vehicle deliveries. With the fourth-quarter results pending release on February 21, the company’s production of 2,391 vehicles and delivery of 1,734 units, while demonstrating sequential growth, may be overshadowed by increased operating losses.

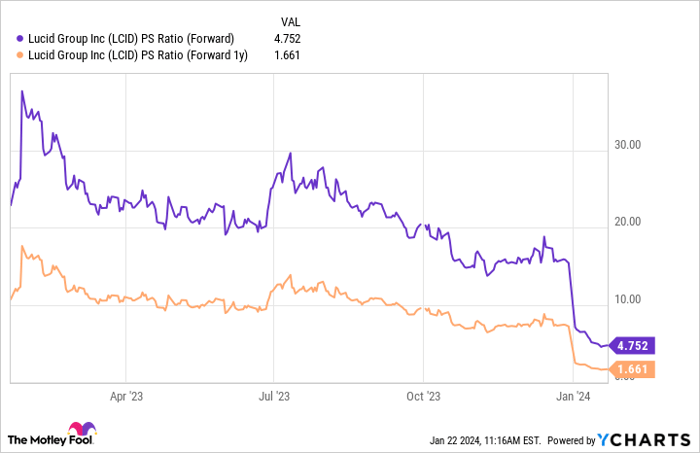

LCID PS Ratio (Forward) data by YCharts

Currently trading at approximately 4.8 times this year’s expected sales and 1.7 times next year’s projected revenue, Lucid stock is poised to experience rapid sales growth, according to analysts. However, fluctuating EV demand poses a potential challenge to the company’s trajectory, with profitability remaining distant, even under the most optimistic scenarios. While the stock holds the promise of substantial returns, it remains a high-risk investment and may not align with the risk tolerance of most investors.

Evaluating the Investment Potential

Prior to investing in Lucid Group stock, prudent consideration is essential. The Motley Fool Stock Advisor analyst team, renowned for identifying investment opportunities, excludes Lucid Group from its list of the 10 best stocks. The absence of Lucid Group from the index implies that there are other stocks with the potential to yield substantial returns in the coming years.

Stock Advisor offers a straightforward blueprint for investors, providing guidance on portfolio construction, regular analyst updates, and two new stock picks monthly. Since 2002, the service has surpassed the returns of the S&P 500 by more than triple.*

*Stock Advisor returns as of January 22, 2024

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.