The Streaming Saga

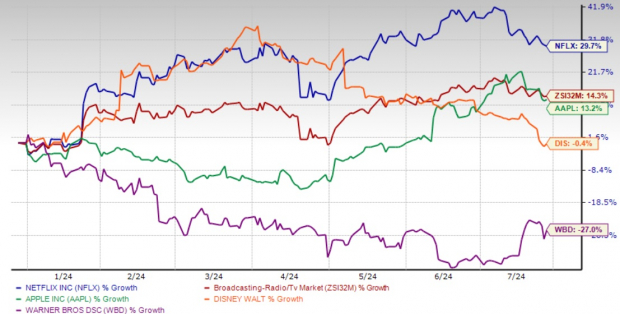

Netflix NFLX has been a rocket, shooting up 29.7% year-to-date. Trampling the Zacks Consumer Discretionary sector, it has investors buzzing. The zest for this stock calls for a deep dive into its ascendancy and whether it’s the golden ticket for investors.

The Momentum Unleashed

Netflix’s recent surge can be credited to a mix of magic—its unmatched content creation engine and strategic maneuvers. Pumping out hit after hit reels in more subscribers and keeps them glued. Dabbling in ad-based subscriptions and gaming diversifies its revenue pool. The recipe seems to be working like a charm.

Streaming’s Crown Jewel: Delving into Netflix’s Investment Attraction

Content—king in the streaming realm—continues to be Netflix’s bedrock, with a hefty investment in original content. Trendy releases and a steady stream of crowd-pleasers have boosted its subscriber base. Crafting content with global appeal has been key in Netflix’s international conquest.

The journey ahead is peppered with gems like “Beyond Goodbye” and “Beastars”. The anime carte du jour includes revamps and fresh picks. Taking the show on the road, Netflix is eyeing a masterpiece in Indonesia. The Philippines is in for “Outside”, a mind-bending thriller. Thailand’s slate is set to sizzle with “Doctor Climax” and more. Avant-garde gaming options and animated delights await.

Financial Fortunes in the Making

The crystal ball sees a 29.8 million rise in paid subscribers for 2024. The paid subscribers by 2024-end are poised to hit 290.4 million, a solid 11.6% upsurge from last year. Unveiling its crackdown on password borrowing, Netflix reels in fresh patrons. Skepticism gave way to a bona fide strategy to tap into shared accounts. Riding this wave is Netflix’s global conquest for streaming dominance.

The revenue forecast for 2024 sees a healthy 14-15% growth, hinting at a robust membership growth pattern. The plan for 2024 doesn’t stop there, with an ad tech platform and revenue acrobatics on the agenda. The projected numbers are singing a sweet tune, with revenue scaling to $38.68 billion and earnings per share riding the growth wave to $19.08, a 58.6% leap from last year.

The Reality Check

Netflix’s path isn’t a bed of roses. Disney’s Disney+, HBO Max, among others, are formidable rivals in the arena. The battle doesn’t end there, with linear TV, YouTube, and gaming posing hurdles. Competition is fierce, with maintaining market supremacy a Herculean task.

A pricing reality check beckons for investors eyeing Netflix. Its forward sales multiple stands at 6.56X, nudging past its five-year norm of 6.02X. Against the Broadcast Radio and Television industry’s 4.35X, Netflix’s multiple seems a tad lofty.

A Cinematic Conclusion

Despite the premium price tag and the wild streaming west, Netflix isn’t to be left in the dust. Its legacy as a trailblazer, global reach, and knack for cultural phenomena make it a hot property. Netflix’s dance with change and innovation hint at a bright future in the entertainment cosmos.

The Rise of Netflix Stock: An Investment Opportunity Worth Considering

Netflix is currently experiencing significant growth in the stock market, making it an attractive option for investors in the near future. The company holds a Zacks Rank #2 (Buy), indicating a favorable outlook for its stock performance.

Market Potential and Growing Demand

The demand for clean hydrogen energy is on the rise, with projections indicating a market value of $500 billion by 2030. This sector is expected to expand exponentially, potentially reaching five times its current size by the year 2050. In anticipation of this growth, three companies are strategically positioning themselves to capitalize on this emerging market.

Strategic Investment Opportunities

Zacks Investment Research has identified these key players in the hydrogen energy sector, referring to them as “emerging powerhouses” positioned for substantial growth. Investors looking to ride the next wave of renewable energy are encouraged to explore these investment opportunities.

Expert Recommendations and Reports

For investors seeking timely insights and recommendations from leading analysts, Zacks Investment Research is currently offering a special report highlighting these emerging opportunities in the renewable energy sector. By accessing this report, investors can gain valuable information on potential investment options in this dynamic market.

Stock Analysis and Reports

For in-depth analysis and reports on leading companies such as Apple Inc., Netflix Inc., The Walt Disney Company, and Warner Bros. Discovery Inc., investors can access free stock analysis reports through Zacks Investment Research. These reports provide valuable insights into the financial performance and prospects of these prominent companies.

To explore further insights on Netflix’s stock performance and market trends, investors can refer to the full article on Zacks.com.