Chipmaker Nvidia, symbol NVDA, has recently found itself at the center of a storm of opinions among financial experts regarding its future trajectory. Aswath Damodaran, renowned as NYU’s “Dean of Valuation,” has brought out the big guns, claiming that Nvidia is currently overvalued, pitching its share price at a mere $87 – a far cry from the prevailing $102.83 level. In light of the downward spiral that NVDA shares have taken following its latest earnings report, it seems a substantial portion of the investing community may be inclined to side with Damodaran’s sobering viewpoint.

However, in the world of stock analysis, where bears tread, bulls are never far behind. Enter Bank of America (BofA), whose market mavens view the recent tumble in Nvidia’s value as an invitation to buy, not bail. Analyst Vivek Arya of BofA pointed out that the tech giant is dangling at its most reasonable valuation in half a decade, sticking a tantalizing price tag of $165 per share on it – hosting a banquet of 60.5% potential appreciation from present values.

Arya isn’t just painting rainbows out of thin air. His bullish outlook stems from Nvidia’s unrelenting dominance in Artificial Intelligence (AI) investments and the forthcoming debut of its much-hyped Blackwell chips. Although regulatory hurdles and production lags for its new-gen chips loom ominously on the horizon, BofA remains unperturbed. The bank believes that the current Hopper chip will continue to enjoy robust demand as the AI sector steams ahead.

It’s also worth mentioning that Arya has managed a whopping 77% success rate in predicting NVDA’s performance, boasting an average return of 81.98% per rating – not too shabby for a financial soothsayer.

Deciphering the Ideal Price for NVDA

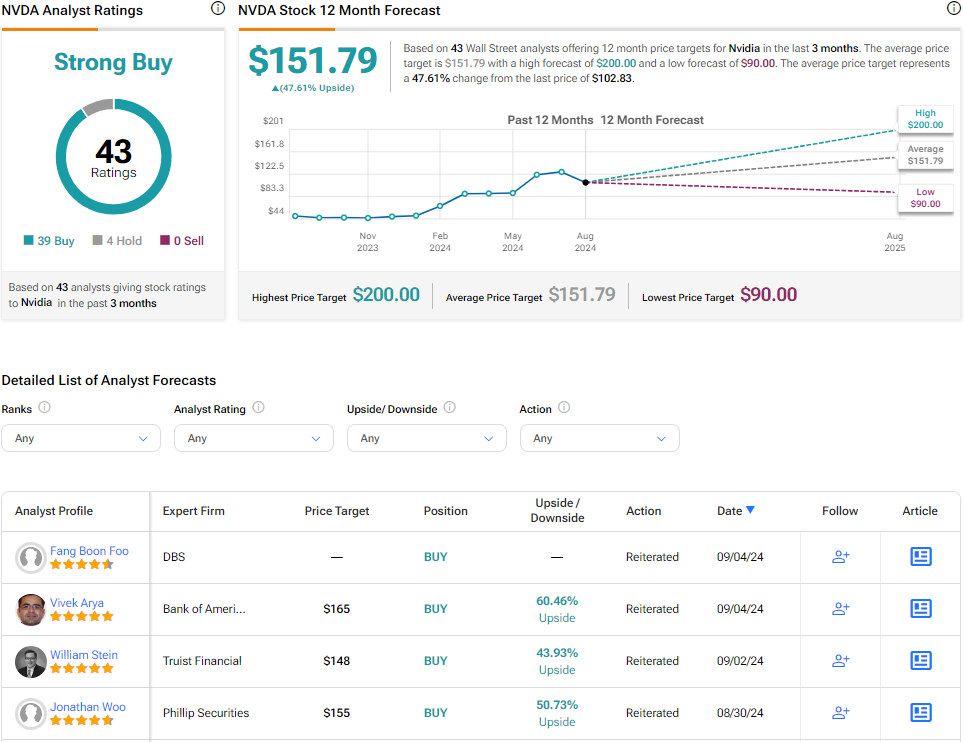

On the whole, industry analysts have painted a rosy picture for NVDA stock. With 39 Buy ratings, four Hold ratings, and zero Sells in play over the past quarter, the narrative is nothing short of a Strong Buy sentiment, as depicted in the graphic below. After witnessing a meteoric 122% surge in its stock price over the last year, the average price target for NVDA rings in at $151.79 per share, signaling an uplifting 47.61% potential upswing in the offing.