NVIDIA’s Stock Performance Following Split

After initiating a 10-for-1 stock split, NVIDIA’s stock surged, opening at around $120 post-split, demonstrating a more than 2% increase. Historical data shows that NVIDIA stock has often seen positive movements in the months following a stock split.

Market Response to Fed Rate Cuts

Boosted by Federal Reserve’s interest rate cuts, NVIDIA stock experienced a positive trajectory. Lower interest rates are expected to enhance NVIDIA’s profit margins while supporting its growth initiatives in the AI market, historically beneficial for the company.

Driving Forces Behind NVIDIA’s Stock

With a dominant position in the GPU market and the imminent shipment of high-demand Blackwell chips, NVIDIA is set for further growth. CEO Jensen Huang’s initiatives indicate a strong market positioning as AI hardware investments soar, projecting a lucrative future for the company.

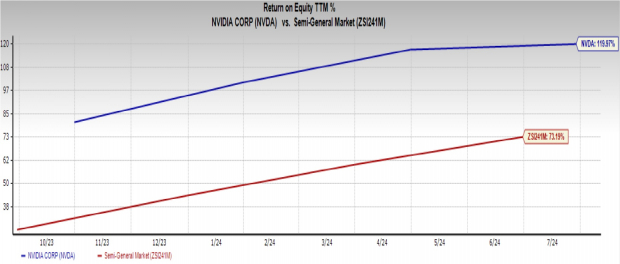

Strength in Fundamentals

Robust fundamentals, including high Return on Equity (ROE) and net profit margin, position NVIDIA favorably. With an ROE at an impressive 120% and a net profit margin exceeding industry standards, NVIDIA showcases efficient cost management and profitability.

Trading NVIDIA Stock

Following macro trends and supported by strong fundamentals, analysts have raised short-term price targets for NVIDIA. Technical indicators like 50-day and 200-day moving averages signal a bullish trend. Although the stock appears expensive, its growth potential remains attractive for long-term investors.

Infrastructure Stock Boom Looming

A significant push towards revitalizing U.S. infrastructure is on the horizon, promising vast investment opportunities. Companies poised to benefit from infrastructure development stand to gain substantial returns amidst the impending wave of public spending in the sector.