Warren Buffett, the legendary investor who helped shape Berkshire Hathaway into a near-trillion-dollar behemoth and co-founded the Giving Pledge charity, is not your typical tech investor. Despite his preference for traditional businesses, his decade-long support for Apple (NASDAQ: AAPL) has been a notable exception, making it Berkshire’s largest holding.

Positive Macro Indicators

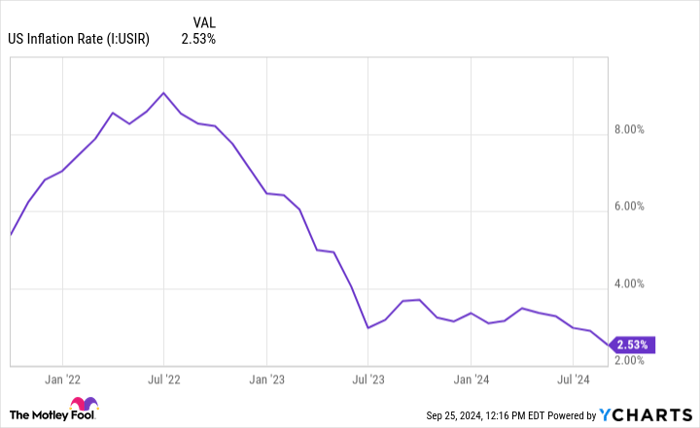

In recent years, economic challenges like high inflation and rising interest rates have impacted the U.S. macroeconomy and global markets, affecting Apple’s performance. However, as inflation moderates and the Federal Reserve adjusts interest rates, consumer spending is expected to rebound.

The Rise of Artificial Intelligence

While many tech giants have delved into artificial intelligence (AI) development, Apple has been relatively reserved. Recent comments from Dan Ives suggest a turning point for Apple, with potential for a tech renaissance driven by AI.

Apple’s AI Ventures

Apple’s new iPhone 16 release and partnership with OpenAI signal a shift towards AI integration in its products, potentially sparking increased consumer interest and product adoption. Forecasts of future partnerships, such as with Baidu, hint at global growth opportunities, especially in China.

Assessing the Investment Opportunity

While Apple’s stock might seem expensive with a high forward P/E ratio compared to the S&P 500, the company’s innovation in AI and new product lines could drive future growth. Investors should consider the potential for sustained consumer demand and resurgence.

Conclusion

Apple’s foray into AI represents a significant growth driver, despite its premium valuation. With evolving consumer preferences and technological advancements, Apple’s strategic moves could position it for sustained success in the dynamic tech landscape.