Pinduoduo (PDD) took a nosedive in pre-market trading following a disappointing Q2 revenue report. The company’s Q2 revenues soared 86% year-over-year to RMB97.06 billion but fell short of the $14.04 billion consensus estimates.

This revenue miss was further exacerbated by a 48% surge in operating expenses to RMB30.79 billion, driven by increased investments in marketing and promotions to reel in shoppers.

Nevertheless, PDD managed to post adjusted diluted earnings per American Depositary Share (ADS) of RMB23.24 ($3.20), surpassing analysts’ expectations of $2.86 per ADS.

Unpacking Pinduoduo’s Revenue Shortfall

Behind Pinduoduo’s revenue hiccup lie several factors, from China’s sluggish economy and woes in the property sector to soaring unemployment rates leading to reduced consumer spending. This ripple effect has adversely affected both the retail and e-commerce sectors in the country.

While Pinduoduo’s attractive pricing strategies have lured budget-conscious shoppers, the company is now facing heightened pressure as major competitors dive into the discount game themselves.

Jun Liu, VP of finance at PDD, bluntly acknowledged the looming challenges, citing that “revenue growth will inevitably face pressure due to intensified competition and external hurdles.”

Pinduoduo’s Strategic Focus: Trust and Merchant Investments

PDD’s Chairman and Co-CEO, Lei Chen, expressed contentment with the company’s recent strides while underscoring the imperative need for substantial investments in building trust and safety within the platform. Chen also accentuated PDD’s steadfast support for high-quality merchants, signaling a commitment to enhancing the merchant ecosystem despite potential short-term setbacks.

Bleak Horizons for Pinduoduo’s Rivals

Pinduoduo’s competitors are grappling with similar predicaments in the face of a slowing Chinese economy. Alibaba (BABA), a prominent rival, also stumbled on revenue expectations, grappling with weak domestic e-commerce sales. Meanwhile, JD.com (JD) reported a mere 1.2% uptick in quarterly revenue.

Is Pinduoduo a Diamond in the Rough?

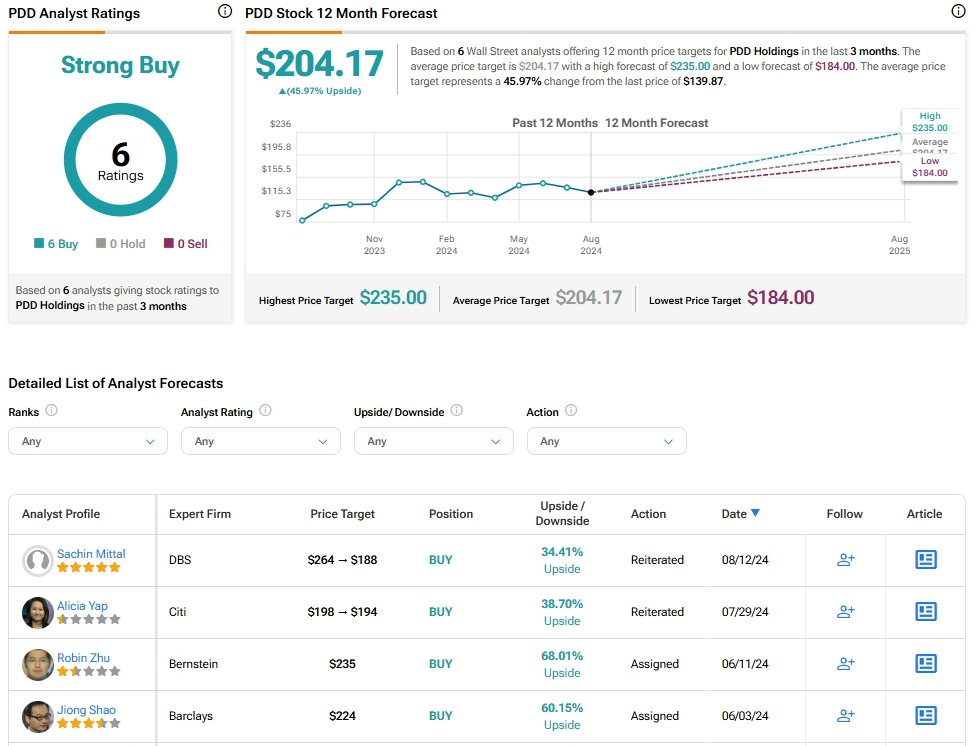

Despite the recent turbulence, analysts have maintained an optimistic outlook on Pinduoduo stock, boasting a resounding Strong Buy consensus rating backed by six unanimous Buy recommendations. In the past year, PDD has soared by over 70%, with an average price target of $204.17 indicating a potential 46% upside from current levels. However, these analyst ratings are susceptible to fluctuations post-PDD’s latest financial revelations.

Explore more Pinduoduo analyst ratings here.