PepsiCo Sets the Stage for Q3 Earnings

PepsiCo, Inc. PEP is gearing up to disclose its third-quarter earnings before the opening bell on Tuesday, Oct. 8.

Market analysts anticipate the company, headquartered in Purchase, New York, to post a quarterly profit of $2.30 per share, an increase from $2.25 per share in the same period last year. Revenue for the quarter is expected to be reported at $23.85 billion, exceeding the $23.45 billion recorded a year ago according to data from Benzinga Pro.

Notably, on October 1, PepsiCo announced a definitive agreement to acquire Garza Food Ventures LLC, operating as Siete Foods, for $1.2 billion.

PepsiCo’s shares experienced a minor decline of 0.5%, closing at $167.21 on Monday.

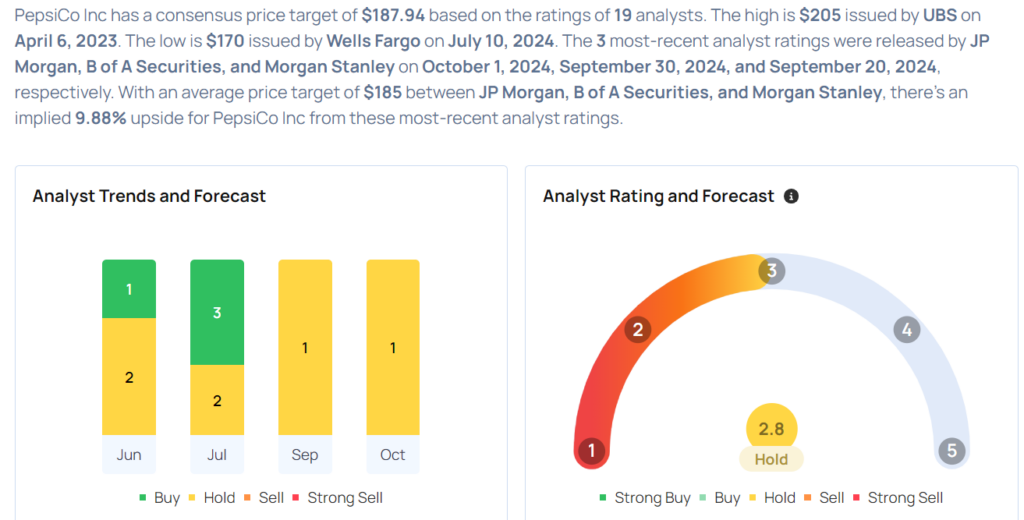

Readers of Benzinga can access comprehensive analyst ratings on the Analyst Stock Ratings page, with the ability to sort by stock ticker, company name, analyst firm, rating change, and other parameters.

Let’s delve into the insights provided by Benzinga’s most accurate analysts concerning the company’s recent performance.

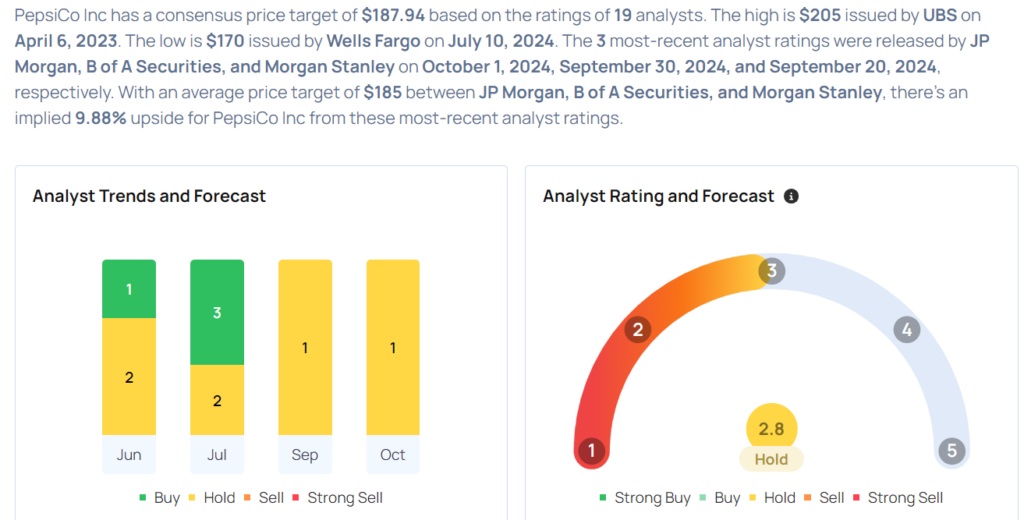

- B of A Securities analyst Bryan Spillane maintained a Buy rating while reducing the price target from $190 to $185 on September 30, boasting an accuracy rate of 68%.

- Morgan Stanley analyst Dara Mohsenian downgraded the stock from Overweight to Equal-Weight with a price target of $185 on September 20, demonstrating a solid accuracy rate of 73%.

- Barclays analyst Lauren Lieberman upheld an Overweight rating and lowered the price target from $187 to $186 on October 4, maintaining an accuracy rate of 61%.

- Wells Fargo analyst Chris Carey retained an Equal-Weight rating while lowering the price target from $175 to $170 on July 10, indicating an accuracy rate of 65%.

- TD Cowen analyst Robert Moskow maintained a Buy rating but decreased the price target from $200 to $190 on July 3, showcasing an accuracy rate of 66%.

Curious about investing in PEP stock? Here’s what analysts have to say:

Read This Next:

Market News and Data brought to you by Benzinga APIs