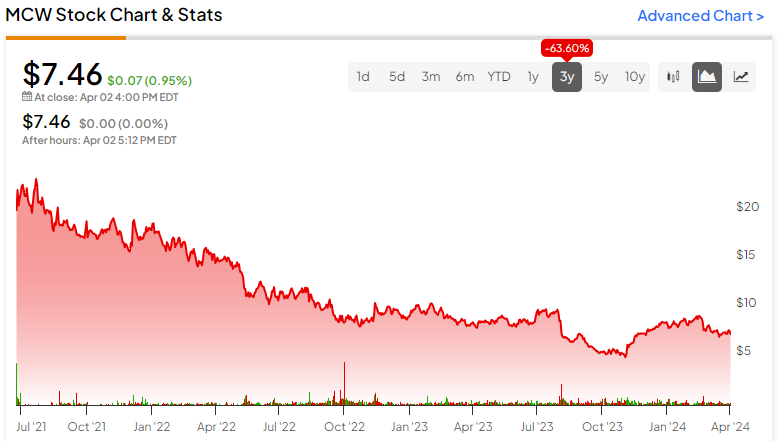

In most situations, retail investors shy away from businesses that bear significant bearish interest. Nevertheless, an opportunity can arise for Mister Car Wash (NYSE:MCW), a company providing conveyorized vehicle washing services. With its encouraging fundamentals and the current speculative market mood, MCW stock stands out. As a calculated, high-stakes gamble, I’m leaning towards a bullish outlook on this distinctive market maneuver with potential for a short squeeze.

The Short Squeeze Scenario for MCW Stock

Let’s delve into the primary upside catalyst for MCW stock – the potential short squeeze. Presently, Mister Car Wash shares exhibit a significant short interest of 13.23% of their float. Furthermore, the short-interest ratio stands at 13.28 days to cover. To comprehend the significance of these metrics, we must first grasp the fundamentals of shorting.

In the traditional investment realm, individuals or entities buy a security anticipating its rise in value. However, shorting operates in the reverse direction. A bearish trader borrows the security from a broker, sells it immediately, expecting its price to drop. If the price falls, the trader repurchases the security at a lower price, returning it to the broker and pocketing the difference.

With more than 13% of its float held short and over 13 days required to cover the bearish positions based on average trading volume, MCW stock presents a scenario where bullish momentum could trap the bears, fueling potential gains.

Mister Car Wash in a Growing Market Landscape

According to analysts at Research and Markets, the U.S. car wash services sector is projected to hit $23.78 billion by 2030, growing at a yearly rate of 5.5%. With MCW stock’s $2.44 billion market cap, the company operates in a robust and expanding market.

The shift towards time-saving measures, cost reduction, and sustainable car wash practices due to increasingly hectic schedules is expected to drive the U.S. car wash service industry. As these trends persist, they bode well for MCW stock’s growth prospects.

Additionally, as the workforce returns to pre-pandemic normalcy with a potential decrease in remote work practices, the demand for time-saving services like car washes is expected to rise. Analysts predict a revenue increase to $1 billion in Fiscal 2024, indicating a positive growth trajectory for MCW stock.

Realistic Valuation Adjustments for MCW Stock

Currently trading at a trailing-year revenue multiple of 2.74x, higher than the specialty business services sector at 1.44x, MCW stock may appear steeply valued. However, with projected revenue growth in Fiscal 2024, a closer look is warranted.

Assuming a $1 billion revenue and constant share count, MCW stock would trade at around 2.54x forward sales multiple. Even at an optimistic revenue target of $1.02 billion, the forward sales multiple would be 2.49x. While higher than the industry average, the underlying potential of Mister Car Wash makes it a compelling investment.

Analysts’ Perspective on MCW Stock

On Wall Street, MCW stock holds a Moderate Buy consensus rating, with analysts forecasting a 29.6% upside potential based on five Buy, four Hold, and one Sell ratings, with an average price target of $9.67.

Final Thoughts on MCW Stock

For bearish speculators, venturing into shorting MCW stock might not be the wisest move given the anticipated industry growth and positive outlook by analysts. With the potential for significant upside fueled by a short squeeze, Mister Car Wash emerges as an intriguing investment choice amidst the evolving market dynamics.