MoffettNathanson’s Analysis Unveiled

Fintel cited by MoffettNathanson on August 19, 2024, initiated coverage of Apple with a Neutral recommendation. The average one-year price target for Apple is reported to be $238.86/share, suggesting an upside of 5.74% from the current closing price of $225.90/share. This recommendation comes amid a forecasted 13.25% increase in annual revenue, with a projected non-GAAP EPS of 6.93.

An Insight into the Fund Sentiment

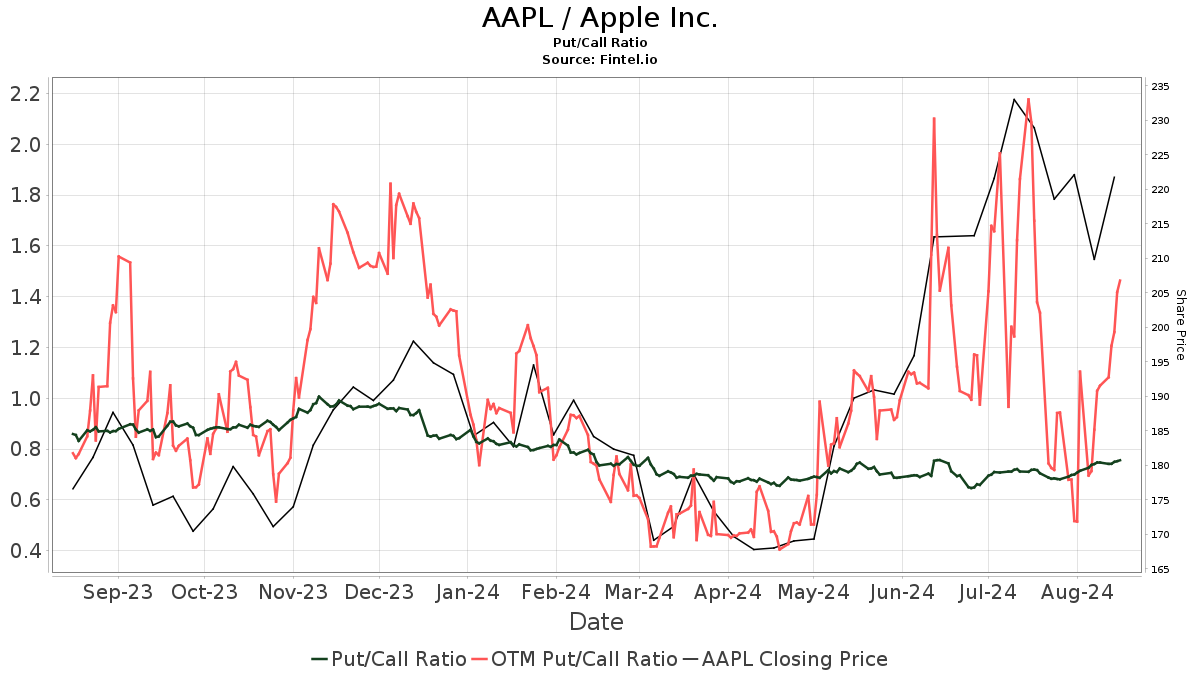

The number of funds or institutions reporting positions in Apple increased by 173, making it to a total of 7,025 stakeholders. The average portfolio weight of all funds dedicated to AAPL witnessed a significant uptick of 3.87%, amounting to 3.39%. In the last three months, total shares owned by institutions rose by 4.89% to 10,100,901K shares. The put/call ratio of AAPL stands at 0.70, indicative of a bullish outlook.

Activity among Prominent Shareholders

Vanguard Total Stock Market Index Fund Investor Shares, Berkshire Hathaway, Vanguard 500 Index Fund Investor Shares, Geode Capital Management, and Price T Rowe Associates have all made significant adjustments to their AAPL holdings. Noteworthy changes include Vanguard’s decrease in portfolio allocation by 19.56% and Berkshire Hathaway’s substantial reduction of 97.34%, as well as Price T Rowe Associates’ notable increase by 20.99%.

Apple’s Diverse Product Portfolio and Services

Apple Inc., based in Cupertino, California, is a technology giant known for its range of consumer electronics, software products, and online services. The company’s offerings include iconic products like the iPhone, iPad, Mac, iPod, Apple Watch, and more. In addition to hardware, Apple’s software ecosystem encompasses various operating systems and creative applications, while its online services such as the App Store, Apple Music, and iCloud have become integral parts of its business model.

Apple’s rich history dates back to its inception in 1976 by Steve Jobs, Steve Wozniak, and Ronald Wayne. Over the years, the company has grown exponentially, gaining a prestigious position among the Big Five companies in the U.S. information technology industry.

Fintel provides a wide range of investing research tools tailored for individual investors, traders, financial advisors, and small hedge funds. Their comprehensive data offers insights into fundamentals, analyst reports, ownership details, and much more, empowering users with valuable information for making informed investment decisions.

For those interested in delving deeper into the intricate world of investing, platforms like Fintel can be a valuable resource.