American brewing giant Molson Coors has taken a step back on its Diversity, Equity, and Inclusion (DEI) policies following escalating pressure from activists. Reports from the Wall Street Journal reveal that Molson Coors will no longer partake in the Human Rights Campaign’s Corporate Equality Index, a tool used to assess a company’s LGBTQ+ inclusion efforts.

The company has announced changes that include discontinuing supplier diversity goals focused on minority and women-owned businesses and shifting executive compensation solely based on performance rather than representation targets. In an internal email, Molson Coors justified the move stating it aims for a more inclusive environment for all employees.

The Shift in Corporate DEI Landscape

Molson Coors joins a growing list of consumer companies yielding to mounting pressure from various groups and activists, including filmmaker Robby Starbuck, who critique “woke” DEI strategies, positing they may discriminate against White men. The company’s HR team has been proactively re-examining its DEI policies since March this year.

Revealing the email sent to employees, Starbuck claimed victory on social media and hinted he had warned Molson Coors of the consequences tied to these policies. This shift aligns Molson Coors with other major corporations such as Ford, Lowe’s, Harley-Davidson, Tractor Supply, and John Deere, all revising their DEI approaches. Meanwhile, the Human Rights Campaign Foundation voices concerns that such retreats may imperil workplace safety and inclusivity.

Evaluating Molson Coors Stock Performance

Market analysts maintain a cautious stance on Molson Coors stock given the persistent challenges in the beer industry. The strategic initiatives aimed at enhancing premium and non-traditional beer segments may not yield immediate results, keeping the stock under pressure. Recently, Molson Coors divested four craft beer labels to Canadian cannabis company Tilray Brands.

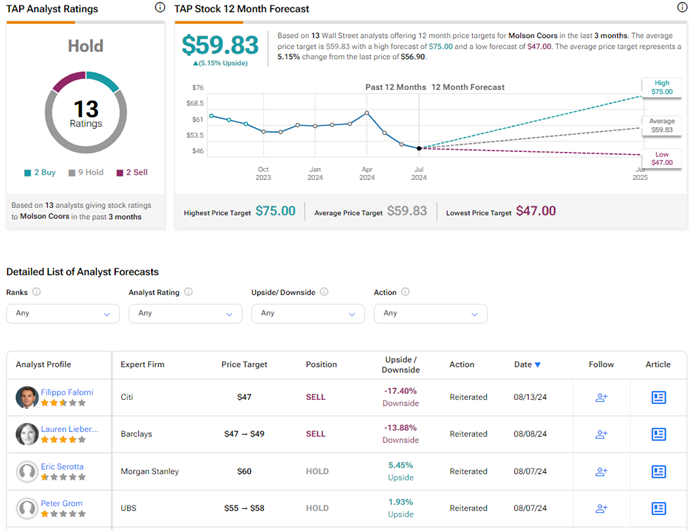

Currently, TAP stock holds a Hold consensus on TipRanks, with two Buy, nine Hold, and two Sell ratings. The average price target stands at $59.83, suggesting a 5.2% upside potential from the current levels. Year-to-date, TAP shares have witnessed a 5.6% decline in value.

Explore more analyst ratings on TAP here