Jerome Powell’s Bold Move

During the Kansas City Fed’s annual summit at Jackson Hole, Wyo., Federal Reserve Chairman Jerome Powell made an important announcement concerning the rates. The stage is set for a new cycle of rate cuts, heralding a potential shift in market dynamics.

Changing Economic Landscape

Powell highlighted the significance of maintaining sustainable inflation levels at 2%. His growing confidence in achieving this target signals a pivotal moment in monetary policy.

Future Uncertainties

As investors anticipate the future trajectory post-September, questions arise. Will the Fed adopt a cautious stance in late-October, evaluating economic indicators? Or are we on the verge of witnessing successive quarter-point cuts until year-end? The data will dictate the next steps.

Focus on Labor Market

One key driver behind this policy shift is the Fed’s concern over the deteriorating labor market. Powell emphasized the need to bolster employment and avoid further cooling in market conditions, reflecting a proactive approach to maintaining economic stability.

Interpreting Market Response

The market’s jubilation following the news hints at a potential influx of sidelined cash into investments. However, the anticipated surge may not lead to the meteoric rise some expect.

Contextualizing Cash Movements

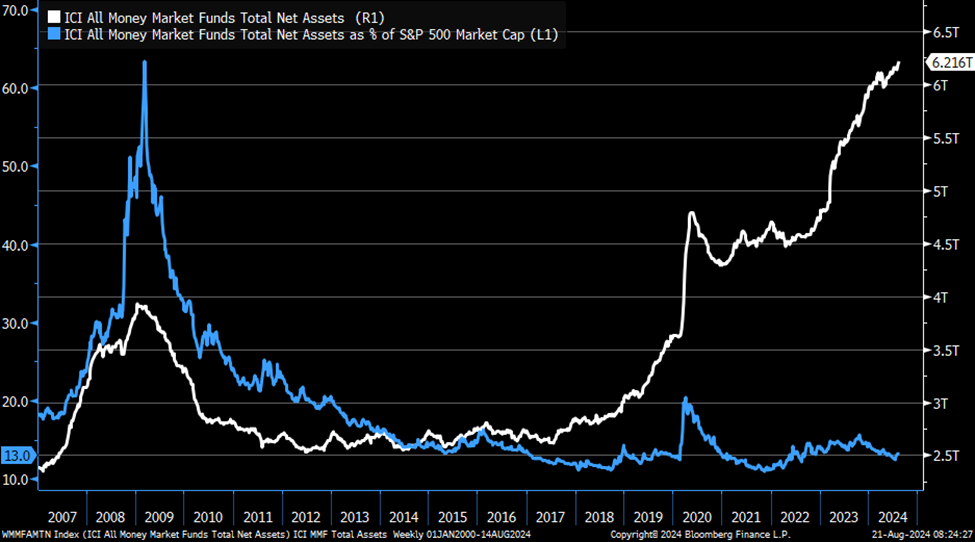

Since October 2022, a staggering $1.2 trillion has flowed into money-market funds, amassing a record $6 trillion. Despite the impressive figure, examining it in relation to the overall stock market size reveals a more nuanced narrative.

The chart illustrates the cash pile’s nominal value versus its percentage relative to the S&P 500. While the total cash amount hits an all-time high, its proportion to the market’s value remains modest, signaling a balanced market environment.

Comparing this scenario to a bygone era where $6 trillion would wield greater influence underscores the evolving market dynamics. Analysts caution against exaggerated expectations, citing the declining impact of cash reserves as a percentage of S&P 500 market capitalization.

In essence, the current market scenario reflects a prudent balance between liquidity and investments, offering insights into the nuanced interplay between cash reserves and market dynamics.

