Investors with substantial financial means have recently taken a pessimistic view on Zions Bancorp.

It’s a development worth noting for retail traders.

The appearance of these trades in publicly accessible options history that is monitored at Benzinga gives us a heads-up.

When significant movements like these occur within the realms of ZION, it often hints at insightful foresight from those involved.

So, what exactly have these investors executed?

Today, Benzinga’s options scanner detected 11 extraordinary options trades related to Zions Bancorp.

Such occurrences are rarely ordinary.

Of all the distinctive options contracts unveiled, 9 involve puts totaling $1,063,673, while 2 are calls amounting to $744,725.

Projected Trajectories and Price Bands

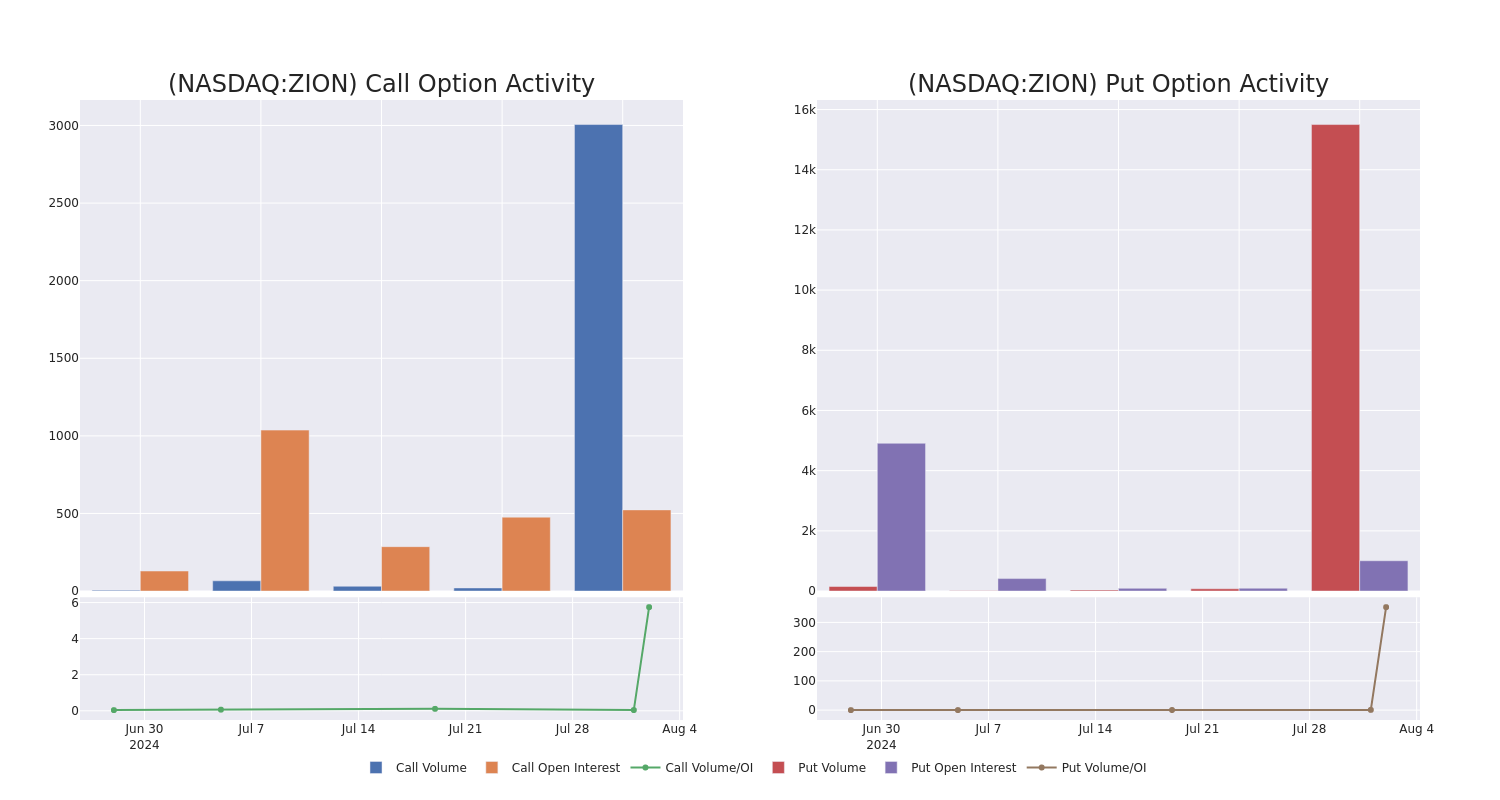

An analysis of trading volumes and Open Interest indicates that major market players are honing in on a price range of $30.0 to $47.5 for Zions Bancorp over the past three months.

Delving into Volume and Open Interest Insights

When engaging in options trading, casting an eye over volume and open interest figures is pivotal. This data aids in keeping tabs on liquidity and interest in Zions Bancorp’s options across various strike prices. Below, we can scrutinize the ebbs and flows in the volume and open interest levels for calls and puts respectively within a strike price bracket of $30.0 to $47.5 for Zions Bancorp’s significant trades over the past month.

Zions Bancorp’s Performance Over the Last 30 Days

Noteworthy Options Discoveries

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ZION | CALL | SWEEP | BULLISH | 10/18/24 | $3.0 | $2.4 | $2.4 | $47.50 | $482.6K | 523 | 2 |

| ZION | PUT | SWEEP | BULLISH | 12/20/24 | $2.1 | $2.05 | $2.1 | $40.00 | $396.0K | 44 | 1.7K |

| ZION | CALL | SWEEP | BULLISH | 10/18/24 | $2.65 | $2.55 | $2.65 | $47.50 | $262.0K | 523 | 3.0K |

| ZION | PUT | SWEEP | BEARISH | 12/20/24 | $2.2 | $2.05 | $2.1 | $40.00 | $202.4K | 44 | 5.0K |

