Warner Music Group’s Notes of Success

Warner Music Group (WMG) struck a chord in the financial world with its recent fiscal third-quarter earnings report. Anticipated figures were nearly met, with earnings per share at 27 cents on $1.55 billion in revenue, just shy of overall expectations.

Comparatively, the year-ago quarter saw a similar performance, with earnings of 27 cents and revenue hitting $1.56 billion, both surpassing projections.

Performance and Growth in a Changing Landscape

Warner Music’s recorded music segment recorded a slight decrease in revenue, while music publishing sales and digital revenue witnessed positive growth. With adjustments in operating income and margins, the company’s trajectory seems upward.

CEO Robert Kyncl attributed the company’s success to its content advantage and adapting to industry trends, particularly the rise of subscription streaming.

Future Tune: Strategic Insights

Analysts project a promising future for Warner Music, with expected increases in EPS and sales by the end of the year. Furthermore, fiscal 2025 could bring significant expansion, showcasing a positive outlook for investors.

A potential paradigm shift in the global music industry, forecasted by MIDiA Research, could see industry revenue reach $100 billion by 2031, driven by an increase in music platform subscribers.

China’s emergence as a leading market and the industry’s expansion in the Global South hint at an exciting journey ahead.

Exploring MUSQ ETF Opportunities

The MUSQ Global Music Industry ETF offers investors exposure to the thriving music industry, encompassing companies like Warner Music, Universal Music Group, Tencent Music Entertainment Group, and Reservoir Media. By diversifying holdings, MUSQ aims to capitalize on the industry’s growth potential.

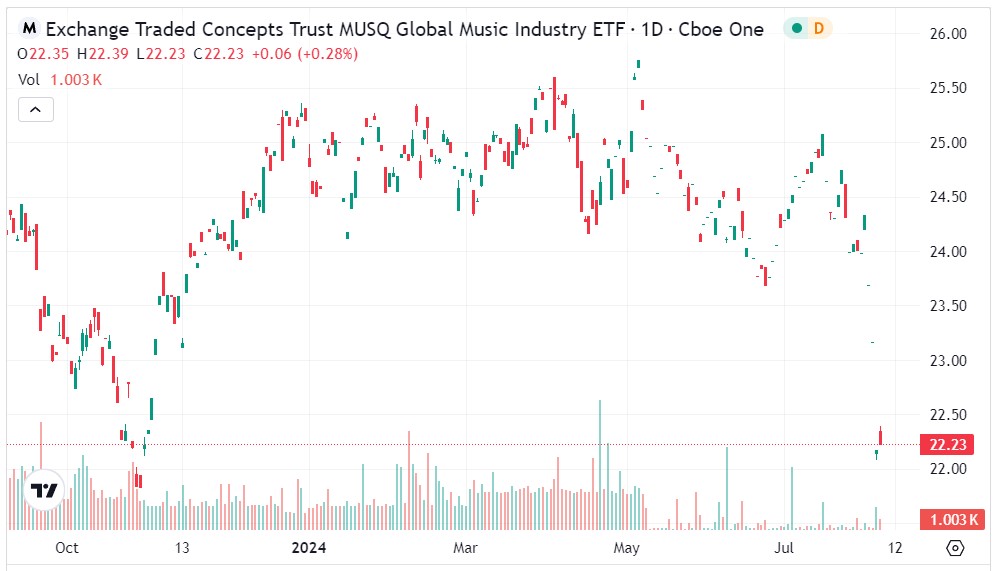

Analyzing MUSQ’s Performance

Despite market fluctuations, MUSQ displayed resilience, showcasing a positive gain during trading. The ETF’s upward trajectory points to a potential breakout, reflecting the underlying strength of music-related enterprises in the current landscape.

- MUSQ is striving to break through key resistance levels, signaling optimism among investors.

- As music-related stocks trend upwards, MUSQ is positioned to ride the wave of positive momentum.

Featured image by Bob McEvoy from Pixabay