The U.S. Department of Justice (DOJ) is currently scrutinizing Nvidia’s (NVDA) business practices, evaluating allegations of monopolistic behavior in the AI chip market. Rivals have accused Nvidia of leveraging its market dominance to push its advanced AI chips onto customers unfairly, leading to an investigation of the situation.

This recent turn of events follows a surge in chip stocks, with Nvidia leading the charge after Microsoft’s (MSFT) announcement of increased AI investments. Nvidia currently commands a significant 80% market share in AI chips and has seen its stock price soar by over 120% in 2024.

Examining the Allegations Against Nvidia

Competitors have alleged that Nvidia exerts pressure on customers choosing chips from other semiconductor companies. Additionally, the DOJ is exploring claims that Nvidia imposes inflated prices on networking equipment for customers who opt for chips from competitors. Concerns have also been raised about Nvidia’s aggressive acquisition strategy of AI startups, potentially stifling competition and consolidating its market position.

Reports have surfaced indicating that the DOJ is particularly scrutinizing Nvidia’s acquisition of the Israel-based AI startup, Run:ai. Progressive groups and Democratic Senator Elizabeth Warren have urged the DOJ to take action against what they perceive as anti-competitive practices by Nvidia.

In response, a spokesperson for Nvidia reiterated the company’s commitment to lawful practices and fair competition, highlighting their focus on innovation and technology. Nvidia maintains that it offers its products openly on both cloud and on-premise platforms, allowing businesses to choose the solutions that best suit their needs.

Investor Sentiment and Stock Performance

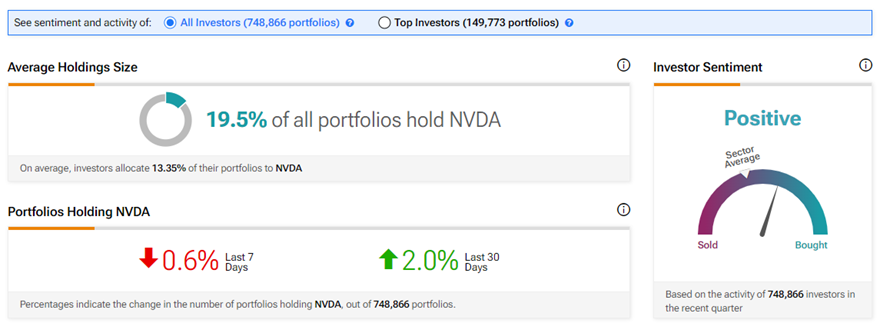

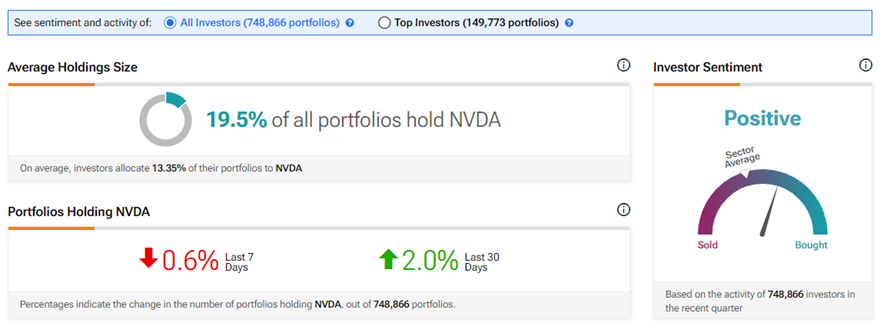

The latest data from the TipRanks Stock Investors tool shows a growing positive sentiment among retail investors towards Nvidia. The number of portfolios containing NVDA stock has increased by 2% over the last month.

Evaluating Nvidia Stock Potential

Nvidia’s stock continues to receive a Strong Buy consensus rating, with 37 Buy recommendations and four Hold ratings on TipRanks. Analysts forecast an average price target of $142.74, suggesting a potential upside of 30.7% from the current price levels.

Explore more Nvidia analyst ratings