Meme stocks have once again grabbed the limelight, catapulting fintech player Robinhood Markets (NASDAQ: HOOD) back into focus. The recent earnings report painted a picture of stellar improvements within the company, injecting a fundamental strength that investors should not underestimate.

Despite being a relatively smaller player in a fiercely competitive arena, Robinhood’s strides towards enhancement and bolstering financial position position the stock as a viable long-term asset within investment portfolios.

Here are the crucial details to consider.

Revamped Incentives Driving Business Growth

Robinhood, synonymous with the trading community, faced criticism for not attracting long-term committed funds due to its trading platform image. However, the company’s strategic move to introduce enticing incentives has paid off, attracting new business in large numbers. As of Q1 2024, Robinhood witnessed a significant surge of 810,000 funded accounts year over year, propelling its AUM to $130 billion, marking a 65% yearly increase.

This rise escalated the average account value to $5,439, indicating a promising trend for Robinhood. Moreover, the shift towards retirement accounts, characterized by more stability than trading accounts, marks a positive stride in reducing dependency on payment for order flow, thereby fortifying the company’s resilience against market fluctuations.

Profitability and Innovation Establishing a Strong Foothold

Contrary to popular belief, Robinhood is not merely a meme stock. Demonstrating profitability in three of the last four quarters, including a substantial $157 million profit in Q1, the company showcases its ability to grow sustainably. With an upcoming major product launch, such as the introduction of the Robinhood Gold Card, Robinhood is poised to unlock new revenue streams.

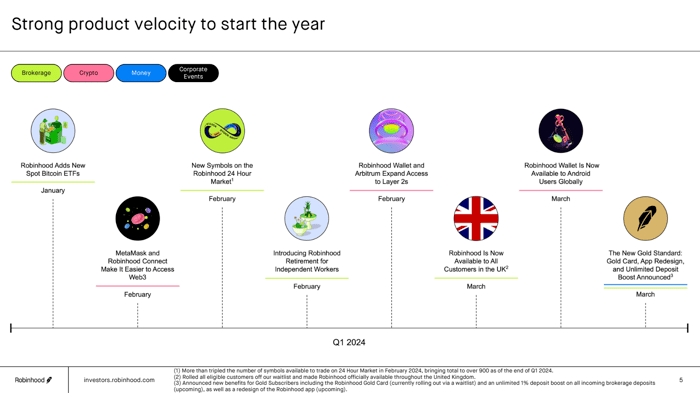

Image source: Robinhood Q1 earnings.

The Robinhood Gold Card, akin to Amazon’s Prime model, offers high-value perks behind a subscription paywall, hinting at potential future revenue streams for the company. With 1.68 million Gold subscribers in Q1, marking a substantial yearly increase, Robinhood’s innovative approach is well-received in the market.

Evaluating Stock Position: Buy, Sell, or Hold?

Robinhood’s stock has surged around 150% in the last six months, indicating strong investor interest. Trading at a forward P/E of 22 while analysts predict an 11% annual earnings growth, investors face a critical decision juncture.

Albeit slightly higher than the ideal PEG ratio of 1.5, Robinhood’s current position offers potential for growth if the company surpasses expectations and analysts adjust their estimates upward. Moreover, the impact of the new Gold Credit Card on future business performance solidifies the case for long-term investment in Robinhood.

Exploring Robinhood Markets Investment Opportunities

Prior to investing in Robinhood Markets stock, weigh the following:

The Motley Fool Stock Advisor team recently revealed their top 10 stock picks for potential high returns, with Robinhood Markets not making the list. Delve into the analytics and consider historical references, such as Nvidia’s inclusion in 2005, signifying the immense growth potential in the market.

The Stock Advisor service provides an actionable investment plan with significant returns compared to S&P 500 since 2002.