To gain an edge, this is what you need to know today.

Microsoft Corp’s AI Market Influence

The market is abuzz with Microsoft Corp’s impending earnings report, anticipated to be the most pivotal this season. The tech giant’s stock behavior, specifically its continuous upsurge and overbought status heralds a crucial momentum in the broader stock market.

Scheduled after market close today, its earnings announcement, expected to echo significant strides in artificial intelligence (AI) monetization, is poised to amplify Microsoft’s profit-generating capabilities. In particular, its Copilot offering holds potential for substantial revenue expansion, with The Arora Report estimating over 50% in gross profits

In addition, the report will shed light on Microsoft’s AI monetization strategy and cloud revenue growth, factors that will undoubtedly sway investor confidence. Conversely, the weak earnings from United Parcel Service, Inc. (UPS) this morning have rattled market sentiments, underscoring its influence as an economic bellwether.

Undercurrents: Real or Political?

Elsewhere, market excitement is rife over the U.S. Treasury’s proposed scaled-back borrowing, ostensibly aimed at fortifying the stock and bond markets in the run-up to the upcoming elections. Such tactical fiscal strategies, while temporarily buoyant, may lack long-term viability, warranting astute investor skepticism especially in an election year rife with calculated political moves.

As per The Arora Report’s focused approach toward capitalizing on such transient maneuvers, prudence and caution are advised.

Labor Dynamics and Financial Markets

Amidst this, UPS’s decision to lay off thousands casts a shadow on labor dynamics, while IBM’s stringent policies regarding on-location work underscore evolving workplace demands amid the pandemic.

Volatile Market Money Flows

Early money flows are seen to be positive in Microsoft (MSFT), NVIDIA Corp (NVDA), and Tesla Inc (TSLA), while being neutral in Alphabet Inc Class C (GOOG) and Meta Platforms Inc (META). Conversely, Apple Inc (AAPL) and Amazon.com, Inc. (AMZN) depict negative money flows, underscoring market volatility.

Stock Preferences and Investments

The momo collection exhibits an early affinity for stock investments, while smart money remains on the sidelines, assessing the market’s evolution.

Commodity Market Shades

Gold showcases tangible buying activity driven by Middle East geopolitical tensions, leading the momo crowd to assertively invest in the precious metal. In a similar vein, oil experiences early buying momentum spurred by decade-low crude inventories at Cushing, suggestive of an imminent short squeeze.

