Microsoft has been a powerhouse in the stock market, with its value soaring over the past five years, nearly tripling in growth. The company stands close to its all-time high, and the fusion of Microsoft Cloud and its AI pursuits promises a pathway to new stock highs.

Microsoft Closes in on AWS Dominion

Microsoft is not the sole behemoth in cloud services, yet it’s steadily encroaching on the stronghold of the largest cloud platform, Amazon Web Services (AWS). Presently holding a 25% market share in cloud computing, Microsoft’s advancement narrows the divide with AWS at 31%. Trailing is Alphabet, with a mere 11% market share.

In Microsoft’s fiscal second quarter of 2024, cloud revenue surged by 21% year-over-year, outperforming AWS’s modest 19% growth. If this pace persists, Microsoft is poised to further gain market territory.

Add to that, amassing market share is lucrative in any sector, more so in a burgeoning industry. The surge in artificial intelligence is expected to spike demand for cloud platforms, with Microsoft leading the charge. With regular feature updates, Microsoft’s cloud services are poised to outshine its competitors.

Microsoft Investors Embrace Cloud Computing Exposure

What sets Microsoft apart from its tech counterparts is its heavy reliance on cloud computing revenue. The company’s heavy investment in cloud computing bodes well since this industry holds substantial promise.

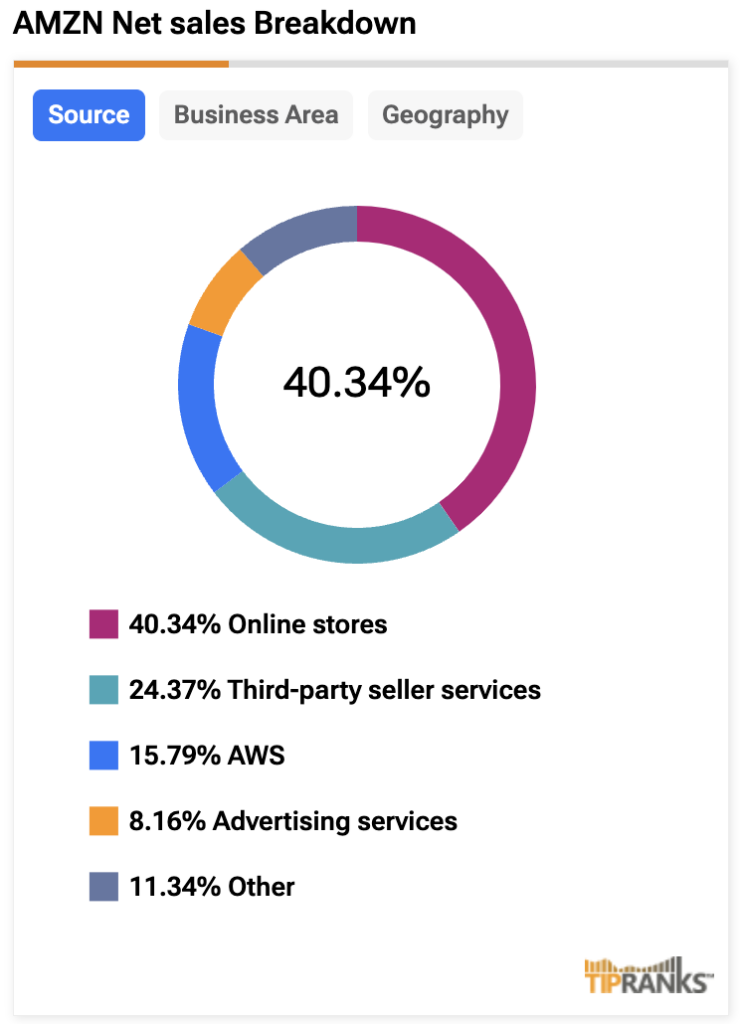

Cloud revenue represents less than 20% of total revenue for Amazon and Alphabet, indicating limited cloud exposure for investors. Conversely, Microsoft records over half its revenue from cloud services, clocking a remarkable $36.8 billion in cloud revenue in the last quarter of FY24, comprising nearly 60% of total revenue.

Microsoft Forges Ahead in AI Dominance

Steered by its robust cloud services, Microsoft is at the forefront of artificial intelligence adoption. Expansive investments in OpenAI and the debut of Copilot underscore Microsoft’s bullish trajectory in the AI landscape. CEO Satya Nadella champions Microsoft’s leadership role in the AI epoch.

Furthermore, Microsoft has seamlessly integrated AI into its product suite, with LinkedIn posts featuring AI-generated recommendations and Copilot streamlining tasks across Microsoft platforms. The recent launch of Copilot for Security underscores Microsoft’s commitment to democratizing cybersecurity for smaller enterprises.

While competitors continuously strive to catch up, Microsoft’s early AI positioning equips it to maintain its lead. As the AI realm expands, Microsoft is poised to report heightened revenue and net income upshots.

Diversified Success Beyond AI and Cloud Computing

Microsoft’s buoyant outlook is underpinned not only by AI and cloud services but also by robust performances in other business segments. Notably, LinkedIn marked a 10% year-over-year revenue uptick in Q4 FY24, cementing its status as a premier resource for business professionals.

Additionally, Microsoft saw a 19% year-over-year surge in search and news advertising revenue (excluding traffic acquisition costs). The acquisition of Activision Blizzard fortified its foothold in gaming, propelling Xbox revenue by 61% year-over-year, with Activision Blizzard contributing significantly to this upswing.

With its diversified business portfolio, Microsoft stands out among public corporations, leveraging AI investments to explore further growth prospects.

Assessing Microsoft’s Investment Potential

Microsoft currently boasts a Strong Buy rating from 30 analysts, with 28 Buy recommendations and 2 Holds. The average price target of $501.15 suggests a promising upside potential of 16%.

The Bright Future of Microsoft Stock: A Closer Look

The Evolution of Microsoft

In the tech world, where innovation is fervent and competition fierce, Microsoft stands as a stalwart, solid as ever. Its transition from a software-centric enterprise to a cloud-focused behemoth has been nothing short of remarkable. By deftly pivoting towards cloud computing and investing heavily in AI, Microsoft has not just adapted but thrived.

Cloud Dominance

Among the illustrious Magnificent Seven tech stocks, Microsoft is the standout star, drawing over 50% of its total revenue from its cloud computing division. This strategic move has propelled the company to sustained success and poised it for even greater heights in the future. The foresight to invest significantly in cloud infrastructure has given Microsoft a leg up on its peers and fortified its product portfolio.

Investor Insights

For investors seeking stability and growth potential, Microsoft offers an enticing proposition. Its diversified revenue streams and forward-looking approach make it a promising choice for those willing to play the long game. With a clear lead in AI advancements and a robust product lineup, Microsoft is well-positioned to deliver returns for patient shareholders.