A Battle of Speculation

As the clock ticks towards Nvidia Corp’s earnings reveal for the fiscal second quarter of 2025, the stage is set for a clash of sentiments. The Wall Street outlook forecasts an earnings per share (EPS) of 64 cents, significantly up from the year-ago figure of 25 cents. Revenue projections offer an even more impressive picture, with estimates soaring to $28.68 billion from $13.51 billion in the same quarter last year.

A Crucial Focus on Artificial Intelligence

Investors have their eyes glued to Nvidia’s messaging on artificial intelligence (AI). Over the past half-decade, Nvidia’s stock has skyrocketed by over 2,900%, largely driven by its cutting-edge graphics processors. These chips play a pivotal role in various AI processes, positioning Nvidia as a key player in the race for advancing machine intelligence.

A Shift in Sentiment

Despite the bullish sentiment, recent actions by traders and experts hint at a potential shift. Market analyst Steve Grasso liquidated his Nvidia holdings before the earnings report, opting to wait for a reentry opportunity. Additionally, Goldman Sachs expressed doubts about the long-term productivity gains offsetting the massive investments projected for AI.

ETF Opportunities in the Fray

The market’s uncertainty around Nvidia brings both risk and reward, creating a fertile ground for profitable moves through Direxion’s NVDA-focused ETFs. The Direxion Daily NVDA Bull 2X Shares offer a leveraged play for those bullish on Nvidia, aiming to double the daily performance of NVDA. On the flip side, the Direxion Daily NVDA Bear 1X Shares provide an avenue for shorting Nvidia’s trajectory, mirroring its inverse performance.

Caution in Leverage

While Direxion’s ETFs present a convenient way to leverage or short without delving into the complexity of options, investors should tread carefully. Leveraged and inverse ETFs are best suited for short-term positions, as holding them for extended periods can lead to value erosion.

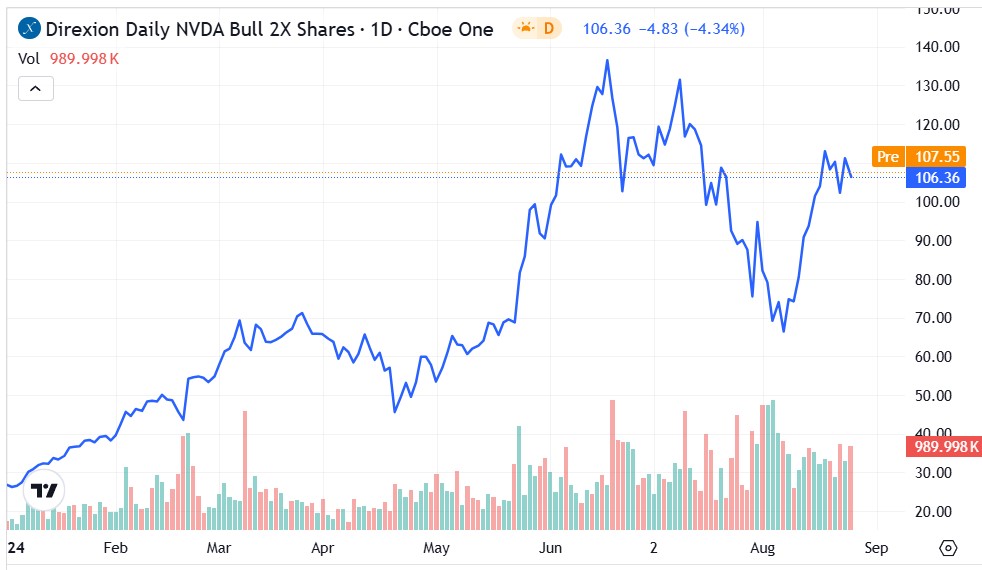

The NVDU ETF: Riding the Rollercoaster

The Direxion Daily NVDA Bull 2X Shares have mirrored Nvidia’s stock performance this year, but with a magnified intensity. Sporting a nearly 300% gain since the beginning of the year, the 2X fund has been a rollercoaster ride marked by heightened demand and a push towards psychological resistance levels.

The NVDD ETF: A Bearish Standoff

In contrast, the Direxion Daily NVDA Bear 1X Shares have faced a tough year, shedding over 68% of their value amid Nvidia’s upward trajectory. Struggling to hold key support levels and sitting below moving averages, the bearish ETF is in a challenging position, with hopes resting on a lackluster Q2 earnings report to spur a reversal.

Moving Forward

With Nvidia’s earnings report looming and uncertainty rife, both bulls and bears have their chance to capitalize on Direxion’s NVDA ETFs. As the market teeters on the edge, the potential for profit awaits those who can navigate the stormy seas of Nvidia’s financial performance.