As 2024 unfolds, the S&P 500 and Nasdaq Composite bask in double-digit gains, in a dance with record levels. One standout, Nvidia, the semiconductor princess, sees its stock soar by 156% in just half of a year. The company’s market cap ascends beyond $3.3 trillion, briefly eclipsing the mighty Microsoft.

Known initially for its semiconductor prowess, Nvidia’s revenue sources run deeper than meets the eye. Let’s delve into how Nvidia rakes in the cash and decipher the implications for the AI realm.

Decoding the Revenue Streams of Nvidia

Gazing at Nvidia’s income statement for the opening quarter of fiscal 2025 that concluded on April 30 unveils a tale of $26 billion in total revenue. Diving deeper, we unravel the revenue breakdown:

| Category | Revenue |

|---|---|

| Data Center-Compute | $19.4 billion |

| Data Center-Networking | $3.2 billion |

| Gaming | $2.6 billion |

| Professional Visualization | $0.4 billion |

| Automotive | $0.3 billion |

| OEM and Other | $0.1 billion |

Data source: Nvidia Investor Relations.

Data centers emerge as the primary cash cow for Nvidia. With the insatiable appetite for GPUs and their pivotal role in generative AI, Nvidia surfaces as a vanguard in computing and networking services.

A deeper look at the profit landscape, rather than just the revenue lens, is essential. As we navigate through Nvidia’s cost structure and profit generation, the bigger picture unfolds.

Unpacking the Impact on Cash Flow and Solvency

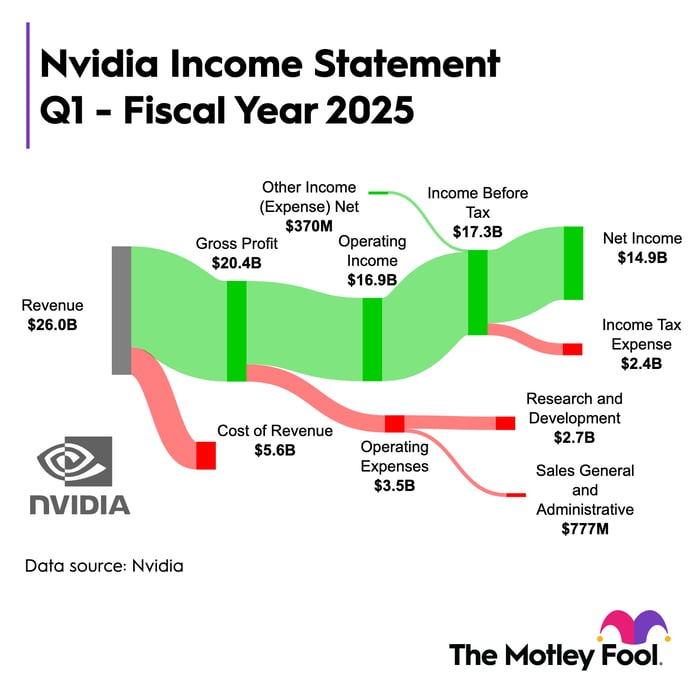

During the first quarter, Nvidia recorded $5.6 billion in cost of goods sold (COGS), paving the way for a $20.4 billion gross profit at a stunning margin of 78.4%.

Considering Nvidia’s expansion of gross margins over recent years, the narrative is clear. The surge in profit margins finds roots both in the AI chip fervor and Nvidia’s pricing power, fueled by chip superiority over rivals like Intel and AMD.

Market echoes suggest Nvidia commands up to 95% of the AI chip pie currently. In a pole position, Nvidia dictates premium prices for its chips, dwarfing competition.

Operating expenses climbed 39% year over year to $3.5 billion during Q1. Albeit a noteworthy uptick, it pales beside the exponential growth in revenue and profits, underscoring Nvidia’s financial agility.

A striking revelation lies in Nvidia’s net income of $14.9 billion, with a jaw-dropping 628% surge year over year. This exponential growth showcases Nvidia’s prowess in accumulating wealth.

Nvidia’s coffers swell with $31.4 billion in cash and equivalents by Q1 close, dwarfing its meager debt load. The vast liquidity serves as a testament to Nvidia’s financial robustness, enabling the company to chart an innovative future.

The Rise of Nvidia: A Closer Look at Stock Performance

Nvidia’s Market Cap and Stock Performance

In a financial landscape that seems to shift like sand, Nvidia has emerged as a rock-solid force. With a current market cap of approximately $3.1 trillion, the company has more than doubled its value since January, sending shockwaves through the investment world. Nvidia’s shares have skyrocketed to unprecedented heights in a remarkably short span of time.

Profit Growth vs. Stock Movement

Analyze the numbers, and you’ll see the true power of Nvidia. While the stock has surged by a jaw-dropping 171% over the past year, profits and earnings per share have ascended by an even more astonishing 300%. This disparity is a testament to Nvidia’s robust financial performance and unwavering growth trajectory.

Even as the stock experiences a meteoric rise, it’s important to note that Nvidia’s price-to-earnings (P/E) multiple stands at 73.9, significantly lower than the figure from a year ago when it loomed around 240. This data suggests that, despite its current dynamism, Nvidia’s valuation is actually more rational today compared to the same period last year.

Investment Considerations

Before diving into Nvidia stock, it’s wise to ponder some crucial factors:

The expert analysts at the Motley Fool Stock Advisor have spotlighted the 10 best stocks for long-term investors. However, Nvidia did not make the cut on this exclusive list. The selected stocks are projected to deliver substantial returns in the years ahead.

Reflect on Nvidia’s glorious past: if you had invested $1,000 in the company on April 15, 2005, following a recommendation from the Stock Advisor team, your investment would have ballooned to an impressive $723,729 today!*

Stock Advisor is renowned for providing investors with a roadmap to success, offering insights on portfolio construction, regular analyst updates, and two fresh stock picks every month. Notably, the service has outperformed the S&P 500 by a factor of over four since its inception in 2002*.

When assessing Nvidia’s investment potential, it’s essential to consider its market positioning, financial robustness, and historical performance as key indicators of future growth.

*Stock Advisor returns as of June 24, 2024