Nutanix NTNX is gearing up for the unveiling of its fiscal fourth-quarter 2024 results on Aug 28.

Anticipating the final quarter of fiscal 2024, Nutanix foresees revenues in the ballpark of $530 million to $540 million. The Zacks Consensus Estimate stands at $537.12 million, marking a sturdy 8.7% rise from the previous year.

The Zacks Consensus Estimate for earnings has held steady at 19 cents per share over the past 30 days, hinting at a 20.8% decrease from the previous year.

Image Source: Zacks Investment Research

As per the preceding quarter’s report, Nutanix brought to the table an outstanding earnings surprise of 64.71%. Remarkably, the company has outperformed the Zacks Consensus Estimate in each of the past four quarters, with an average of 63.48%.

Evaluating Nutanix Price and Earnings Per Share (EPS) Performance

Nutanix price-eps-surprise | Nutanix Quote

Assessing Earnings Expectations

Our trusted model abstains from conclusively predicting an earnings outperformance for Nutanix this time around. The amalgamation of a favorable Earnings ESP combined with a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold) raises the likelihood of an earnings beat. Discover top-tier stocks worth buying or selling before the earnings rollout with our Earnings ESP Filter.

Nutanix currently presents an Earnings ESP of 0.00% and a Zacks Rank #3. Explore today’s complete list of Zacks #1 Rank stocks here.

Factors Driving Consideration

Nutanix’s performance in the fourth quarter of fiscal 2024 is anticipated to benefit from the robust uptake of its hybrid cloud solutions and an expanding customer base. The company continues to witness substantial growth in its core hyper-converged infrastructure (HCI) software and notable adoption of its hybrid multi-cloud solutions among Fortune 100 and Global 2000 enterprises.

Surging demand for Nutanix products and a high level of customer satisfaction are fueling the company’s customer expansion. The company’s in-house hypervisor is gaining considerable traction as customers prefer it as an economical alternative to offerings from other vendors. Its cloud-based deployment approach stands out. NTNX’s Xi Cloud Services is poised to challenge AWS, Microsoft Azure, and Google Cloud in the infrastructure-as-a-service sector.

Nutanix’s expanding stream of recurring revenues reflects customer allegiance to its solution lineup, enhancing the predictability of its revenue growth trajectory.

During the third quarter of fiscal 2024, the company onboarded 490 fresh clients, elevating the total customer count to 25,860. Moreover, the company’s shift to software-only sales is projected to significantly boost gross margins. In the third fiscal quarter, non-GAAP gross margin expanded 250 basis points year over year to 86.5%.

For the fourth quarter of fiscal 2024, Nutanix is eyeing Annual Contract Value billings ranging from $295 million to $305 million.

Share Price Movement & Valuation Picture

Nutanix has witnessed its stock appreciate by 10.3% year to date, trailing the Zacks Computer and Technology sector’s return of 22.3%. Nutanix operates in a fiercely competitive landscape dominated by established players and cloud behemoths, potentially exerting pressure on Nutanix’s market share and margins in the short term. Significant competitors comprise VMware, Dell Technologies DELL, and Hewlett Packard Enterprise HPE, all offering akin solutions for hybrid and multi-cloud environments. Furthermore, public cloud giants like Amazon Web Services, Microsoft MSFT Azure, and Google Cloud Platform present indirect competition as businesses progressively shift workloads to the cloud.

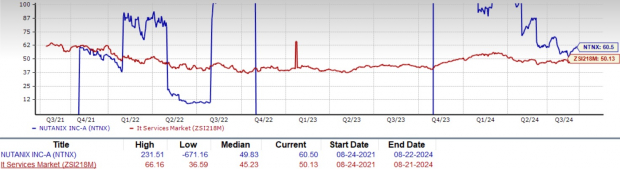

In terms of valuation, the company’s three-year trailing 12-month EV/EBITDA ratio of 60.5 outstrips the Zacks Computers – IT Services industry average of 50.13. This premium valuation is somewhat justified by Nutanix’s robust revenue expansion and successful pivot to a subscription-oriented model. However, it renders the stock susceptible to market volatility and potential perceptions of deceleration in the company’s growth.

Nutanix’s 3-Year EV/EBITDA TTM Ratio Signals Extended Valuation

Image Source: Zacks Investment Research

Investment Deliberations: Weighing Risk versus Gain

Nutanix presents an enticing investment avenue within the hybrid cloud infrastructure domain. The company’s software-defined HCI streamlines data center operations, offering scalability and cost-effectiveness. Nutanix’s shift to a subscription-driven model is amplifying recurring revenues and customer retention. Its expanding product array, encompassing database management and desktop-as-a-service solutions, diversifies revenue streams. Firm partnerships with leading cloud providers and an expanding customer base spanning various sectors showcase market validation. Despite contending with established players, Nutanix’s innovative stance and focus on simplifying intricate IT environments position it favorably for long-term expansion in the ever-evolving cloud computing landscape.

Conclusive Thoughts

For investors pondering the stakes with Nutanix stock in the fourth quarter of fiscal 2024, a nuanced evaluation is warranted. Despite the competitive backdrop, Nutanix’s robust footing in the burgeoning hybrid cloud realm and expanding customer roster intimate that jumping ship hastily might be premature. Prospective investors are advised to bide their time for an optimal entry point for Nutanix, currently sporting a Zacks Rank #3 (Hold). Explore today’s full lineup of Zacks #1 Rank (Strong Buy) stocks here.

7 Prime Stocks for the Upcoming 30 Days

Just unveiled: Specialists encapsulate which stocks could be the next big contenders. Dive into the investment world with a fresh perspective!

The Rise of Elite Stocks: Potential for Early Price Pops

Focusing on a curated selection of 7 elite stocks from the extensive list of 220 Zacks Rank #1 Strong Buys, analysts have identified these particular tickers as having the “Most Likely for Early Price Pops.”

Reflecting on historical data, since 1988, the comprehensive Zacks Rank #1 Strong Buy list has consistently outperformed the market by more than 2 times, boasting an impressive annual average gain of +24.0%. Given this remarkable track record, investors are encouraged to divert their immediate attention to these carefully selected 7 stocks.

Highlighted Elite Stocks:

Introducing Microsoft Corporation (MSFT), Dell Technologies Inc. (DELL), Hewlett Packard Enterprise Company (HPE), and Nutanix (NTNX).

Each of these stocks has been rigorously analyzed and identified as potential candidates for generating early price pops in the market.

Current Investment Recommendations:

Investors looking for the latest recommendations from Zacks Investment Research can explore the free report titled “7 Best Stocks for the Next 30 Days.”

This insightful report provides valuable insights into the market dynamics surrounding these elite stocks, aiming to assist investors in making informed decisions during their trading journey.

Indulge in a deep dive into the analysis and stock performance of Nutanix (NTNX) before their Q4 earnings through the detailed article available on Zacks.com.

Unveil the intricacies surrounding this potential investment opportunity to ascertain whether it aligns with your investment strategy and risk appetite.

Delve into the world of elite stocks and witness the potential for early price appreciation as these carefully selected candidates strive to outperform market expectations.

Stay informed, stay vigilant, and seize the opportunity for lucrative gains in the ever-evolving landscape of the stock market.