Paychex, Inc. PAYX is gearing up to unveil its first-quarter earnings report before the market opens on Tuesday, Oct. 1.

Market analysts are eyeing the Rochester, New York-based company to disclose earnings of $1.14 per share for the quarter, in comparison to the $1.14 per share reported in the same period last year. The consensus among analysts is that Paychex is likely to announce quarterly revenue of $1.32 billion, up from $1.29 billion a year ago, as per data from Benzinga Pro.

In its previous earnings release on June 26, the company showcased a 5% increase in sales compared to the previous year, bringing in $1.295 billion, aligning closely with the estimated $1.296 billion as per analyst projections.

As of Friday, Paychex shares concluded trading at $132.99.

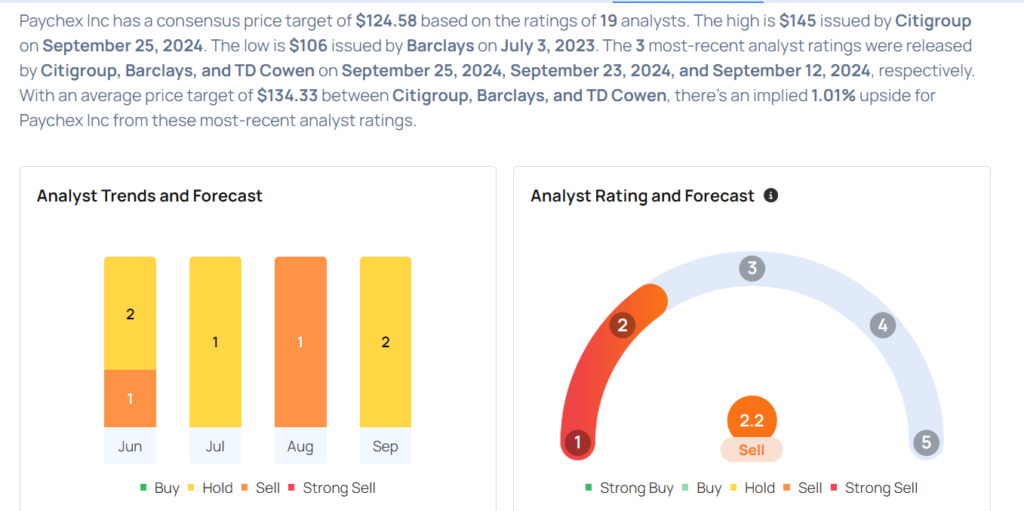

For the most recent analyst ratings on Paychex, readers can find detailed insights on the Analyst Stock Ratings page by Benzinga. The ratings can be arranged by stock ticker, company name, analyst firm, rating changes, or other criteria.

Lend an ear to how the top-notch analysts at Benzinga have evaluated the company over the recent period.

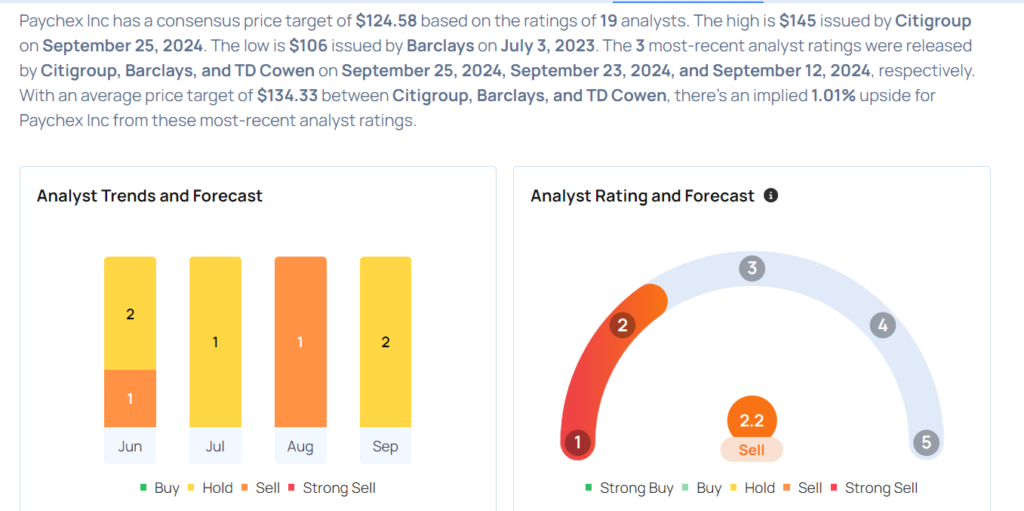

- Citigroup analyst Peter Christiansen held a Neutral rating and upped the price target from $125 to $145 on Sept. 25 with an accuracy rate of 66%.

- Barclays analyst Ramsey El-Assal retained an Equal-Weight rating and increased the price target from $118 to $132 on Sept. 23, boasting an accuracy rate of 68%.

- TD Cowen analyst Bryan Bergin maintained a Hold rating and raised the price target from $121 to $126 on Sept. 12, possessing an accuracy rate of 61%.

- JP Morgan analyst Tien-Tsin Huang upheld an Underweight rating and raised the price target from $120 to $128 on Aug. 20, with an accuracy rate of 66%.

- Morgan Stanley analyst James Faucette sustained an Equal-Weight rating but revised the price target downward from $125 to $122 on June 27, holding an accuracy rate of 65%.

Thinking about delving into PAYX stock? Here’s a snippet of what analysts have to say:

Read This Next: