As any seasoned investor knows, volatility on Wall Street is as common as the changing of seasons. Fluctuations between bear and bull markets have been the norm in this decade, painting a vivid picture of the capricious nature of stocks in the short term. Despite investors yearning for a departure from this pattern in 2024, the unpredictability persists.

When faced with volatility, both professional and retail investors often gravitate towards companies with a proven track record of success through various economic climates. The rise of the FAANG stocks over the past decade is a testament to this trend, yet in recent years, it is stocks undergoing splits that have stolen the limelight.

Image source: Getty Images.

A “stock split” is essentially a cosmetic adjustment that enables a publicly traded company to modify its share price and outstanding share count without impacting its market capitalization or operational performance.

Forward-stock splits can render shares more affordable for retail investors without fractional-share purchasing capabilities. Conversely, reverse-stock splits aim to elevate a company’s share price to maintain listing on a major stock exchange. High-flying businesses typically focusing on forward-stock splits garner most investor attention.

A Surge of Forward Stock Splits in Major Companies Since Mid-2021

Corporations implementing forward stock splits are often immensely profitable and pioneers in innovation within their industries.

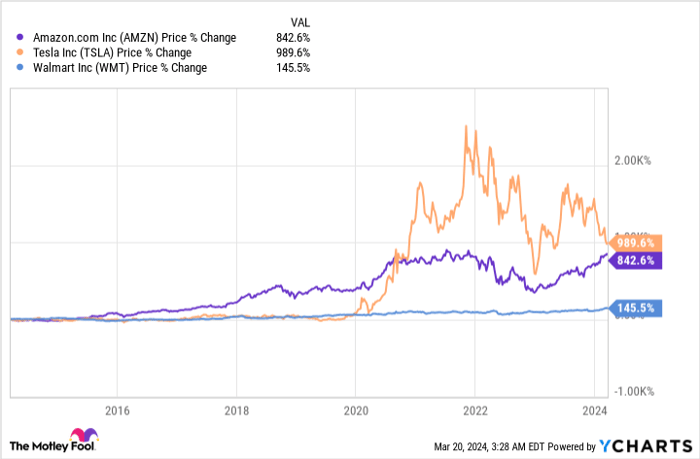

Notably, since mid-2021, nearly a dozen prominent companies, including Amazon (NASDAQ: AMZN), Tesla (NASDAQ: TSLA), and Walmart (NYSE: WMT), have executed forward-stock splits. Amazon and Tesla’s splits were at 20-for-1 and 3-for-1, respectively, in 2022, while Walmart implemented a 3-for-1 split last month.

These companies’ exceptional performance stems from their distinctive competitive edges:

- Amazon dominates the e-commerce realm, accounting for nearly 38% of U.S. online retail sales in 2023, approximately six times the share of its closest competitor. Amazon’s Amazon Web Services (AWS) serves as the leading cloud infrastructure service platform globally.

- Tesla leads North America’s electric-vehicle (EV) production, emerging as the sole profitable pure-play EV manufacturer. Tesla’s production is slated to surpass 2 million vehicles this year.

- Walmart leverages its size competently, benefiting from cost advantages due to bulk purchasing. This strategy enables Walmart to maintain a competitive edge on pricing vis-à-vis local stores and grocery chains, while its sprawling retail footprint fosters customer loyalty and engagement.

On March 19, another exceptional company joined the elite league of stock-split stocks.

Image source: Chipotle Mexican Grill.

Chipotle Mexican Grill: Serving Up a Delectable Stock-Split Surprise

After market close on March 19, the board of directors at fast-casual eatery Chipotle Mexican Grill (NYSE: CMG) publicized a groundbreaking 50-for-1 stock split, marking one of the most substantial forward splits in the annals of the New York Stock Exchange. Pending approval from shareholders at the annual meeting in June, Chipotle will commence trading at a revised post-split price on June 26, 2024.

Having gone public in January 2006 at $22 per share, Chipotle’s stock price nearing $3,000 precipitated this bold move. The 50-for-1 split will recalibrate Chipotle’s share price to approximately $60 per share, based on current levels.

Jack Hartung, Chipotle’s chief financial and administrative officer, articulated,

This marks Chipotle’s inaugural stock split in its 30-year journey, expanding accessibility for employees and a broader investor base alike.

The Tech Stock Split Craze: Is Broadcom Next in Line?

Chipotle’s Recipe for Success

The recent stock split announcement by Chipotle Mexican Grill serves as a testament to the company’s exceptional performance in the market. Bolstered by a trifecta of outstanding food quality, a streamlined menu, and a penchant for innovation, Chipotle has managed to captivate both investors and customers alike. By focusing on locally sourced ingredients and maintaining a limited yet exciting menu, Chipotle has differentiated itself from the competition. Moreover, its innovative strategies, such as the introduction of “Chipotlanes,” have further solidified its position as a frontrunner in the industry.

The AI Frenzy Hits Stock Splits

Following in the footsteps of Chipotle, semiconductor giant Broadcom is poised as a probable candidate for a stock split in the near future. With the artificial intelligence (AI) industry witnessing unprecedented growth and potential, Broadcom’s extensive experience and expertise in the field position it favorably for such a move. Riding on the coattails of AI’s projected enormous impact on the global economy, Broadcom’s Jericho3-AI chip has garnered significant attention for its pivotal role in supporting AI solutions and large-scale language model training.

Broadcom’s Wireless Chip Dominance

In addition to its AI ventures, Broadcom’s wireless chip segment, particularly its 5G wireless chips, has contributed significantly to its profitability. As consumers flock to upgrade their devices in pursuit of faster connections and enhanced wireless capabilities, Broadcom stands at the forefront of delivering cutting-edge solutions. This steady demand for wireless technology bodes well for Broadcom’s future growth and financial stability.

The Potential Stock Split Catalyst

Despite a history devoid of stock splits, Broadcom’s soaring stock price could potentially catalyze a change in the company’s strategy. With shares trading above $1,200, making them prohibitively expensive for many investors, a stock split may be the necessary step to increase accessibility and drive further investor interest in the company.