Small Cap Surge: Russell 2000 on a Winning Streak

Small-cap stocks have reason to celebrate as they rounded off their third consecutive week of gains, riding high on a wave of investor optimism. These gains were primarily fueled by growing confidence in interest rate-sensitive industries and firms, underpinned by strong expectations of a forthcoming Federal Reserve rate cut in September.

Amidst current market dynamics, investors are pricing in a 100% probability of a Fed rate cut within the next couple of months, with nearly three cuts expected by the year-end, as reflected in CME Group’s FedWatch tool.

This buoyant sentiment is further bolstered by a lack of imminent worries about an economic slowdown, creating an environment particularly conducive to small-cap stocks.

Recent economic data has painted a positive picture of the U.S. economy, revealing a 2.8% increase in output during the second quarter, surpassing the anticipated 2% rise and showing a significant uptick from the first quarter. Moreover, the ease in jobless claims last week has helped allay concerns regarding a sudden downturn in labor market conditions.

With real growth expanding, inflationary pressures have notably diminished. The widely tracked Federal Reserve inflation gauge dropped to 2.5% last month, marking its lowest level since February 2021.

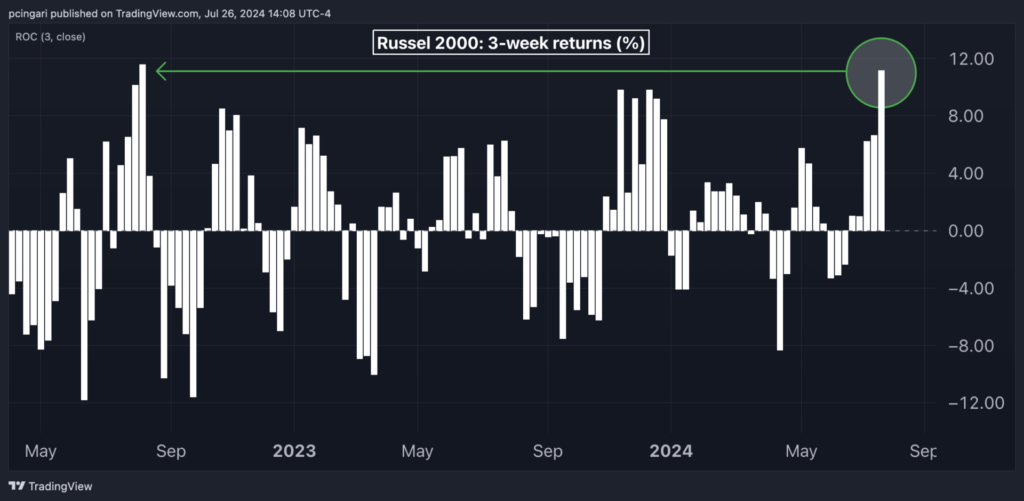

Over the past three weeks, small-cap stocks have surged by more than 11%, marking their most robust three-week performance since August 2022.

In July alone, the iShares Russell 2000 ETF (IWM) attracted over $6 billion in inflows, logging its strongest influx year to date.

Positive Economic Signs Reflected in Small Caps

Small-cap stocks, according to Chief Global Strategist Quincy Krosby from LPL Financial, act as a “barometer” for the economy. Krosby elaborates that the anticipation of rate cuts has propelled the rally in smaller stocks, which are more responsive to interest rate adjustments compared to the S&P 500, especially when juxtaposed with the prominent mega-tech entities that have led the market for the majority of the year.

The attractive valuations have further underpinned this trend. Krosby notes that the stability and advancements in the broader financial sector have positively influenced the Russell 2000, which carries a significant weighting of small to mid-sized banks.

While there are signs of a cooling economy, Krosby reassures that it is not on the brink of collapse.

Krosby suggests that the sustained inflow into small-cap stocks, amidst political and economic uncertainties, signals investor confidence in a sturdy economic backdrop combined with the anticipation of lower interest rates.

However, she warns that small-cap stocks, with their heightened risk profile relative to the S&P 500, are susceptible to rapid sell-offs should investors perceive a significant shift in the economic trajectory.

The focus for the upcoming week will revolve around a substantial array of economic data releases, including the payroll report, factory orders, the FOMC meeting, and key technology earnings reports, which are expected to continue supporting the small-cap resurgence.