“Tokenization,” especially of “real world assets” (RWAs), has been hyped as the next big thing in the crypto world. This movement constitutes a resurgence of security tokens, a term that had virtually vanished since 2018 – with good reason.

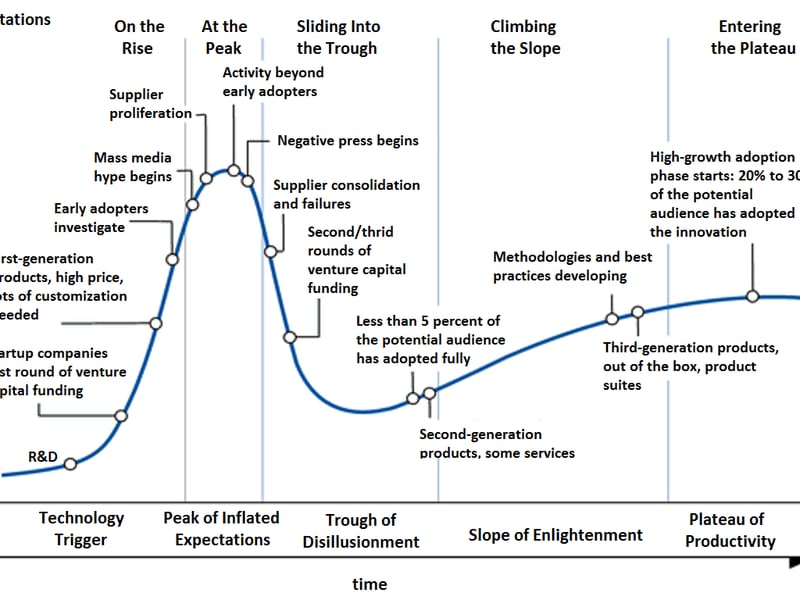

The proponents of tokenization might mean well, but the ongoing fervor is slightly misguided. Trends come and go, and if “security tokens,” “tokenization,” and RWAs are all part of the same technological spectrum, and if we heed the Gartner “Hype Cycle,” it’s probable that a another downturn looms on the horizon.

Many of the current advocates for tokenization are individuals who previously championed decentralized finance (DeFi). Although influential Traditional Finance (TradFi) figures and CEOs view tokenization as a natural progression in finance, the tokenization of “every financial asset” is far more complex, and largely misunderstood by both proponents and detractors.

The tokenization of RWA assets industry is entering its eighth year, emerging towards the end of 2017. My firm was responsible for launching one of the first fully compliant, Reg D/S equity tokenizations in March 2018. The challenges we faced led us to pivot from our original role as an issuer of tokenized equity to becoming an “enabling enterprise software company” within the digital asset ecosystem.

Since then, we’ve witnessed the expansion and subsequent substantial contraction of non-fungible tokens (NFTs) and DeFi. NFTs and DeFi were more user-friendly applications of tokenization technology, yet they have also experienced a rapid decline in their appeal. For instance, OpenSea investor Coatue marked down their $120 million investment to $13 million due to the waning fortunes of the platform.

Similarly, the previously red-hot DeFi market has exhibited its own cooling trend, with several projects now seemingly rebranding and refocusing on real-world assets. This includes DeFi titans MakerDAO and Aave.

Individuals now priding themselves on their RWA expertise often cite large, traditional financial institutions as clients or partners. This is understandable, given that many DeFi founders have backgrounds from esteemed institutions before entering the world of Wall Street banks.

Fascinated by the volatility and work-life balance associated with decentralization, the DeFi movement is well-versed in the world (and wealth) of global finance, but less enthusiastic about its rules, regulations, and discipline. Recognizing the evolving trends, smart DeFi founders have transitioned from the governance token-airdrop game in 2022 to focus on tokenization, initiating a mass migration and embracing the RWA label.

The fact that the assets and collateral involved in most of these RWA projects are largely stablecoins, and not tangible assets, does not seem to deter their enthusiasts.

If one were to evaluate the current RWA market through the lens of the hype cycle, it would most likely land at “Supplier Proliferation.” The rush to join the RWA business is palpable.

Tokenization of RWA is indeed an appealing concept. Presently, ownership of most private assets – the prime target for RWA – is tracked on spreadsheets and centralized databases. There is an evident lack of motivation to invest in technology that facilitates sales for assets with trading restrictions, like public stocks, bearer bonds, or cryptocurrencies. The outdated data management infrastructure prevalent in private markets is a result of inertia.

Advocates of RWA tokenization claim that it rectifies this issue.

Is Tokenization the Ultimate Solution?

There is a kernel of truth to this assertion, but in reality, while tokenization does not single-handedly resolve liquidity or legality issues pertaining to private assets, it also introduces new challenges. RWA tokenization advocates conveniently sidestep this issue, since most of the so-called real world assets being tokenized are simple debt or collateral instruments that are not held to the same compliance and reporting standards as regulated securities.

In truth, most RWA projects partake in an age-old process called “rehypothecation,” wherein the collateral comprises lightly regulated cryptocurrency and the product is a form of a loan. That’s why nearly all RWA projects flaunt money-market type yield as their allure. Best not to scrutinize the quality of the collateral too closely.

Borrowing and lending represents a significant industry, so it would be unwise to dismiss the potential and long-term success of tokenization. Nonetheless, asserting that real world assets are being brought on-chain is inaccurate. It essentially equates to the collateralization of crypto assets, disguised as a token. Tokenization is merely one piece of the puzzle, albeit an essential one.

When industry giants like Larry Fink and Jamie Dimon endorse the tokenization of “every financial asset,” their focus is not on crypto-collateral RWAs. They are actually alluding to the tokenization of real estate and private equity, and eventually, public equities. This cannot be accomplished solely through smart contracts.

Insights from Experience

After dedicating over seven years to building a digital transfer agent and tokenization platform that has tokenized almost four billion units representing interests in nearly 100 companies, the reality of mass financial asset tokenization is significantly more intricate.

Firstly, tokenization is a rather uncomplicated and minor component of the process. Tokenization is a commoditized business, and numerous companies can tokenize assets. It is not particularly profitable and is engaged in a relentless race to the bottom in terms of fees.

More crucially, there are fiduciary responsibilities associated with tokenizing and transferring RWAs. That’s where the arduous part, the ledger, comes into play.

Distributed ledgers offer tangible benefits for tokenizing financial assets, providing immutability, auditability, and trustworthiness. This lays the foundation for verifiable ownership and facilitates an error-free record of all transactions in real time. Without this, any purported revolution in finance using tokens will falter.

The ledger instills trust, allowing financial professionals and their clients to embrace the visions of Larry Fink and Jamie Dimon, but in a manner that encourages more widespread adoption compared to the intricate and technical realm of DeFi and crypto.

Before succumbing to the hype cycle, one should examine the past and contemplate what lies ahead. Beware of finding yourself on the wrong side of the cycle, or risk experiencing another iteration of NFT-like disillusionment.