Nvidia (NVDA) stands on the brink of unveiling its fiscal Q1 2025 earnings this Wednesday, May 22, a moment certain to spark a furor across the markets. Last year, in the aftermath of its fiscal Q1 2024 earnings, Nvidia ascended to the illustrious cohort of $1 trillion corporations on the back of an extraordinary quarterly report that stood as a paragon of earnings and guidance accomplishments, even in the annals of Nvidia’s praiseworthy stature.

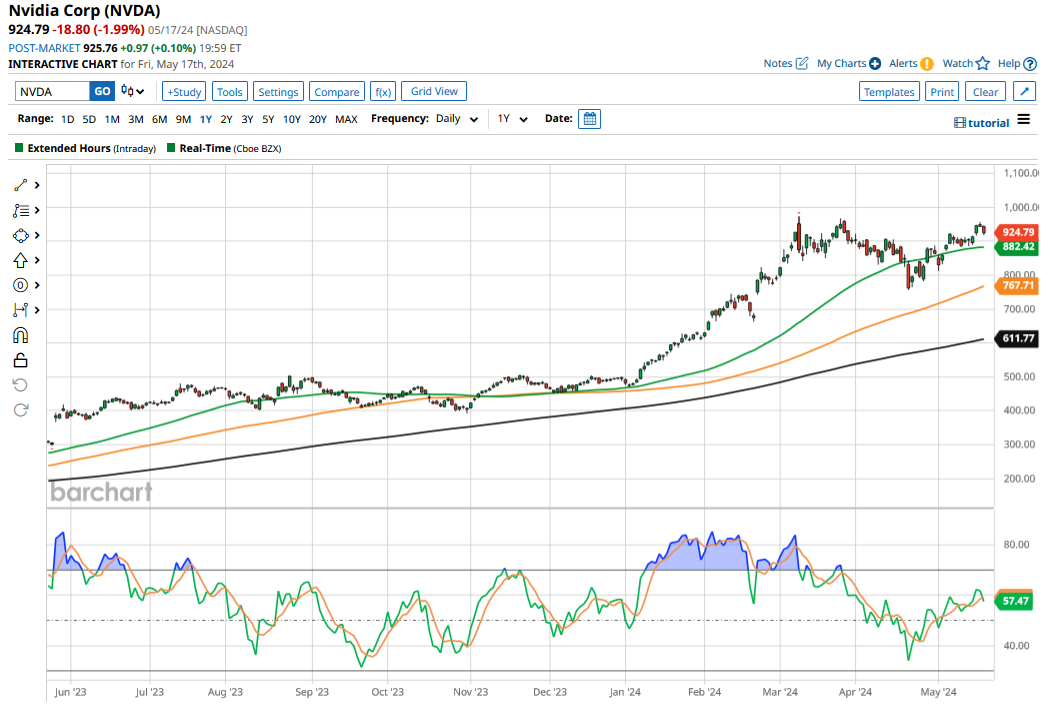

Since that epochal moment, Nvidia has writ a narrative of unyielding valor, its ascent punctuated by momentary downturns, but steadfastly maintaining a top-tier status among the S&P 500 index’s crème de la crème, securing YTD gains nearing the 89% zenith mark.

Anticipated with bated breath, Nvidia’s stock routinely pirouettes through volatility in the aftermath of its earnings unveilings. Traders adroitly wield option strategies as Nvidia readies to unfurl its quarterly earnings, beckoning us to probe into Wall Street’s expectations of the Jensen Huang-led company, pondering whether the stock holds the potential to transcend the $1,000 milestone post-earnings.

Nvidia Fiscal Q1 Earnings Expectations

Nvidia tantalizes analysts’ projections for revenues totaling $24.5 billion during the quarter denouement in April, heralding a 241% YoY crescendo, following the antecedent’s 265% YoY magnification.

In the antecedent earnings dialogue, Nvidia prophesied fiscal Q1 revenues at $24 billion at the midpoint. In a saga of recurrent triumphs, the company has consistently outperformed its own prognostications, as well as analysts’ estimations, etching an indelible mark amidst burgeoning demand for its artificial intelligence chips.

Key Metrics to Watch in NVDA’s Q1 Earnings

Nvidia’s revenues have vaulted upon a pedestal of exponential growth over the trailing triad of quarters. Forecasts presage a moderation in this ascent in the impending quarters, with analysts envisaging a 98% YoY surge in sales for the fiscal second quarter, subsequently waning further, with consensus estimates adumbrating a 25.7% revenue swell in the ensuing fiscal year.

In an idiosyncratic narrative, Nvidia unveiled its venerated Blackwell chip in March, with segments of the market speculating a deceleration in revenue growth as the transition to this novel chip, slated for public release later this year, unfolds. Despite this, Morgan Stanley remains unflinching in its conviction, asserting an unhampered sales trajectory for Nvidia even amidst the transition from H100 chips to the Blackwell variant.

Anticipation coalesces around Nvidia’s revenue guidance and management’s elucidation of the demand landscape, poised to attract rapt scrutiny. Bank of America prognosticates the company’s fiscal Q2 guidance will herald a sequential revenue uptick in single digits. Coincidentally, the financial juggernaut opines that Nvidia’s gross margins will resile to a “more normalized” range of 75%-76% in the fiscal second quarter.

In a heartening development, significant Big Tech entities – such as Meta Platforms, Alphabet, Amazon, and Tesla – escalate their capex towards the realm of AI, auguring amplified expenditure on Nvidia’s chips, among other strategic avenues.

Nvidia Stock Price Forecast

Prior to the curtain call on its fiscal Q1 earnings, analysts have uplifted Nvidia’s target price, with Jefferies hoisting it from $780 to $1,200, and HSBC elevating the bar from $1,050 to a bullish $1,350.

Bank of America, while donning a cloak of circumspection regarding potential growth atrophy, retains a “buy” rating, adjoined with a soaring target price of $1,100 upon Nvidia’s strapping shoulders.

Nvidia’s average target price of $990.51 casts a beacon of allure, beckoning an ascent of 7.1% above last week’s denouement. Throughout the ebullient price oscillations of the past year, Nvidia has often transcended its consensual target prices, goading analysts into a ceaseless pursuit to match the stride following every earnings divulgence.

Can NVDA Stock Rise Above $1,000?

At present, NVDA’s mean target price hovers a hair’s breadth away from the illustrious $1,000 echelon. Given the marquee’s ebullient response to Nvidia’s recent earnings revelries, the prospect of the stock breaching past $1,000 in the wake of this week’s grand reveal does not linger as a distant fantasy.

Nvidia serenades the trading realms at a next 12-month price-to-earnings multiple of 36.6x, a figure neither beguilingly sumptuous nor exorbitantly extravagant, when juxtaposed against the prodigious top-line and bottom-line surge that the company adroitly wields.

Prognosticators narrate a tale of burgeoning global AI expenditure over the horizon, heralding a clarion call for high-octane chips akin to Nvidia’s vaunted creations. Albeit, the specter of supply remains a specter on the horizon, as chip manufacturers such as Advanced Micro Devices and Intel, alongside Big Tech colossi like Microsoft, fervently forge their own paths in the realm of AI chip innovation.

As the pendulum of competition sways, Nvidia presently holds sway over its rivals, navigating the competitive seas with aplomb. Should the company sustain this vanguard of advantage over its competitors, the coveted fruits of the “AI boom” shall continue to rain down unabated.