Technological Dominance

In a display of unwavering conviction, Nvidia’s CEO Jensen Huang has unequivocally stated the unparalleled supremacy of their GPUs in the AI sector, even challenging the value proposition of competitor AI chips offered for free.

During a gathering at the Stanford Institute for Economic Policy Research, Huang emphasized that the cost-effectiveness of Nvidia’s GPUs transcends rival offerings, regardless of their pricing strategy.

Elucidating his stance, Huang declared that the quality of Nvidia’s AI chips is so exceptional that even when competing chips are distributed for free, they remain insufficiently economical.

Despite acknowledging heightened competitiveness in the industry, Huang staunchly defended Nvidia’s technological fortitude, underscoring the rigorous challenges the company faces.

Market Influence and Strategy

Huang’s statements form part of a larger narrative outlining Nvidia’s growing assertiveness in the AI landscape. As early as February, Huang had forecasted universal integration of Nvidia’s AI “operating system” across enterprises worldwide, citing impressive revenue figures in the software and services segment.

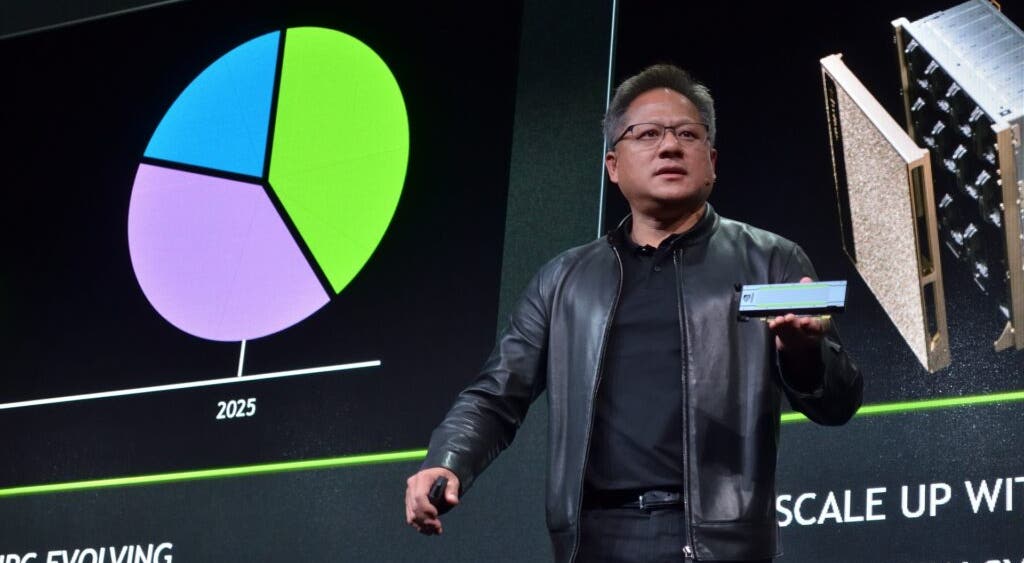

Within the AI chips market, Nvidia maintains a commanding 70% market share, further reinforcing Huang’s vision of AI-centric evolution. The company’s successful foray into software services substantiates Huang’s anticipation of significant business opportunities in the AI realm.

Moreover, Huang’s advocacy for countries to cultivate their distinct “Sovereign AI” underscores a broader strategic directive. By advocating for national investment in AI capabilities to safeguard data autonomy, Huang anticipates exponential growth in data center expenditures by 2029.

Innovation and Market Response

Huang’s proactive engagement with customers, facilitating the design of alternative AI processors and sharing product roadmaps, positions Nvidia as a collaborative industry force. In countering skepticism surrounding Nvidia’s operational ethics, Huang accentuated the distinctive features of their GPUs, such as programmability and widespread adoption among cloud computing entities.

Nvidia’s stock experienced a slight dip of 1.4% at the close of trading on Friday, highlighting the market’s immediate reaction to Huang’s remarks. This movement underscores the close scrutiny that investors place on Nvidia’s strategic positioning within the competitive AI landscape.