Software powerhouse Microsoft (NASDAQ:MSFT) has emerged as the most valuable stock in the world, boasting a staggering market cap of $3.08 trillion. In a mere six-month span, the stock surged by 28%, prompting a fervent reaffirmation of my bullish outlook. Microsoft’s trajectory underpins the imminent onset of a supernormal decade marked by expansive growth catalysts.

Microsoft’s Continual Uphill Climb

Microsoft’s Q2 earnings, reported on January 30, marked the sixth consecutive quarter of stellar performance, driven by robust cloud computing momentum and pervasive growth across all business segments. Notably, adjusted earnings trumped analyst estimates by a substantial margin, propelled by the firm’s unwavering 26.3% year-over-year earnings surge. The revenue front echoed this exuberance, boasting a 17.7% leap year-over-year and handily outstripping analysts’ predictions.

The Intelligent Cloud business segment, which encompasses Azure Cloud, SQL Server, and Windows, experienced an impressive 20% year-over-year growth to reach $25.8 billion in revenues – surpassing expectations. Azure and other cloud services reported a staggering revenue growth of 30%, firmly asserting Microsoft’s dominance in the cloud space.

Fusion of Cloud and AI

AI and cloud computing are set for a synergistic dance that will continue to fuel demand. The cessation of recessionary cloud optimization in 2023 has heralded a second wind for cloud computing, encapsulated by the substantial growth reported across the industry. Microsoft’s Azure AI services achieved exponential growth, spearheading a significant portion of Azure’s overall growth. Notably, Azure AI now boasts 53,000 customers, with a skyrocketing growth rate anticipated to foster a $3 billion run rate business.

The unrelenting march of AI is exemplified by Microsoft’s massive 69% jump in CapEx during the recently reported December quarter, reinforcing its unwavering commitment to AI. Microsoft’s strategic collaboration with OpenAI affords the company an enviable position in the AI sphere, underpinning its optimistic outlook for the future.

The Balancing Act of Valuation

Despite reigning as the most valuable stock globally, Microsoft’s valuation is a tale of relative moderation. Sporting a P/E ratio of 36x, the stock may appear pricey at first glance. Nevertheless, its sturdy market position, robust margins, diversified revenue stream, and profound exposure to high-growth AI and cloud businesses justify this premium. When juxtaposed with Amazon’s P/E of 58.5x and Meta Platforms’ P/E of 31.9x, Microsoft’s valuation assumes a balanced stance.

Analyst Consensus

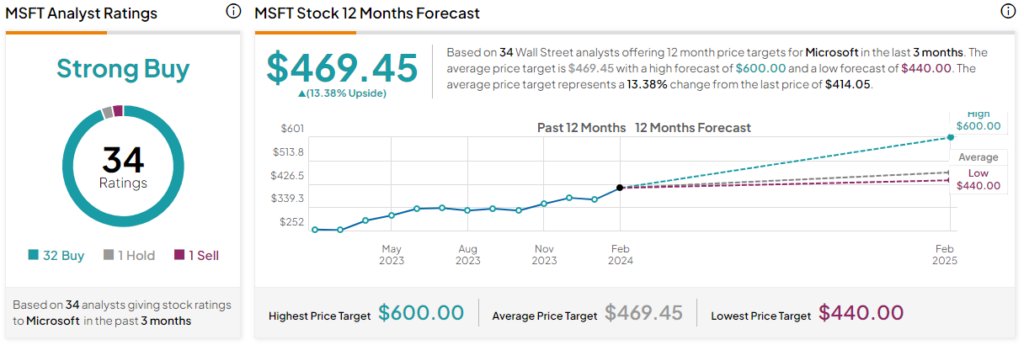

Despite a tepid market response post-Q2 earnings, Wall Street analysts maintain a bullish outlook, with the majority revising their price targets upwards. This resounding support is reflected in the stock’s Strong Buy consensus rating, underpinned by 32 Buys, one Hold, and one Sell. The average price target of $469.45 reflects a promising 13.4% upside potential from present levels.

The Road Ahead: Investing in a Microsoft Future

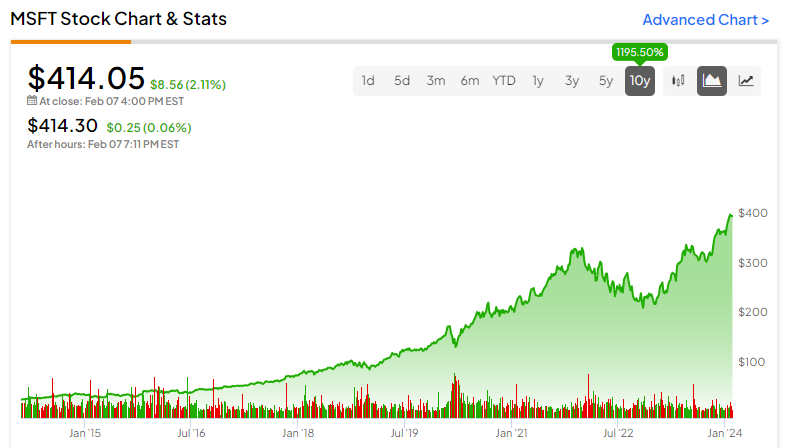

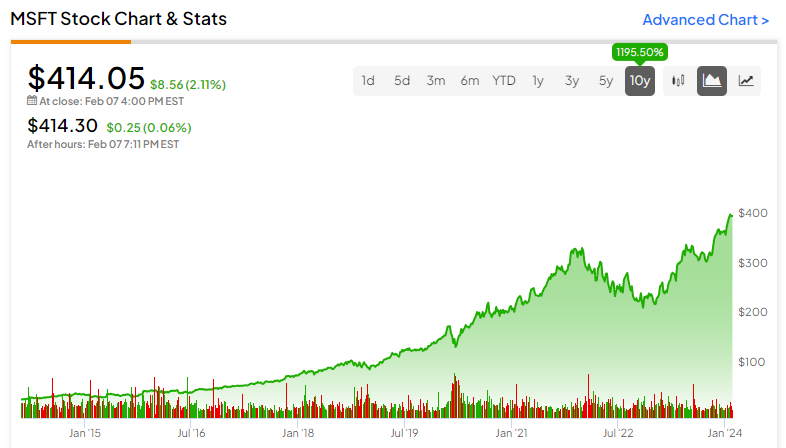

Microsoft stock has generated striking returns, culminating in a monumental 1,200% surge over the past decade. This robust trail blazed by Microsoft is indicative of its leadership in AI and computing, fortified by a diversified portfolio and a robust execution track record. The next decade promises to be exhilarating, fueled by the relentless growth of AI and cloud computing. Therefore, a bullish long-term outlook underscores the pragmatism of investing in the stock at current levels.