Shaping the Landscape

Looking back a decade, who could have foreseen the meteoric rise of Nvidia? The realm of market cap dominion is a fickle one, brimming with surprises and uncertainties. Yet, gazing into the future can unravel shreds of enlightenment for investors. After all, without a semblance of foresight, one might as well be playing darts in the dark and stick to safer bets like index funds.

The Rise of Titans

Deemed the “Magnificent Seven” behemoths, Amazon (NASDAQ: AMZN) and Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), are poised to claim the crowns as the world’s most extensive corporations by 2030. Here’s a glimpse into the compelling reasons behind this prophecy.

Amazon: Clouding the Competition

Amazon’s culture of innovation has paved its path to dominance across various product categories. While it’s hailed as North America’s e-commerce juggernaut raking in billions annually, the true cash cow lies in Amazon Web Services (AWS).

AWS reigns as the leading global cloud infrastructure provider, hauling in a monumental $91 billion in revenue and close to $25 billion in operating income last year. Amidst competitions from Microsoft Azure and Google Cloud, AWS has sustained its sovereignty since its inception nearly two decades ago, boasting a 31% market share.

The realm of cloud computing is far from saturated, with analysts projecting a 19% growth rate through 2030. Should AWS retain its market share and profit margins, the division could witness a 19% annual earnings surge, scaling over $90 billion by 2030. Coupled with its expansive e-commerce arm, international ventures like India’s market, and audacious initiatives such as the Project Kuiper internet service, Amazon stands a stout chance of clinching a top-notch position in the business hierarchy by 2030.

Alphabet: A Multifaceted Growth Odyssey

As the curtain unveils the other contender, a mere glance at Amazon’s cloud rivals reveals the answer.

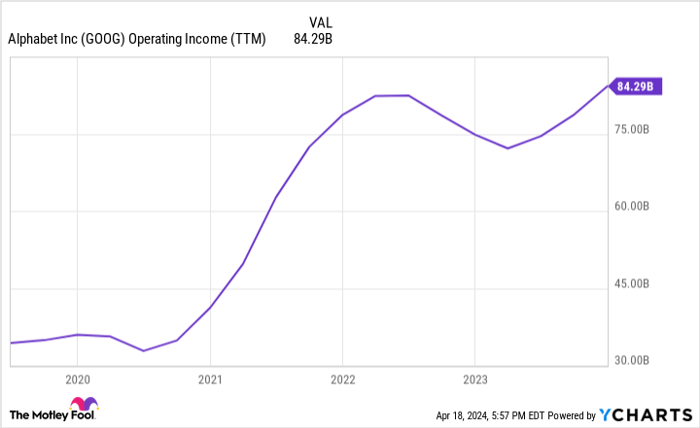

GOOG Operating Income (TTM) data by YCharts

Alphabet, the progenitor of Google Search, YouTube, Google Cloud, and avant-garde ventures like autonomous driving firm Waymo, is geared up for a remarkable trajectory. Mirroring AWS’s growth prospects, Google Cloud is earmarked to escalate from a $36 billion annualized revenue to a whopping $100 billion by 2030, ushering in prosperity for Alphabet. Nevertheless, that’s merely the tip of the iceberg.

Google Search steals the limelight, churning a staggering revenue of $48 billion in a single quarter of 2023, with projections hinting at an annual $200 billion soon. Embracing the role of a pivotal advertising engine for myriad sectors like travel, insurance, and financial services, Google Search is poised for growth as smartphone and internet adoption surge hand in hand with the global GDP.

And then there’s YouTube, Alphabet’s gem. Dominating the global video landscape, YouTube amassed $9.2 billion in advertising revenue in the last quarter. With billions of global users and a stronghold as the premier streaming service on American TV screens, YouTube’s potential is boundless. By 2030, it may well have cemented its status as an entertainment juggernaut.

Boasting $85.7 billion in operating earnings last year, Alphabet’s array of growth avenues paints a compelling narrative. With the wind in its sails, the path seems clear for Alphabet to outstrip giants like Apple and Microsoft, forging ahead to join Amazon in claiming the throne as the largest corporations by 2030.