Marvell Technology Shines with Meteoric Surge: An Investor’s Odyssey

The Market’s Dance: Marvell Technology’s Meteoric Rise

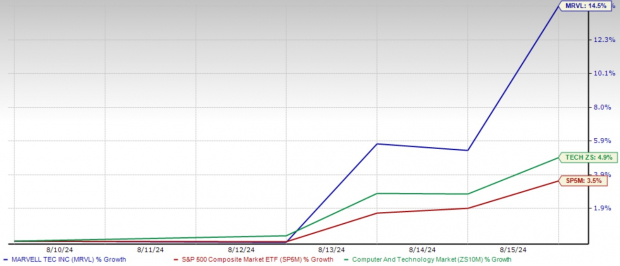

In a week ablaze with financial fervor, Marvell Technology (MRVL) has soared 14%, leaving its contemporaries in the dust. The murmurs of the market resonate with awe as the S&P 500 and the Computer and Technology sector timidly climb, a mere 3.5% and 4.9% respectively, in comparison.

As the financial rollercoaster of early August 2024 jolted investors, fear brewed, whispering of a looming U.S. recession. The market’s correction trembled under the weight of concerns over the Federal Reserve’s interest rates and a bleak weekly job report.

The Optimistic Horizon: Investor Sentiment Rises

But in the market’s pendulum, investors have nibbled at fear, savoring it as an opportunity to feast on hope. The whispers of despair have now whispered away, brushed aside by yesterday’s robust economic reports.

Amidst the storm, a beacon of light emerges – robust retail sales and the gentle fall of weekly jobless claims. These beacons paint a tapestry of U.S. economic resilience, a canvas that bears the weight of trials but emerges stronger.

Marvell basks in this newfound optimism, hand in hand with the semiconductor industry titans – NVIDIA, Advanced Micro Devices, and Micron – all caught in the throes of a rally.

Riding the Wave: Marvell’s Long-Term Prospects

Amidst the tumult, Marvell’s voyage towards long-term prosperity stands unwavering. The AI market stands as a treasure trove, awaiting Marvell’s deft hand. Gartner’s whispers of AI semiconductor revenues growing 33% to $71.25 billion in 2024 and a further 29% in 2025 hint at a future painted in optimism.

While Marvell’s chips may not partake in the AI feast directly, their orchestration of data flow in the AI realm is vital. As AI data demands escalate, Marvell’s solutions find themselves in high demand.

Marvell’s foray into high-performance electro-optics products lays the groundwork for seamless data transmission in AI-boosted data centers. A trailblazer in innovative technologies, Marvell’s strategic bets on scalable data center solutions firm its position in the industry.

Forecasting the Skies: Marvell’s Glittering Future

Wall Street’s sages cast Marvell in a shimmering light, projecting a 31.5% uptick in revenues and 73% growth in earnings for fiscal 2026. These whispers of prosperity for Marvell far eclipse the industry average, painting a portrait of ascension amongst the stars.

As Marvell dances towards the future, the road not taken stands littered with challenges. Foremost, the shadows of U.S. semiconductor export restrictions loom, threatening Marvell’s Chinese revenue domain. Winds of uncertainty blow strong, disrupting the supply chain and ruffling the feathers of progress.

Moreover, Marvell stands tall but risks stumbling on the pedestal of its lofty valuation. Glowing brightly in the market’s eye, Marvell’s price-to-sales ratio sparkles at 11.22X, casting shadows on the industry’s 9.21X average.

The Odyssey Continues: A Call to Investors

Like Odysseus navigating tempestuous seas, investors ponder Marvell’s voyage ahead. Resting on the cusp of euphoria, a cautious whisper tugs at the sleeves of greed. While the harbingers of Marvell’s future sing of prosperity, the harsh realities of export restrictions and overvaluation paint a cautionary edge on the horizon.

For stalwart shareholders, the chronicles of wisdom echo: hold fast amidst the storm. Marvell’s foothold in growth markets and strategic tech investments steer the compass towards brighter tomorrows. Yet, the current tempests forewarn that prudence must temper ambition.

Thus, the skies beckon investors to tread wisely – to hold, not fold. Bask in Marvell’s past glory, but peer cautiously at the shadows dancing on the walls of tomorrow. The stars of MRVL flicker with promise, carrying a Zacks Rank #3 (Hold), a totem of the Odyssey that lies ahead.

Exploring Elite Stock Picks – A Financial Analysis

Unveiling Elite Stock Opportunities: A Closer Look at Top Financial Picks