Microsoft (MSFT) has been under the watchful eyes of Zacks.com visitors recently, sparking curiosity among investors. As the stock market ebbs and flows like a capricious tide, it’s imperative to delve into the factors that could sway the performance of this eminent software giant.

Despite its recent performance trailing behind the Zacks S&P 500 composite, with a -1.5% return over the last month, Microsoft remains a stalwart in the Zacks Computer – Software industry. A mere glance at these figures begs the question: Where is this stock headed in the immediate future?

Speculations and rumors can often ruffle the feathers of stock prices, causing chaotic fluctuations. However, at the heart of long-term investment decisions lie critical fundamental factors.

Assessing Earnings Estimate Revisions

Zacks prioritizes scrutinizing the alterations in a company’s future earnings projections above all else. It firmly believes that the intrinsic value of a stock is derived from its future earnings potential.

Analyzing how sell-side analysts adjust their earnings forecasts in light of evolving business landscapes provides a critical perspective. When earnings estimates rise, so does the fair value of the stock. This upward trajectory in fair value relative to market price sparks investor interest, propelling the stock price higher. Studies show a robust link between earnings estimate trends and short-term stock price movements.

Microsoft is anticipated to reveal earnings of $3.08 per share for the current quarter, up 3% from the prior year. The Zacks Consensus Estimate has ticked down by 0.1% over the past month.

Furthermore, the consensus earnings estimate of $13.03 for the current fiscal year suggests a 10.4% year-over-year rise. However, this estimate saw a slight dip of 0.1% over the last 30 days.

Looking ahead to the next fiscal year, the consensus earnings projection of $15.01 indicates a substantial 15.2% uptick from the previous year. Over the past month, this estimate has slightly wavered, declining by 0.1%.

With a robust externally audited track record, Zacks Rank, a proprietary stock rating tool, is a beacon in deciphering a stock’s trajectory. Leveraging the power of earnings estimate revisions, the recent shift in the consensus estimate, among other factors, places Microsoft at Zacks Rank #3 (Hold).

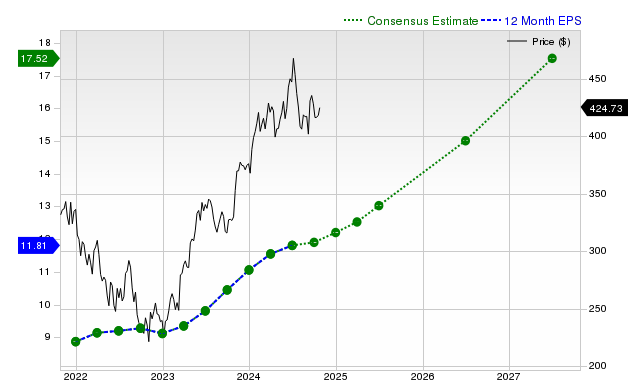

Below is a visual illustration depicting the company’s forward 12-month consensus EPS estimate:

12 Month EPS

Forecasting Revenue Growth

While earnings growth is a beacon of a company’s fiscal vitality, revenue growth is the orchestrated symphony that propels this financial dance forward. A company’s longevity hinges on its ability to augment revenues. Without this cornerstone, sustained earnings growth remains a distant mirage.

Microsoft boasts a consensus sales estimate of $64.41 billion for the current quarter, signaling a 14% year-over-year rise. Projections for the current and upcoming fiscal years stand at $277.29 billion and $314.36 billion, reflecting growth rates of 13.1% and 13.4%, respectively.

Recent Performance and Surprise Legacy

In its latest quarterly report, Microsoft showcased a revenue figure of $64.73 billion, marking a robust 15.2% surge from the same period a year ago. The EPS for the quarter stood at $2.95, compared to $2.69 in the corresponding period.

Exceeding the Zacks Consensus Estimate of $64.19 billion, Microsoft’s reported revenues exhibited a positive surprise of 0.84%. The EPS surprise was even more notable at +1.72%.

Consistency is key, and Microsoft has consistently outperformed consensus EPS and revenue estimates in the past four quarters, a testament to its enduring success.

Valuation Insights

Deciphering a stock’s valuation is akin to unraveling the enigmatic path to El Dorado. Peering into metrics like price-to-earnings (P/E), price-to-sales (P/S), and price-to-cash flow (P/CF) ratio provides a compass to gauge a stock’s true worth and growth potential.

The Zacks Value Style Score assesses Microsoft as a ‘D’, hinting at its premium valuation relative to peers. Understanding these valuation metrics and how Microsoft stacks up against industry counterparts sheds light on the reasonability of its current valuation.

To navigate this valuation maze, the Zacks Value Style Score wrangles stocks into five categories spanning A to F, a useful compass in identifying a stock’s true valuation tether.

Microsoft’s ‘D’ grade implies a premium valuation, signaling caution for eager investors. For further insights on this evaluation, click here.

Final Thoughts

The labyrinth of financial analyses on Zacks.com offers a treasure trove of information for investors eyeing Microsoft. While the Zacks Rank #3 underlines Microsoft’s potential to track market trends in the short term, discerning investors should tread carefully and consider all facets before diving headfirst into this bustling market.

Investor’s Delight

Just released: 7 handpicked elite stocks by experts from the coveted list of 220 Zacks Rank #1 Strong Buys. These top-tier selections are deemed “Most Likely for Early Price Pops.”

Since its inception in 1988, this list has outperformed the market twofold, boasting an average annual gain of +23.7%. Don’t miss out on these 7 gems; give them your undivided heed.

Want more recommendations from Zacks Investment Research? Get your free report on 5 Stocks Set to Double today.