The Cloud Over Microsoft’s Azure

Microsoft-owned Azure cloud business is facing potential scrutiny from the Competition Commission of South Africa, an agency aimed at regulating market competition. The Commission is gearing up to lodge a formal complaint against Microsoft, alleging exorbitant fees for businesses attempting to shift their cloud licenses to other vendors. This impending clash could escalate into a legal battle, possibly culminating in fines amounting to 10% of Microsoft’s revenues in the nation.

Two years ago, Microsoft instated global software licensing adjustments, allowing South African clients to transfer their Microsoft software licenses to any local cloud provider without incurring additional fees. Nevertheless, amidst a global tide of regulatory examinations concerning Big Tech, Microsoft is under the magnifying glass, facing accusations of anti-competitive conduct and asserting market dominance, not solely in South Africa but across various jurisdictions. The repercussions of these investigations may significantly reshape the competitive landscape within the tech industry.

Global Regulatory Rumbles

Regulatory pressure on Microsoft’s Azure spans beyond South Africa, with authorities globally focusing on potential anti-competitive activities. Recently, Microsoft disclosed plans to separately sell its chat and video app, Teams, from its Office suite on a worldwide scale. This decision follows the unbundling of these products in Europe six months earlier, a move aimed at warding off a potential antitrust penalty from the European Commission (EU).

The EU commenced an investigation in 2020, following a complaint from Slack, a competing workspace messaging app owned by Salesforce, accusing Microsoft of anti-competitive practices by bundling Teams with Office subscriptions and obscuring its true cost. Despite these adjustments, Microsoft’s unbundling efforts may not fully shield it from further regulatory scrutiny. EU antitrust charges could be looming, particularly pertaining to fee levels and the compatibility of rival messaging services with Office Web Applications.

With a history of incurring EU antitrust fines totaling around $2.37 billion over the past decade, Microsoft could potentially face penalties amounting to 10% of its global yearly turnover if found guilty of antitrust violations. In 2022, the Cloud Infrastructure Services Providers in Europe (“CISPE”) lodged a complaint with the EU, asserting that Microsoft’s cloud computing licensing practices are detrimental to Europe’s cloud computing ecosystem. The EU also expresses concerns about Microsoft’s data collection policies and its adherence to privacy regulations like the General Data Protection Regulation.

The Competition and Markets Authority in the UK has initiated its own investigation into the cloud market, with a specific focus on Microsoft’s Azure terms to identify potential clauses limiting competition.

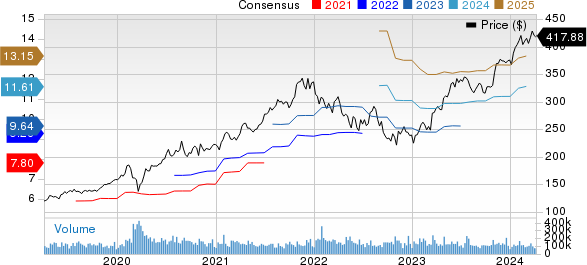

Shares of this Zacks Rank #3 (Hold) company have seen an 11.1% increase year-to-date, contrasting with the Computer and Technology sector’s growth of 12.1%. The evolving narrative surrounding Microsoft’s cloud endeavors underscores a broader trend in the tech ecosystem, hinting at the competitive challenges facing major industry players.