Dramatic Upsurge in Mortgage Applications

The Mortgage Bankers Association recently revealed that mortgage applications soared by 16.8% in the week ending Aug. 9, marking a significant uptick in consumer activity. This surge, the most substantial seen in a week since January 2023, follows a 6.9% rise in the prior week.

Despite a minimal change in the average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances, holding steady at 6.54%, compared to 6.55% the previous week, homebuyers took advantage of the opportunity to refinance.

Refinance Activity Reaches New Heights

Refinance applications witnessed an outstanding 35% surge from the previous week, marking an impressive 118% increase from the same period last year. This remarkable increase represents the most significant weekly gain for the Refinance Index since May 2022.

Consequently, the refinance share of mortgage activity climbed to 48.6% of total applications, up from 41.7% in the previous week. Additionally, there was a notable uptick in the share of adjustable-rate mortgage (ARM) applications, which increased to 7.3% of total applications.

Impact on Mortgage-Linked Stocks

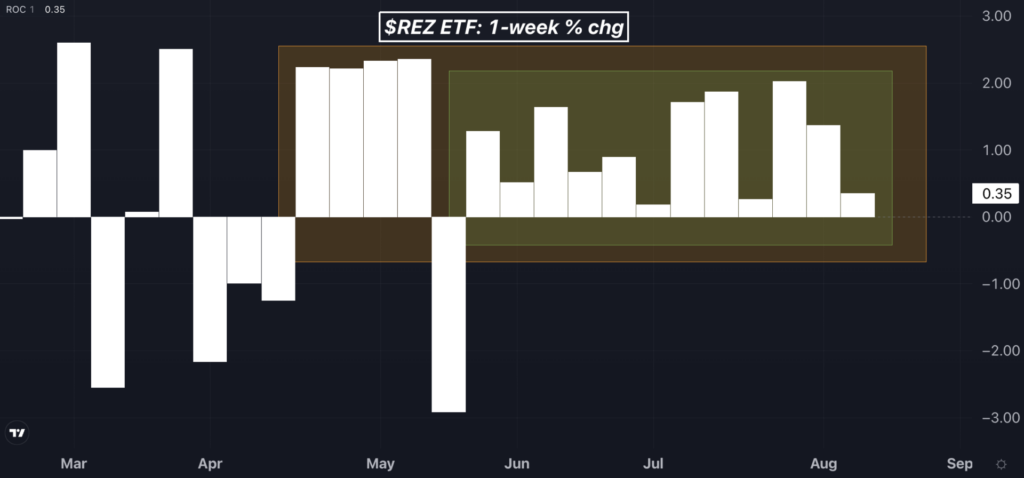

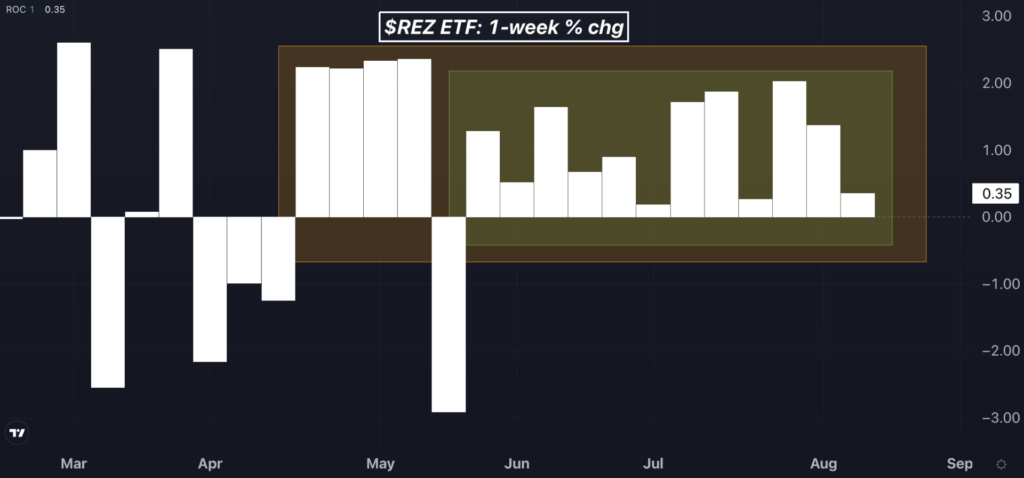

The recent surge in mortgage activity reverberated positively in the stock market, propelling mortgage-linked stocks to levels not seen since September 2022. Notably, the iShares Residential and Multisector Real Estate ETF (REZ) recorded a 0.3% increase on Wednesday, positioning it to close at its highest point since September 2022.

Remarkably, the REZ ETF has been on an upward trajectory, posting gains for 12 consecutive weeks, marking its longest winning streak since its inception in 2007. Over the last 17 weeks, the fund has ended in the green in 16 instances, showcasing a remarkable performance trend.

Highlighted below are the top-performing stocks within the REZ ETF year-to-date:

| Name | Ytd Return (%) |

| Diversified Healthcare Trust (DHC) | 310.64 |

| National Health Investors, Inc (NHI) | 37.44 |

| Welltower Inc. (WELL) | 33.37 |

| UMH Properties, Inc. (UMH) | 31.73 |

| Independence Realty Trust, Inc. (IRT) | 31.51 |

Stay tuned to witness how this ongoing trend influences the broader market landscape.