SoundHound AI (NASDAQ: SOUN) has witnessed a meteoric rise of close to 128% over the past six months, making it a red-hot favorite among investors. However, for those who missed the boat on this AI stock’s spectacular surge and are contemplating jumping in now, a wiser gambit lies in exploring alternative avenues.

SoundHound AI’s Growth Concerns

The recent significant downturn in SoundHound’s shares can be attributed to apprehensions regarding its ability to sustain robust growth and justify its lofty valuation. With a decline of nearly 55% in the last month, the company, specializing in voice AI solutions, is currently trading at a price-to-sales (P/S) ratio of 22, substantially higher than the U.S. tech sector’s P/S ratio of 7.2.

While SoundHound projects robust revenue growth in the coming years and boasts of a solid revenue pipeline, the company’s smaller size leaves it vulnerable to fierce competition from industry stalwarts. Hence, investors eying the AI space may find greater promise in well-established entities like Nvidia (NASDAQ: NVDA).

Nvidia’s Dominance and Growth Trajectory

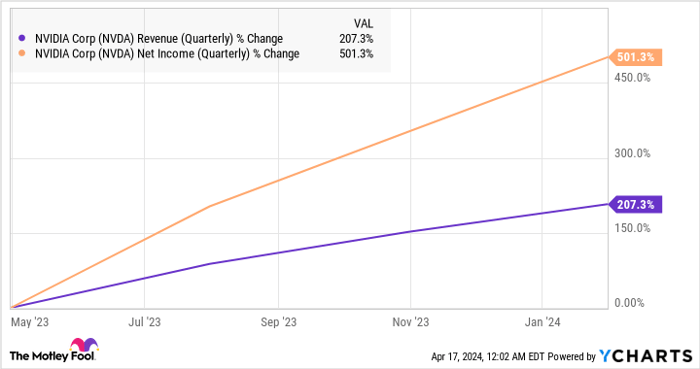

Nvidia reigns supreme in the rapidly expanding realm of AI chips, capturing a dominant market share exceeding 90%. This supremacy has fueled a period of rapid expansion for the chip giant, evident in its robust financial performance.

Contrasting the growth trajectories, Nvidia’s fiscal 2024 revenue swelled to nearly $61 billion, a staggering 126% surge year-over-year. Comparatively, SoundHound AI closed 2023 with a 47% revenue uptick to $46 million. Notably, analysts anticipate Nvidia’s revenue to accelerate further, targeting an 81% surge to $110.5 billion in fiscal 2025, outpacing SoundHound’s projected 51% growth this year.

Further bolstering Nvidia’s allure is its profitability, with a non-GAAP gross margin of 73.8% in fiscal 2024, a considerable leap from the prior year’s 59.2%. This robust margin expansion, fueled by Nvidia’s commanding position in AI chips, drove adjusted net income to jump from $8.4 billion in the preceding year to $32.3 billion in fiscal 2024. In stark contrast, SoundHound AI reported a net loss of $89 million in 2023, underscoring its ongoing struggle to achieve profitability.

Nvidia’s Expansion Prospects

Projections indicate Nvidia is on track for a nearly 38% annual earnings growth over the next five years, with the potential for even quicker expansion. This optimism stems from Nvidia’s positioning to capitalize on a vast addressable market encompassing gaming, automotive, and digital twins.

The global GPU market, slated to grow at a 34% annual clip through 2032, offers a revenue potential of $773 billion by the end of the forecast horizon. With Nvidia commanding leadership in AI GPUs and PC GPUs, the company is primed to capitalize on this lucrative expansion trajectory.

Contrarily, SoundHound AI foresees its addressable market reaching $160 billion by 2026, signifying Nvidia’s superior growth runway. The chip behemoth’s forward-looking valuation metrics further tip the scales in its favor over SoundHound.

Valuation Comparison

While Nvidia’s current price-to-sales ratio stands at 36, higher than SoundHound’s trailing sales multiple, a shift in viewpoints emerges upon scrutinizing the forward sales multiples.

Analyzing Nvidia’s Potential: Is it a Strong Buy?

When it comes to the dynamic realm of AI stocks, Nvidia is a wily contender. With a forward P/S ratio that’s toe-to-toe with its peer SoundHound, Nvidia’s robust profitability stands as a testament to its allure. Trading at 36 times forward earnings, Nvidia sits beneath the lofty perch of the U.S. technology sector earning multiple of 45, showcasing that it’s not just a flash in the pan but a steady presence in the market.

A Deep Dive into Nvidia’s Appeal

Nvidia emerges as a standout growth stock, surpassing SoundHound in this regard. Its momentum seems unflagging, hinting at continued acceleration in the coming days. For those investors regretful of missing SoundHound’s recent surge and on the prowl for a promising AI stock, Nvidia shines as the beacon on a stormy night, poised to weather the uncertainties and deliver substantial rewards in the long haul.

Exploring the Investment Landscape for Nvidia

Considering a $1,000 investment in Nvidia? Let’s delve deeper:

The esteemed Motley Fool Stock Advisor team has unearthed the 10 best stocks primed for investor success, and while Nvidia didn’t make the list, the chosen few hold the potential to yield astronomical gains in the foreseeable future.

With a roadmap to financial triumph, Stock Advisor offers a blueprint for prosperity, furnishing invaluable insights on portfolio construction, timely assessments from analysts, and two fresh stock picks every month. Boasting returns that tower over the S&P 500 since 2002, the Stock Advisor service epitomizes a reservoir of investment acumen*.

*Stock Advisor returns as of April 15, 2024

Harsh Chauhan takes no stakes in any of the mentioned stocks. While the Motley Fool strides alongside and advocates for Nvidia, it also adheres to a strict disclosure policy.