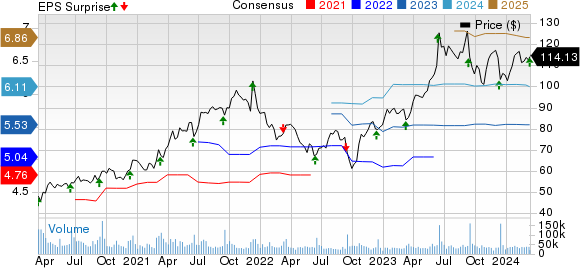

Oracle ORCL pulled off a remarkable feat in the third quarter of fiscal 2024, surpassing expectations with non-GAAP earnings of $1.41 per share – a jump of 15.6% compared to the previous year. The figures trounced the Zacks Consensus Estimate by 2.92%, showcasing the company’s resilience and agility in a fiercely competitive market. At constant currency, earnings displayed robust growth, climbing by 16% year over year.

The upward trajectory didn’t stop there. Oracle’s revenues mirrored this success, reaching $13.28 billion – up 7% year over year and surpassing the Zacks Consensus Estimate by 0.04%. This surge in revenues signals a promising outlook for the tech giant.

The market responded with enthusiasm, propelling Oracle’s stock to a 15% surge in premarket trading. This uptick was significantly fueled by the company’s strategic partnership with AI chip giant NVIDIA Corporation, underscoring Oracle’s relentless pursuit of a share in the cloud-computing domain.

Oracle’s forward-thinking investment in cloud infrastructure and cutting-edge solutions, like the innovative Ambulatory Clinic Cloud Application Suite, positions the company for sustained growth in the ever-evolving software industry landscape.

Geographically, Oracle witnessed revenue growth across regions, with the Americas recording a 7.8% increase to $8.27 billion, followed by European, Middle Eastern, and African markets climbing 8.1% to $3.31 billion. The Asia Pacific region also saw a 2% uptick to $1.69 billion in revenues.

Oracle’s Robust Revenue Mix

Oracle’s stellar performance was underpinned by a robust revenue mix. In upholding its trajectory, Cloud services and license support revenues surged 12% year over year to $10 billion, driven by strategic cloud applications, autonomous database, and Oracle Cloud Infrastructure (OCI).

On the flip side, Cloud license and on-premise license revenues experienced a modest decline of 3% year over year to $1.3 billion. However, the overall cloud revenues, including Infrastructure as a Service (IaaS) and Software as a Service (SaaS), surged to $5.1 billion – a substantial 25% increase compared to the previous year.

Further drilling down, Cloud Infrastructure (IaaS) revenues skyrocketed by 49% year over year to $1.8 billion, illustrating Oracle’s acumen in leveraging cloud services. Meanwhile, Cloud Application (SaaS) revenues saw a healthy 14% increase to $3.3 billion.

Operating Prudently: Oracle’s Financial Health

Oracle’s prudent financial management was exemplified through its operating expenses, which rose by 3.8% year over year to $7.48 billion. Despite the incremental expenses, the company’s non-GAAP operating income soared by 15% to $5.79 billion, demonstrating a robust operating margin of 43.6% – a considerable 180 basis points expansion from the previous year.

Solid Balance Sheet & Cash Position

As of Feb 29, 2023, Oracle boasted cash & cash equivalents and marketable securities amounting to $9.9 billion, showcasing a healthy financial foundation compared to $8.69 billion in the prior quarter. The company’s commendable operating cash flow and free cash flow stood at $18.23 billion and $12.25 billion, respectively.

Notably, Oracle’s remaining performance obligation (RPO) exceeded $8 billion, with a significant portion excluding Cerner, soaring by 41% at constant currency. This robust RPO underscores Oracle’s ongoing commitment to future revenue growth prospects.

In terms of shareholder rewards, Oracle repurchased four million shares worth $450 million and disbursed dividends amounting to $4.4 billion over the last 12 months, strengthening its bond with investors.

Promising Guidance signaling Future Growth

Looking ahead, Oracle remains optimistic, with projections indicating a bright future ahead. For the fourth quarter of fiscal 2024, the company forecasts a growth range of 4-6% in total revenues, with cloud revenues excluding Cerner expected to grow in the range of 22-24%. Earnings per share are anticipated to range between a 2% decline and remain flat at $1.62-$1.66.

Industry Metrics & Recommendations

Within the broader Computer and Technology sector, Oracle maintains a Zacks Rank #3 (Hold). Despite this, Oracle’s shares have surged by 8.3% year to date.

For investors seeking market opportunities, Meta Platforms (META) and Amazon.com (AMZN) remain promising picks, each currently holding a Zacks Rank #1 (Strong Buy). These companies exhibit strong growth prospects and present compelling investment avenues in the tech landscape.

The developed consensus, revealing positive revisions for both Meta Platform’s 2024 earnings and Amazon’s expected earnings growth, paints a promising picture. Meta Platforms has recorded a remarkable 42.9% rally in the trailing 12 months, highlighting its growth potential. Meanwhile, Amazon has surged by 15.4% year to date, showcasing its resilience in a volatile market environment.