| ZION | PUT | SWEEP | BEARISH | 12/20/24 | $2.15 | $2.1 | $2.15 | $40.00 | $156.5K | 44 | 728 |

Insight into Zions Bancorp

Zions Bancorporation, a regional U.S. bank, operates in 11 states with a headquarters in Salt Lake City. The bank’s operations primarily cater to small and midsize businesses, focusing mainly on commercial and commercial real estate lending.

After dissecting the options trading landscape surrounding Zions Bancorp, let’s delve deeper into the corporation for a more comprehensive evaluation of its market position and performance.

Zions Bancorp’s Current Standing

- Trading volume currently sits at 2,306,442, with ZION’s price experiencing a -4.13% drop, resting at $46.61.

- Relative Strength Index (RSI) indicators suggest the stock may be nearing an overbought condition.

- Earnings announcement anticipated in 80 days.

Analyst Perspectives on Zions Bancorp

Over the past month, 5 experts have shared their ratings on this stock with an average target price of $49.8.

- An analyst at RBC Capital opts to maintain their Sector Perform rating on Zions Bancorp, setting a price target of $48.

- Another from Morgan Stanley continues to uphold an Underweight rating for Zions Bancorp, aiming for a price of $42.

- A representative from Stephens & Co. maintains an Equal-Weight rating on Zions Bancorp with a target price of $51.

- RBC Capital remains steadfast in their Sector Perform rating for Zions Bancorp, targeting a price of $54.

- Additionally, an analyst at Goldman Sachs maintains a Neutral rating for Zions Bancorp, targeting a price of $54.

Trading options involves risks but also presents potential for amplified profits. Skillful traders manage these risks through continuous learning, strategic trade modifications, utilization of various indicators, and keeping an ear to the ground for market movements. Stay updated on the latest options dealings for Zions Bancorp with Benzinga Pro for instant alerts.