NVIDIA Outperforms Expectations with Record Revenue

Despite concerns about the AI sector overheating, NVIDIA Corp’s recent financial results shattered all doubts. In the first quarter of fiscal 2025, NVIDIA reported revenues of $26.04 billion, a staggering 262% increase year-over-year. This marks the third consecutive quarter with growth exceeding 200%. The company also surpassed the consensus estimate of $24.33 billion, with adjusted earnings per share of $6.12, outdoing the Zacks Consensus Estimate of $5.49.

Riding High on Data Center and Gaming Segment

NVIDIA’s data center revenues witnessed a remarkable 427% surge compared to the previous year, reaching $22.6 billion. Gaming revenue also showed an 18% year-over-year increase, amounting to $2.65 billion. Additionally, the company reported professional visualization revenues of $427 million and automotive sales of $329 million.

AI Market Acceleration

The AI landscape has been rapidly expanding due to the widespread integration of digital technologies. NVIDIA’s exceptional financial performance can be attributed to the unprecedented demand for its Hopper graphics processors, particularly the H100 GPU.

NVIDIA’s Bold Projections and Next-Gen Technology

NVIDIA foresees sales reaching $28 billion in the upcoming fiscal quarter, exceeding the current consensus estimate of $26.6 billion. CEO Jensen Huang highlighted the significance of the company’s next-generation AI chip, Blackwell, set to launch in the data center by the fourth quarter of fiscal 2025. Huang expressed confidence in substantial revenue generation from Blackwell during the year.

Future Prospects in an Expanding Market

As a pioneer in visual computing and GPU innovation, NVIDIA’s strategic shift towards AI-based solutions has proven fruitful. The company’s stock price has soared 25-fold over the past five years, and the outlook remains positive. With soaring demand for Hopper chips and the projected growth of the AI market from $200-$300 billion to nearly $2 trillion by 2030, NVIDIA is poised for sustained success despite potential supply challenges and chip price hikes.

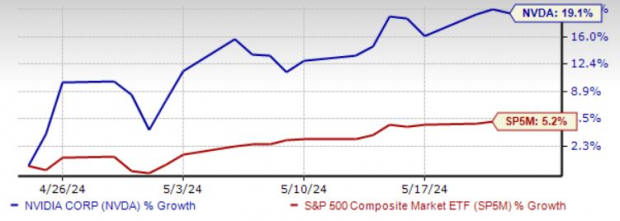

Market Response and Continued Momentum

Following the remarkable first-quarter results, NVIDIA’s stock price surged by 210% over the past year and 92% year-to-date. The momentum behind this tech juggernaut is expected to persist, solidifying its status as a favored investment choice on Wall Street.

The enduring success of NVIDIA in the AI market signals a bright future for the company, with continued growth and innovation driving its dominance in the industry.