Nvidia’s advanced AI chips are finding their way to China despite U.S. export restrictions. As reported by the Financial Times, several smaller Chinese cloud providers are offering access to servers equipped with eight Nvidia A100 processors for approximately $6 per hour to local tech companies. This rate significantly undercuts the prices set by smaller U.S. cloud vendors for the same configuration.

In a twist, Nvidia’s A100 and H100 chips are openly available for purchase on Chinese social media platforms, e-commerce sites like Xiaohongshu and Taobao, as well as in electronics markets, albeit with slightly higher price tags compared to overseas markets.

The Significance of Nvidia’s Chips in AI

Understanding the significance of these chips reveals why they are highly sought after. Nvidia’s AI chips, particularly the A100 and H100, play a crucial role in training large language models for various AI applications. The company, however, has been prohibited from exporting the A100 to China since 2022 and has never been allowed to sell the H100 in the country.

Chinese Cloud Giants Offer Access to Nvidia’s Chips

Curiously, major cloud operators in China such as Alibaba and ByteDance charge notably higher rates for Nvidia A100 servers compared to smaller local vendors. Despite the higher initial prices, these larger providers ultimately offer competitive pricing with discounts factored in, aligning their rates with those of Amazon Web Services, which charges between $15 and $32 per hour for similar services.

Nvidia’s Response to AI Chip Availability in China

In response to these developments, Nvidia clarified that it primarily sells its processors to reputable partners who ensure compliance with U.S. export control regulations. The company also mentioned the availability of pre-owned products through various secondary channels. While Nvidia admits it cannot track products post-sale, it asserts that it will take action against any customer found violating U.S. export rules.

Assessing Nvidia’s Investment Potential

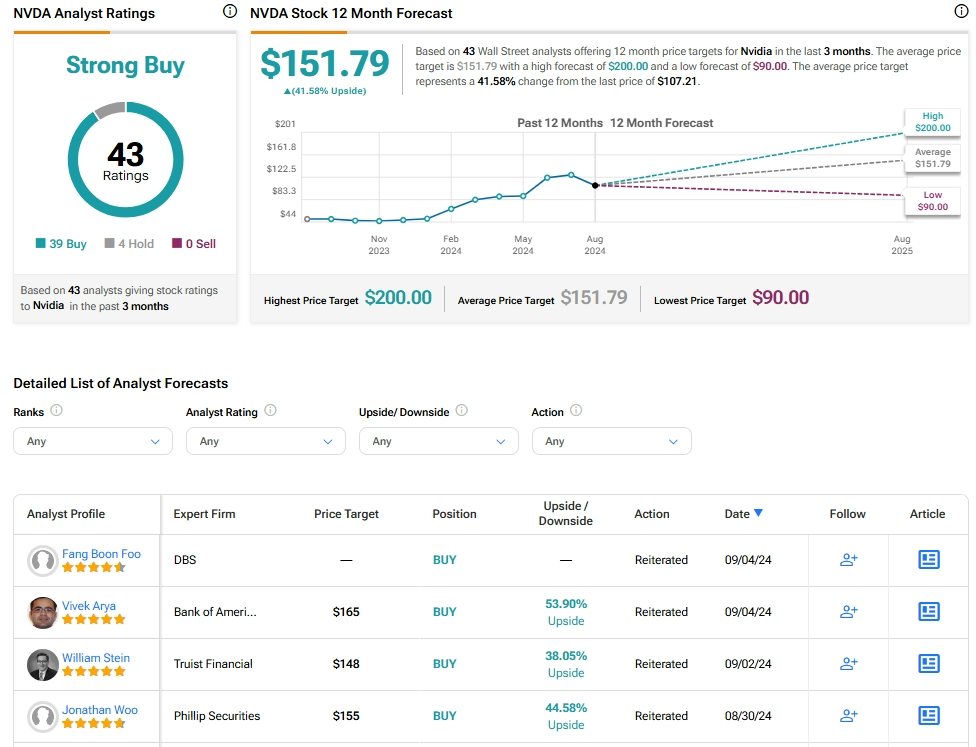

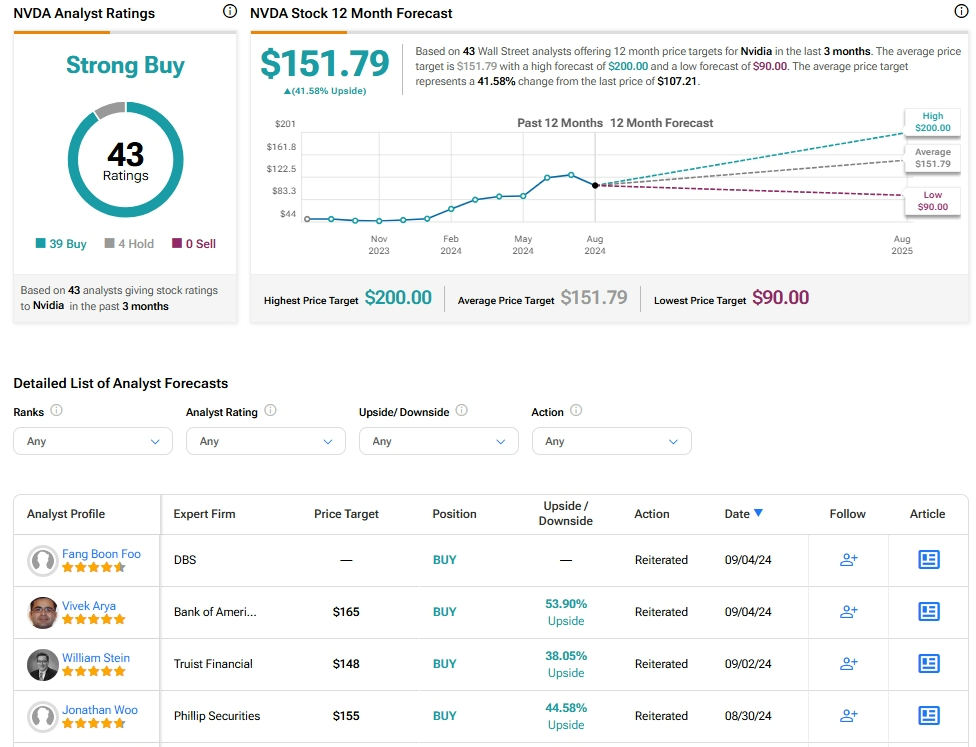

Market analysts are optimistic about NVDA stock, maintaining a Strong Buy consensus based on 39 Buy ratings and four Holds. Over the last year, NVDA has surged by over 100%, with the average price target of $151.79 indicating a potential upside of 41.6% from current levels.

Explore more NVDA analyst ratings here