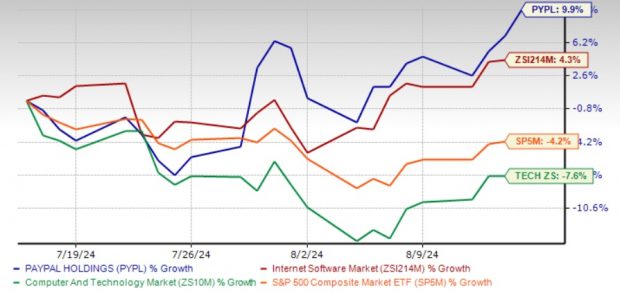

PayPal PYPL has witnessed a remarkable 9.9% increase in its stock price over the past month. This surge outpaces the industry’s growth of 4.3% and significantly outperforms the Computer & Technology sector and the S&P 500 index, which experienced declines of 7.6% and 4.2%, respectively.

The company’s success is attributed to its strong presence in both domestic and international markets, driven by robust digital payment solutions, effective customer strategies, and improved pricing discipline.

Notably, in the second quarter of 2024, PayPal generated $4.55 billion in revenues from the United States and $3.33 billion in international revenues, marking a growth of 8% year over year for each segment.

Exploring the One-Month Price Performance

As PayPal continues its impressive growth trajectory, investors are left pondering how the company intends to sustain this momentum and what steps they should take.

PayPal’s pioneering brand and technology, along with its secure peer-to-peer transaction capabilities, set it apart from competitors like Block SQ, Alphabet GOOGL, and Apple AAPL.

Strength in Portfolio Driving Growth

By providing digital payment solutions that empower merchants and consumers to transact globally, PayPal maintains a steady customer momentum. Its leading brand and guest checkout solutions are instrumental in its growth.

The company’s success across its branded checkout, Braintree, and Venmo platforms contributes significantly to the growth of transaction margins. PayPal is observing a surge in monthly active accounts owing to the rising adoption of its services.

With initiatives like Fastlane for quick and secure checkouts and the expansion of the PayPal Complete Payments platform, PayPal solidifies its position in the e-commerce landscape.

Future Outlook and Estimate Revisions

Looking ahead, PayPal’s commitment to democratizing financial services and enhancing economic opportunities worldwide is expected to drive its growth prospects.

For the third quarter of 2024, PayPal anticipates mid-single-digit revenue growth year over year, with analysts projecting a 5.8% increase to $7.85 billion. The company also expects high-single-digit growth in non-GAAP earnings per share.

Estimates for 2024 depict low to mid-teens growth in non-GAAP earnings per share, with anticipated revenues of $31.95 billion, presenting a year-over-year growth of 7.3%.

Final Thoughts

PayPal’s strong market position, growing traction in e-commerce, diverse product lineup, competitive edge, and positive estimate revisions make it an attractive investment opportunity. Furthermore, trading at a forward 12-month P/S ratio of 2.02X versus the industry’s 2.51X, PayPal is currently positioned as a compelling prospect for investors.

Image Source: Zacks Investment Research

Cheap valuation, together with robust fundamentals, creates an irresistible allure for potential investors eyeing the PYPL stock at its current price levels.

Exploring Elite Stock Picks

Recent revelations from experts have unveiled 7 elite stocks carefully selected from a current roster of 220 Zacks Rank #1 Strong Buys. These chosen securities are tagged as “Most Likely for Early Price Pops.”

Since 1988, this exclusive list has outperformed the market by over twofold, boasting an average yearly gain of over +24.0%. Hence, these 7 hand-picked gems deserve your immediate and undivided attention.