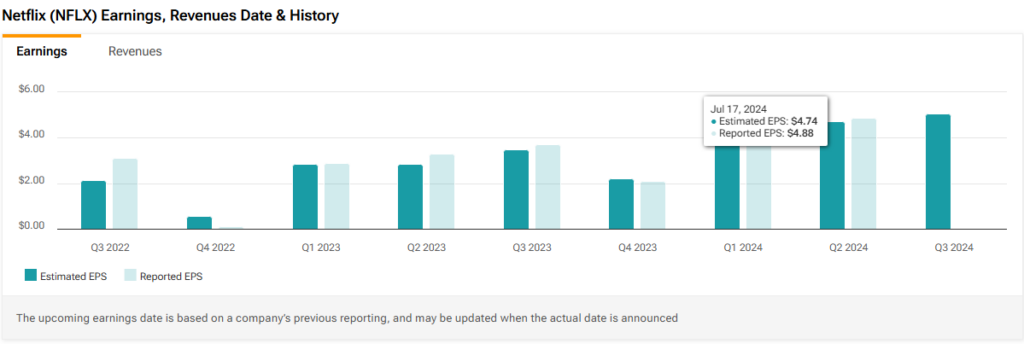

Netflix’s Q2 earnings report showcased a company in full bloom, surpassing forecasts with an EPS of $4.88 and revenue hitting $9.56 billion. While not catapulting the market into jubilation, the performance continues a trend of Netflix outshining expectations, especially in areas like operating margin and subscriber growth.

Netflix’s Q2 Earnings Recap

Despite an unruffled reception from the market, Netflix’s operating margin for Q2 surged to 27.2%, highlighting a steady upward trajectory. The streaming giant added a whopping eight million subscribers in the quarter, far surpassing analyst estimates and signaling positive outcomes from recent growth strategies.

In another demonstration of financial mastery, Netflix has upgraded its 2024 revenue growth forecast to 17% and its operating margin forecast to 26%. The company’s first-half free cash flow of $6.6 billion bested its annual guidance, hinting at a potential conservative estimate or a possible slight decrease in cash flow in the latter part of the year.

Despite these favorable updates, market caution lingers due to uncertainty surrounding long-term trends. Doubts persist on the sustainability of recent initiatives like the crackdown on password sharing and the continuation of accelerated subscriber growth.

The Next Phases of Netflix’s Growth Journey

Netflix’s stock surge, climbing nearly 300% since dipping below $170 per share in 2022, underscores a market sentiment reverting to Netflix as a growth dominator. Operating margins emerge as a key factor in this shift, with Netflix consistently exceeding expectations, showcasing resilience and adaptability.

Comparing Netflix’s robust margins to industry players like Disney, with far lower profitability margins, cements Netflix’s dominance. The company’s financials reveal a judicious control of expenses, with revenues trumping expenses consistently since 2022. Projecting a 17% revenue growth and a 26% operating margin for 2024, Netflix’s upward trajectory seems set to durably cruise forward.

A vital catalyst in Netflix’s growth saga is its ad

The Power of Netflix: Unveiling Strategic Moves and Market Insights

The streaming behemoth, Netflix, embarked on a mission to secure an impressive 40 million ad-supported subscribers back in Q3 of the previous year. It, however, took until May of this year to realize this audacious target, underscoring the magnitude of this achievement. Despite the paramount importance of this segment in bolstering subscriber metrics, Netflix’s ad-supported platform still stands at the threshold of proving its worth amidst an intensely competitive landscape.

The Quest for Improvement in Ad Strategies

To traverse the road ahead successfully, Netflix recognizes the imperative need to elevate its CPMs (cost per thousand impressions), amplify ad load, and craft more personalized ad encounters for enhanced outcomes. Only recently, Netflix made waves by declaring the retirement of its $11.99 monthly ad-free plan for new subscribers, paving the way for a lineup that includes a $6.99-a-month ad-supported plan alongside a duo of pricier ad-free options (tagged at $15.49 and $22.99 per month).

Through a strict stance against password sharing, Netflix’s leadership disclosed that a staggering 100 million households indulged in this practice over the past year. Adding fuel to the growth engine, the company managed to onboard an additional 37 million households since Q2 of 2023, signifying a vast reservoir of untapped potential in converting non-paying users into subscribers.

Unraveling the Valuation Enigma

Presently, Netflix is hovering at a forward P/E ratio of 33x, a figure notably lower than its historical five-year average of 49x. While Netflix may not be labeled as a steal of a deal, the price tags attached to its shares are far less extravagant compared to recent times.

Delineating a promising trajectory, Netflix is poised for robust bottom-line growth courtesy of its ad initiatives’ vigor and the efficacious management of expenses, thereby upholding delightful operating margins. Projections paint a bullish picture as EPS is anticipated to surge by 59% in 2024 and potentially by 19% in 2025. These indicators hint that by the year 2025, Netflix might find itself trading at a forward P/E ratio of 27.8x, signifying a somewhat de-risked proposition.

Investor Sentiment and Analyst Insights

Although not unequivocally bullish, the overall sentiment towards Netflix by Wall Street analysts resonates largely positive. Out of a pool of 36 analysts dissecting Netflix stock, 12 suggest a Hold stance, with one lone voice advocating for a Sell stance, while the remainder tilt towards the optimistic end, culminating in a Moderate Buy consensus rating. An estimated Netflix stock price target of $704.81 alludes to a potential upside of 9.7%.

Learn more about Netflix analyst ratings here

The Final Verdict

Netflix’s Q2 earnings may not have set the world ablaze, yet they stand as a testament to the company’s unwavering solidity and consistency. Noteworthy upticks in subscriber growth coupled with operating income surpassing projections underscore a steady ship navigating through turbulent waters. Albeit harboring concerns about maintaining growth in the long haul, Netflix’s shrewd initiatives such as ad forays and the battle against password sharing are yielding tangible results.

By steering a course that emphasizes content diversification bolstered by stringent expense management, Netflix remains steadfast in upholding its premium margins. This keen strategic focus is poised to cement Netflix’s dominance in the streaming sphere and position the company ingeniously to capitalize on prevailing growth opportunities.