Investment Strategies for Turbulent Times

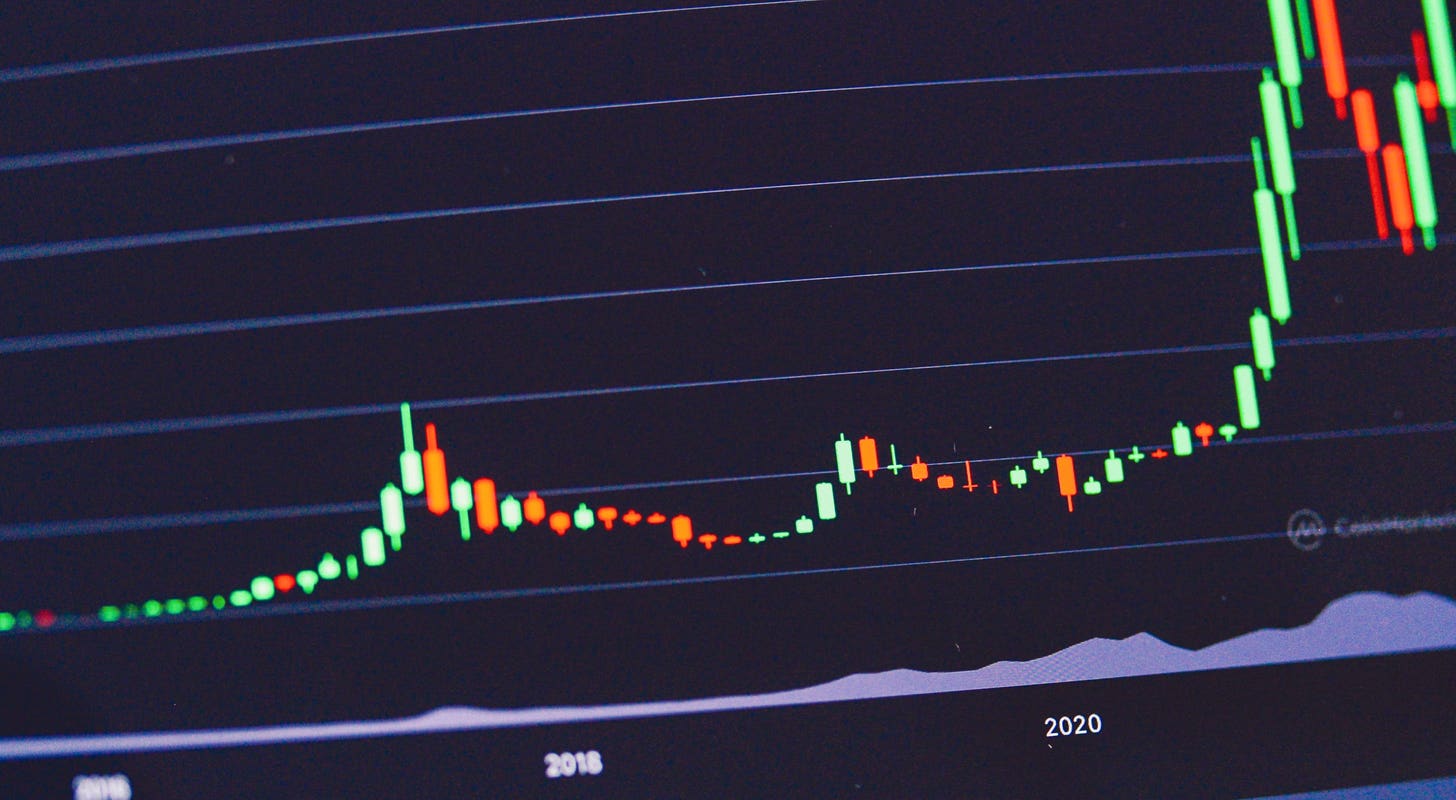

The Bitcoin Surge

Amidst the cacophony of speculative junk stocks, Bitcoin (BTC/USD) is currently riding the crest of a speculative wave, buoyed by positive risk sentiment.

Navigating Market Volatility

In today’s unpredictable financial landscape, it is of paramount importance for investors to keep their eyes firmly set on the road ahead, rather than dwelling on past performances.

With that in mind, it is prudent for investors to consider retaining promising, long-term positions. Depending on individual risk tolerance, a protective strategy comprising of cash reserves, Treasury bills, short-term tactical trades, as well as short to medium-term hedges can serve as a safety net while simultaneously enabling participation in potential market upswings.

Setting up protection bands, tailored to individual risk profiles, is an effective strategy. The upper band is suitable for conservative or older investors, while the lower band is more apt for aggressive or younger investors. Those who opt not to hedge should maintain a proportion of cash holdings higher than usual, but still lower than the combined total of cash and hedges.

It’s crucial to remember that seizing new opportunities becomes untenable without adequate cash reserves. When adjusting hedge levels, it’s advisable to consider altering partial stop quantities for stock positions, employing wider stops on the remaining quantities, and affording more leeway for high-beta stocks – those that tend to sway more than the broader market.

The New Norm for Diversification

In light of the current risk-reward dynamics, the notion of long-term strategic bond allocations is currently not in favor.

For those who still adhere to the traditional 60% stock and 40% bond allocation, a prudent move would be to focus exclusively on high-quality bonds and those with a duration of seven years or less. On the other hand, investors looking to enhance the sophistication of their portfolios might consider treating bond ETFs as tactical assets, rather than strategic ones, at this juncture.