The Financial Frontier: Navigating Cash Levels, Stock Markets, and Tax Proposals

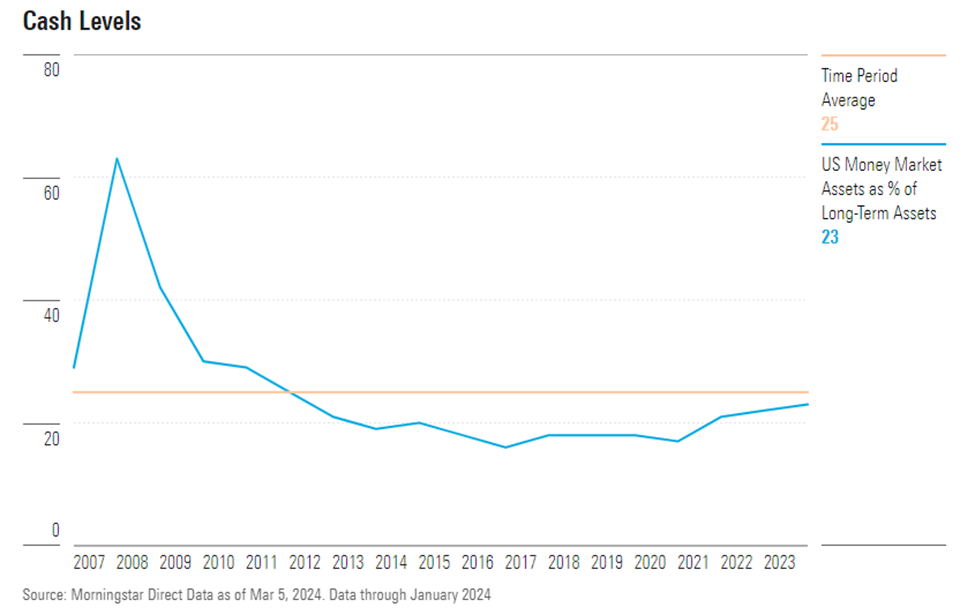

Source: Morningstar

The market’s trajectory has been intriguing since January, soaring by about 18%, which notably diminishes the perceived abundance of cash on the sidelines remarked in that month. While there’s speculation of a stock market surge commencing, it might call for more than the $6 trillion cash stockpile currently at play.

Engaging in a conversation about this, one must ponder the potential redirection of cash flows away from dominant Mag 7s stocks into the realms of small- and mid-cap entities.

An intuitive forecast suggests a preference for smaller entities, projecting substantive relative growth in this sector. The discourse merits a comprehensive exploration, one deserving a dedicated analysis.

Considering Investment Strategies Amidst Tax Proposals

With the imminent presidential race looming, thoughts turn to adjusting investment strategies in light of the proposed tax reforms. Leading the pack is the proposition to heighten taxation on investment gains, particularly targeting the affluent segment.

The suggested increment entails elevating the long-term capital gains tax to a historic high of 44.6%, significantly raising the tax bar. An additional tax on unrealized capital gains for ultra-wealthy individuals is also part of the proposal, posing a substantial financial impact.

For individuals falling under the ultra-wealthy category, the tax burden tends to loom larger, hinting at likely shifts in investment behavior and asset management strategies.

Unpacking Second-level Implications on the Market

Amidst calls for taxing unrealized gains and revising capital gain levies, a ripple effect across various sectors of the economy beckons scrutiny. Sensibly evaluating the multifaceted impacts of such policy changes unveils a complex interplay influencing market dynamics and investor decision-making.

The implications of such tax proposals extend beyond the ultra-rich, permeating through diverse layers of the economy. Delving deeper into second-level considerations illuminates the intricate webs of influence, spotlighting potential ramifications on investment behaviors and market trends.

This intricate dance between proposed tax changes and economic repercussions accentuates the fragile balance between governmental revenue needs and investor sentiments, underscoring the delicate equilibrium required to navigate the financial landscape effectively.

Navigating Uncertainty: Embracing an Era of Fiscal Evolution

As the financial frontier evolves with each policy pronouncement and market shift, the onus lies on investors to adapt swiftly to changing landscapes. Amidst the ebb and flow of economic tides, strategic foresight and prudent decision-making emerge as critical tools in navigating the inherent uncertainties of the financial realm.

While the horizon appears laden with challenges and uncertainties, the prospect of embracing a new era of fiscal realities beckons, demanding astute responses and agile approaches to capitalize on emerging opportunities and mitigate potential risks.

As the financial narrative unfolds with each passing day, the saga of cash levels, stock market fluctuations, and tax proposals intertwines, shaping a tapestry of financial evolution that demands unwavering attention and nimble adaptability from investors navigating the ever-shifting currents of the financial markets.