Elon Musk’s immense pay package and shift towards self-driving cars have sparked varied sentiments, prompting acclaim from Nvidia’s co-founder, Jensen Huang. With Nvidia’s remarkable success in AI chips, Huang’s praise for Musk’s foresight in the self-driving arena speaks volumes.

Musk’s pivot towards AI-driven self-driving technology represents a bold departure from Tesla’s initial sustainable travel focus. Initially steered towards increased production, Tesla’s recalibration to prioritize AI reflects a strategic progression amidst evolving market trends.

Tesla’s Pivot Supported by Current Market Dynamics

Tesla’s strategic pivot aligns with prevailing market forces. Amidst dwindling interest in purely sustainable driving solutions, both Tesla and the broader electric vehicle market witness sales decline. The industry shift towards hybrid models compels Tesla to mirror this stance and focus on enhanced self-driving technology.

Thus, Tesla’s emphasis on transforming its self-driving system substantiates its proactive approach, resonating with Huang’s strategic perspective.

Is Tesla a Buy or Sell?

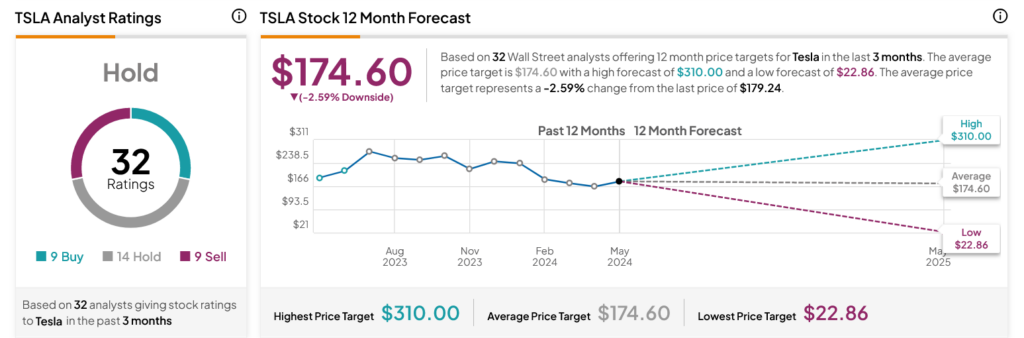

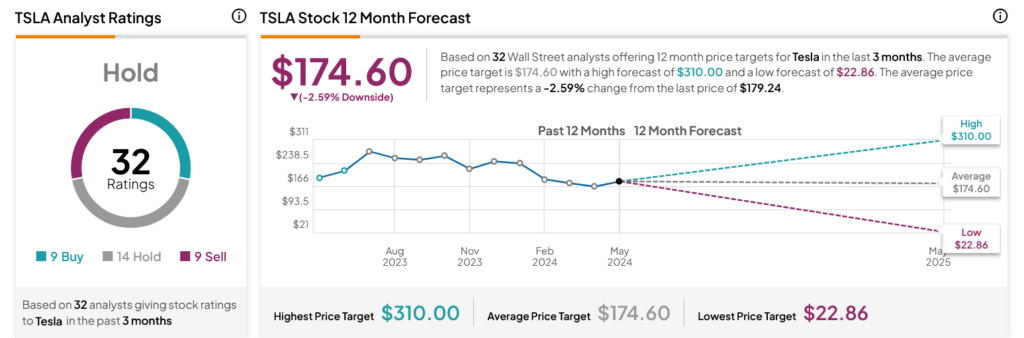

Analysts currently uphold a Hold consensus on TSLA stock, with a mosaic of nine Buys, 14 Holds, and nine Sells over the past three months. Despite a 10.9% share price dip in the previous year, the average TSLA price target of $174.60 indicates a marginal downside risk of 2.59%.

It remains to be seen how Tesla’s evolving stance towards AI and self-driving capabilities will influence its market trajectory and investor sentiment in the coming quarters.