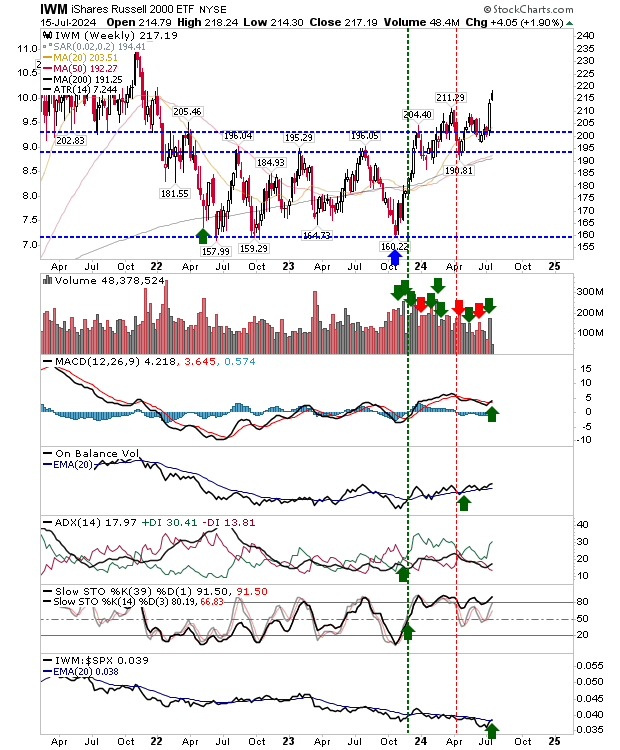

Russell 2000 Shows Strength Amidst Volatile Markets

Amid a backdrop of uncertainty, the Russell 2000 index has emerged as a beacon of optimism, surprising many with its robust performance in recent sessions. After a positive finish last week, the index is displaying promising signs of forming a right-hand-side base, hinting at potential for further gains. Historically, such breakout opportunities have proven to be pivotal moments for investors, offering a glimpse into the market’s sentiment and future prospects.

Market Dynamics: S&P 500 and Nasdaq Grapple with Doji Reversal Threats

On the other hand, the S&P 500 and Nasdaq started the recent sessions with gaps higher, but their inability to sustain this momentum has raised concerns among traders. While technical indicators reflect a net positive outlook, the S&P 500 is currently underperforming the Nasdaq, signaling potential challenges ahead. Yesterday’s appearance of a doji candlestick pattern on both indices has further heightened the apprehension, with the possibility of a looming trend reversal.

Technical Analysis Insights: Potential Reversal Scenarios

For the Nasdaq, the doji pattern was restricted by the high set on the previous Thursday, exposing it to increased vulnerability for a reversal in the upcoming sessions. Similarly, the S&P 500 faces the risk of a market downturn if the pre-market performance remains weak, potentially leading to a challenging trading day. However, a breakthrough above key resistance levels could nullify the bearish implications of recent selling pressure, offering a glimmer of hope for traders.

Russell 2000 Outlook: Actionable Insights for Investors

Market participants are advised to closely monitor the pre-market activities, with a particular focus on the Russell 2000 index. The index’s bullish trajectory presents ample opportunities for upside potential, making it an attractive option for investors seeking profitable trades amidst market fluctuations. While a lackluster pre-market performance may impact the S&P 500 and Nasdaq traders negatively, a strong finish above previous session highs could mitigate the concerns surrounding the potential doji reversals.