Amidst the swirling tides of politics, streaming powerhouse Netflix (NFLX) recently found itself in choppy waters after co-founder Reed Hastings publicly threw his weight behind Kamala Harris in the presidential race. The aftermath? A deluge of subscription cancellations that ravaged the company’s coffers, marking it as “…the single worst day for cancellations this year.” This political firestorm struck Netflix at an already vulnerable moment, following a prior surge in cancellations triggered by the axing of its basic service tier earlier in the year.

Adding fuel to the flames, Hastings also made headlines by pledging a staggering $7 million to The Republican Accountability PAC – a group with views on Donald Trump akin to trees on forest fires. This move acted as a catalyst for a speedy exodus of subscribers, with many irate cancellers taking to social media to voice their discontent with Hastings’ political alignment.

Legal Drama Unfolds Over “Baby Reindeer”

Netflix also faced a setback in the courtroom related to its hit show “Baby Reindeer.” A judge presiding over the case ruled that the portrayal of Fiona Harvey, the real-life inspiration behind a character on the show, could have amounted to defamation by Netflix. The company’s liberal use of the phrase “based on a true story” did not bode well for its defense, with the judge slamming Netflix for callous disregard in verifying the accuracy of statements within the series.

Stock Analysis: A Mixed Bag for Netflix

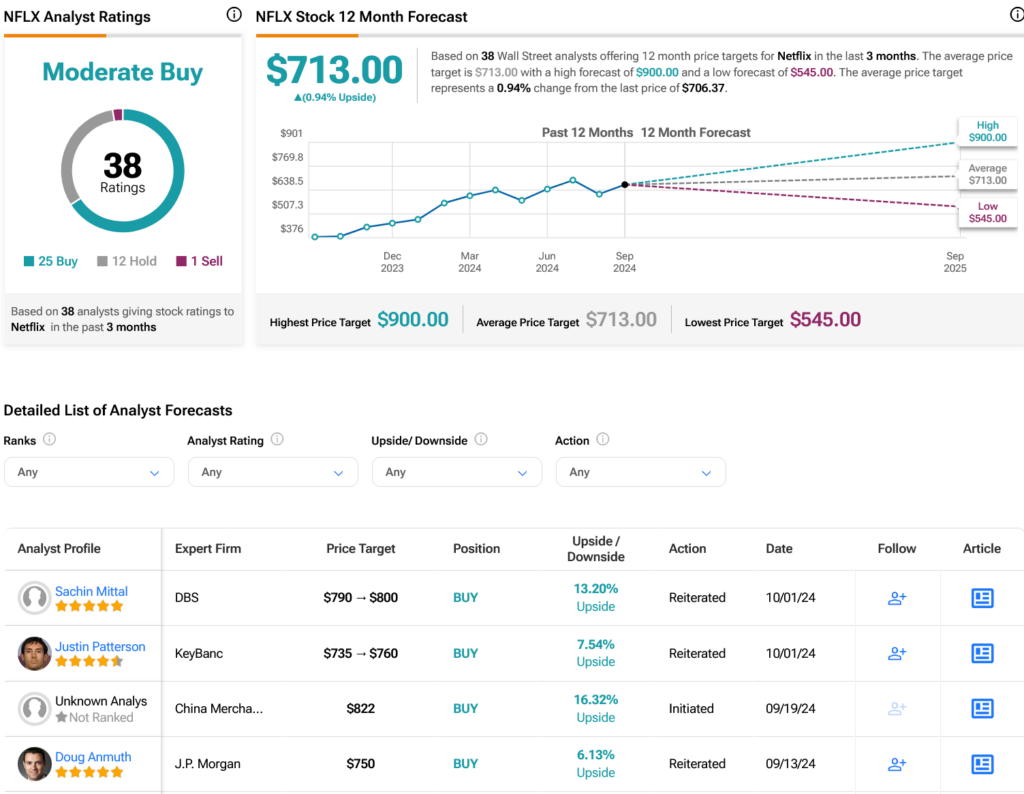

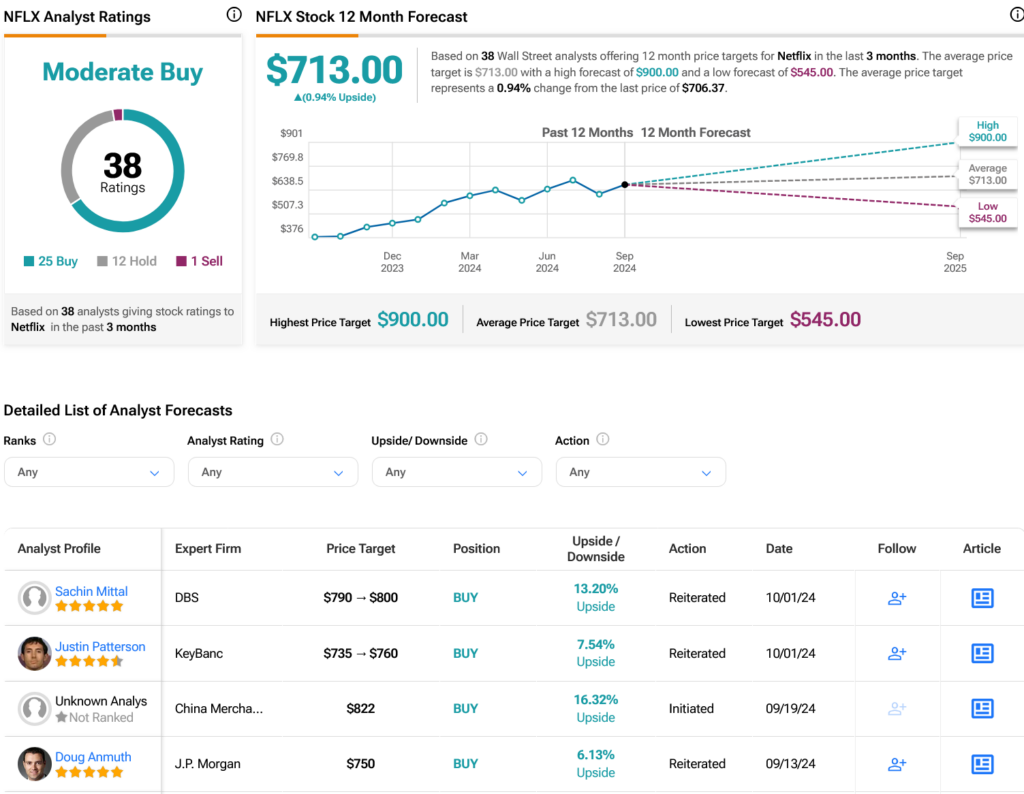

Shifting our gaze to Wall Street, analysts have carved out a Moderate Buy consensus rating for NFLX stock, with 25 Buy, 12 Hold, and one Sell recommendations issued in the last three months. Despite witnessing a robust 85.81% surge in its share price over the past year, Netflix’s average price target of $713 per share signals a modest 0.94% upside potential, as depicted in the visual below.

Explore further NFLX analyst ratings